A Vancouver woman says she’s been left thousands of dollars out of pocket for medical expenses and has been left short on income replacement as a result of the province’s no-fault insurance system.

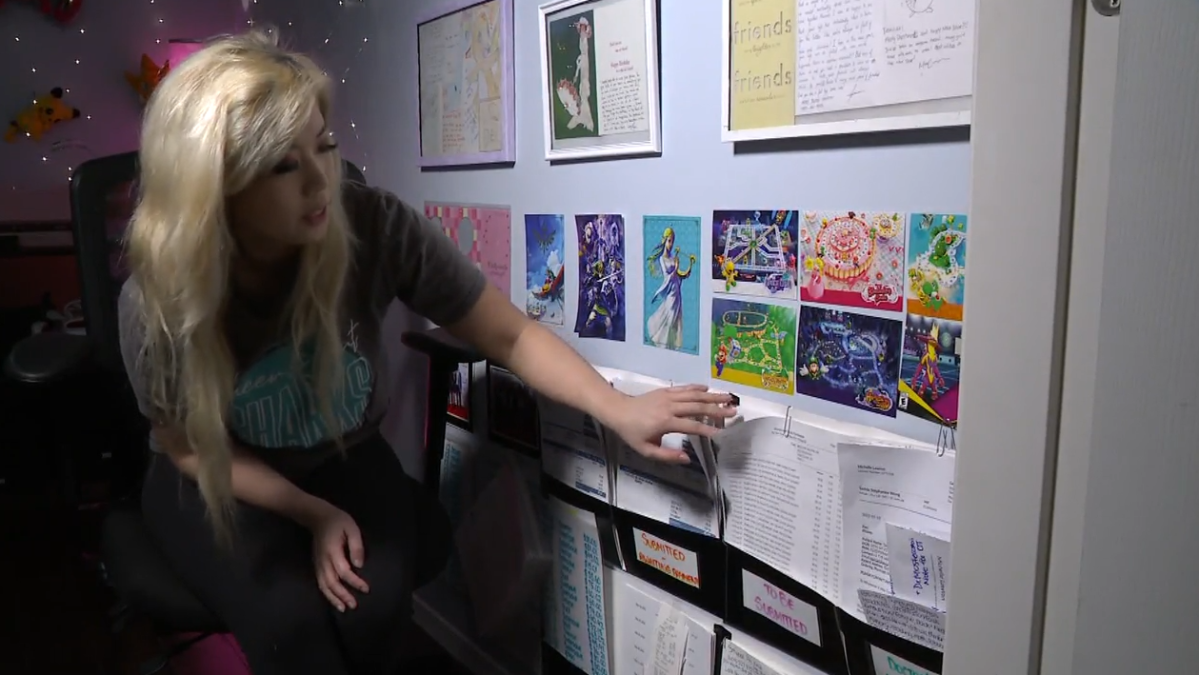

“My car was heavily dented and crashed. ICBC determined it was a write off,” Tashia Wong told Global News.

“It has dramatically changed every single thing in my life. I have really really bad back and neck pain. Sometimes it’s so bad need to just lay down on the floor and not move.”

Wong’s car was hit by another driver who ran a stop sign on May 3, 2022, a collision that also left her with a concussion and lasting symptoms including migraines, light and sound sensitivity and problems with short-term memory.

But since the crash, she said she’s been left in a bureaucratic nightmare trying to deal with the public insurer, with her adjuster asking her to repeatedly re-submit pay stubs, tax documents and other paperwork.

As a result of her head injury, she said she needs to deal with the insurer by email, which she said has allowed her to carefully document every time she’s provided the necessary information.

“Why do I have to resend all of my documents to the same person multiple times when it’s in emails? I was talking to ICBC every single day. They were asking me the same questions every day. And I couldn’t find the words to express what I was thinking,” she said.

“They fight me on every single thing. I have to get approval for all of my appointments, for every medical professional I see. There’s not only no pain and suffering payment, there’s no money at all for my life being changed.”

ICBC’s no-fault system, which the insurer calls “Enhanced Care,” took effect in May 2021. Under the program, people injured in collisions are eligible for up to $7.5 million in medical and rehabilitation benefits, along with 90 per cent coverage of lost income, up to $105,500.

Under the change, crash victims lost the power to sue an at-fault driver for compensation.

Wong estimated she has spent thousands of dollars of her own money to cover medical expenses, including prescription medication and counselling, that she alleges ICBC has not reimbursed her for.

She said she’s also been in a protracted dispute with the insurer about income replacement, despite sending ICBC a year’s worth of pay stubs and all her tax documents multiple times.

Wong, who works in the film industry, estimated she earned up to $2,000 a week prior to her crash.

“Their initial assessment that 90 per cent of my wage is $600 a week is completely inaccurate. That’s way less than half. It’s been nine months and they haven’t paid any of it, they haven’t even decided what my average is yet. This has been given to them over and over again, ever since May,” she said.

“I had to force myself to go back to work part time, with the ridiculous 12, 13, 14 hours days so I could make money. I pay my own mortgage, all of my bills I pay for myself. Because ICBC says we haven’t determined your wage loss rate, we haven’t gotten your paperwork yet.”

The response from the Insurer, Wong said, feels calculated, and she said the constant battle to address every aspect of her case has left her exhausted as she tries to recover from a brain injury.

In a statement, ICBC said it has funded 100 appointments for Wong’s treatments since her crash, but that as a result of her need to communicate by email, “it’s been challenging to get all of the details, updates and receipts needed from the customer.”

ICBC said it plans to involve an occupational therapist to assist Wong in her communications with it.

In response to her allegations about the income replacement benefits, ICBC said it has paid Wong $4,190 so far.

It said it hadn’t received any pay stubs from Wong since October, which it needs due to her modified work schedule.

“Previously, her part-time income has been greater than the income replacement benefits she’s entitled to. Income replacement benefits are based on the customer’s income before a crash,” it said.

Those answers are cold comfort for Wong, who said she feels like she’s been left to navigate a confusing system in which she has no rights.

“I’m just overwhelmed and extremely stressed. I haven’t been able to see a counsellor since they stopped paying for it back in, I believe it was July or August,” she said.

“They’re 100 per cent trying to wait me out.”

Comments