Inflation may be cooling off but grocery prices are still climbing, according to a recent report.

Canada’s food inflation rate has been around ten per cent since May of this year and prices at grocery stores are continuing to rise, reaching a level not seen since 1981.

There are a number of reasons why, including the cost of commodities and transportation compounded with a declining Canadian dollar, according to experts.

“We have to start mentally preparing ourselves for some higher food prices over the next coming year,” said Stuart Smyth, University of Saskatchewan professor.

“The uncertainty of the situation in Ukraine continues to affect our markets,” he added.

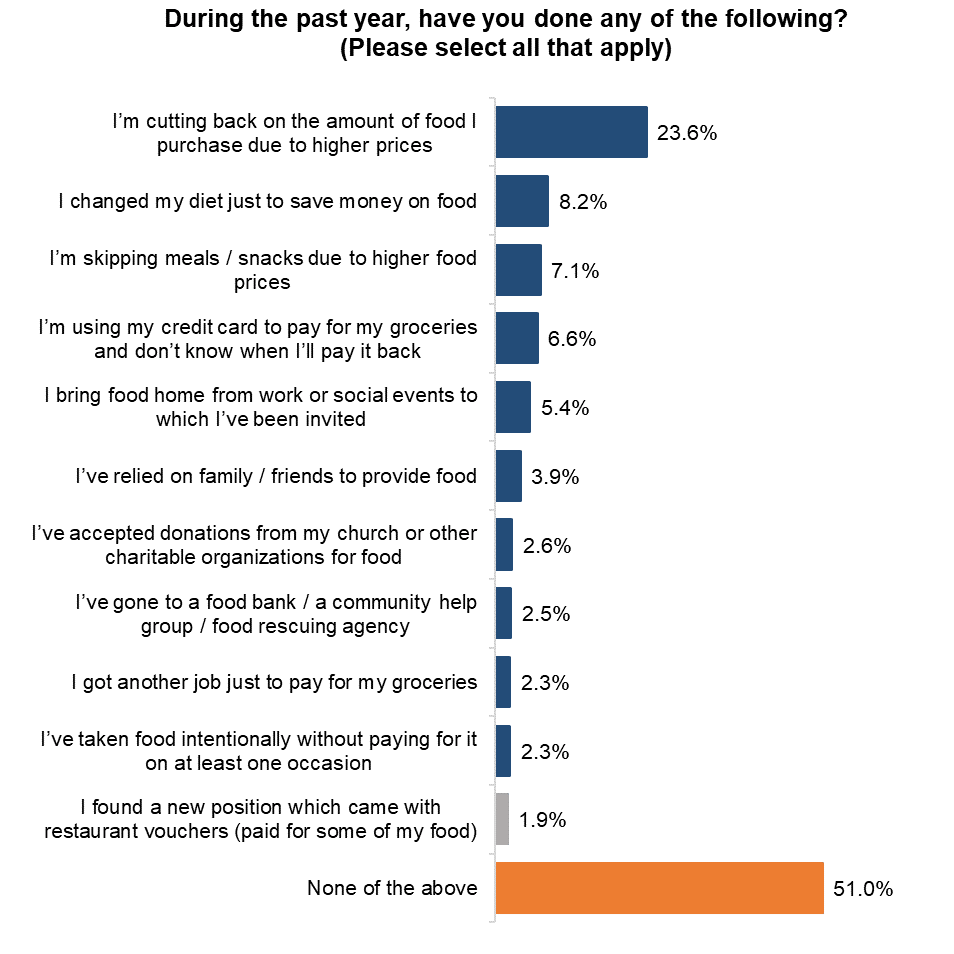

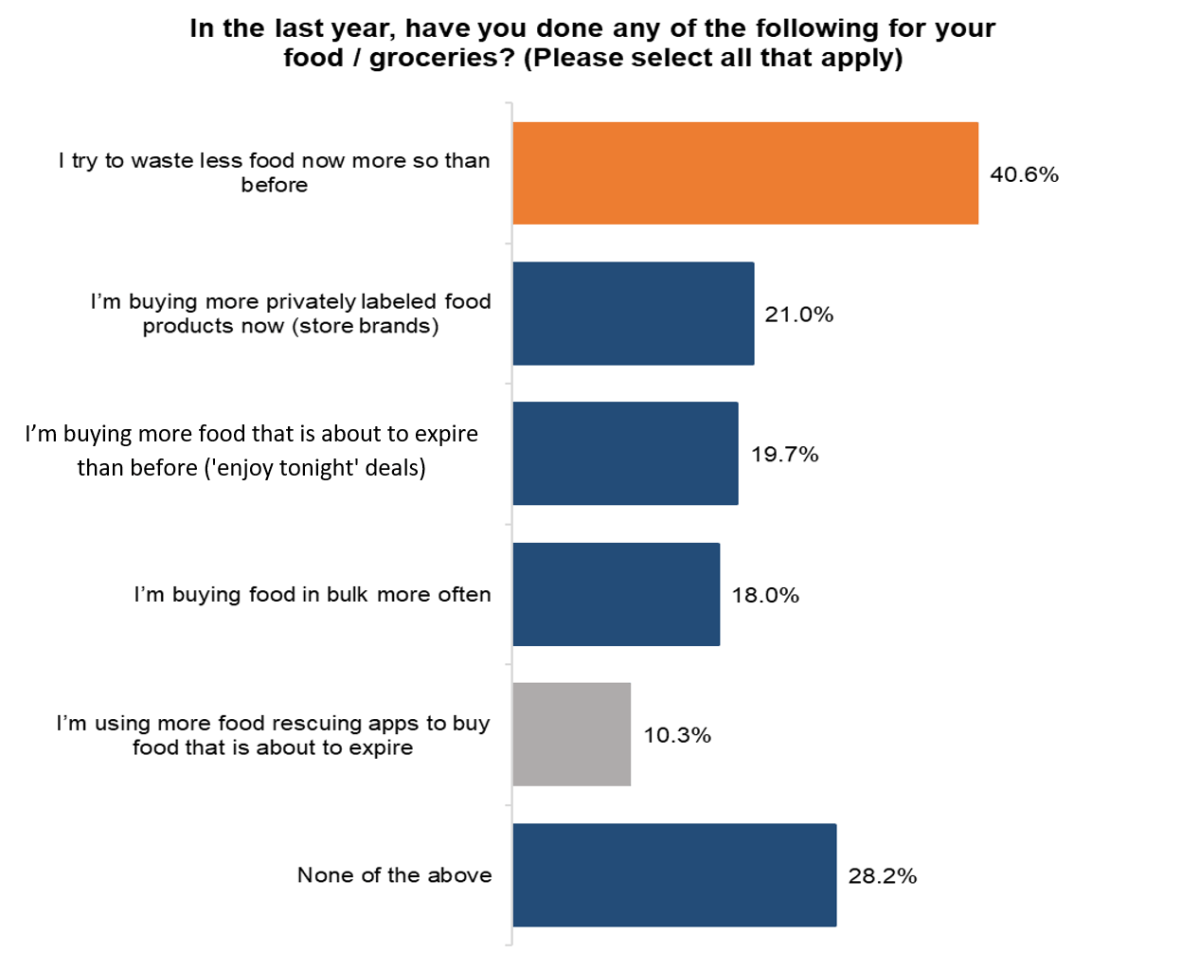

The report from Dalhousie University says Canadians are desperately changing their habits to cope.

The numbers are concerning for the well-being of people especially females, according to Sylvain Charlebois from Dalhousie University.

“Twenty-four per cent of Canadians are actually buying less food. And of that number, almost 70 per cent are women,” he said.

In total, 5,000 Canadians were consulted between Sept. 8 and Sept. 10 for this cross-national survey.

While a total of 18,1 per cent of Canadians are focusing more on their health and nutrition, 12.4 per cent claimed that they have moved just in the last year. A total of 12.0 per cent of Canadians have changed jobs and 9.3 per cent started to exercise. A total of 7.1 per cent of Canadians became new pet owners as well.

Get daily National news

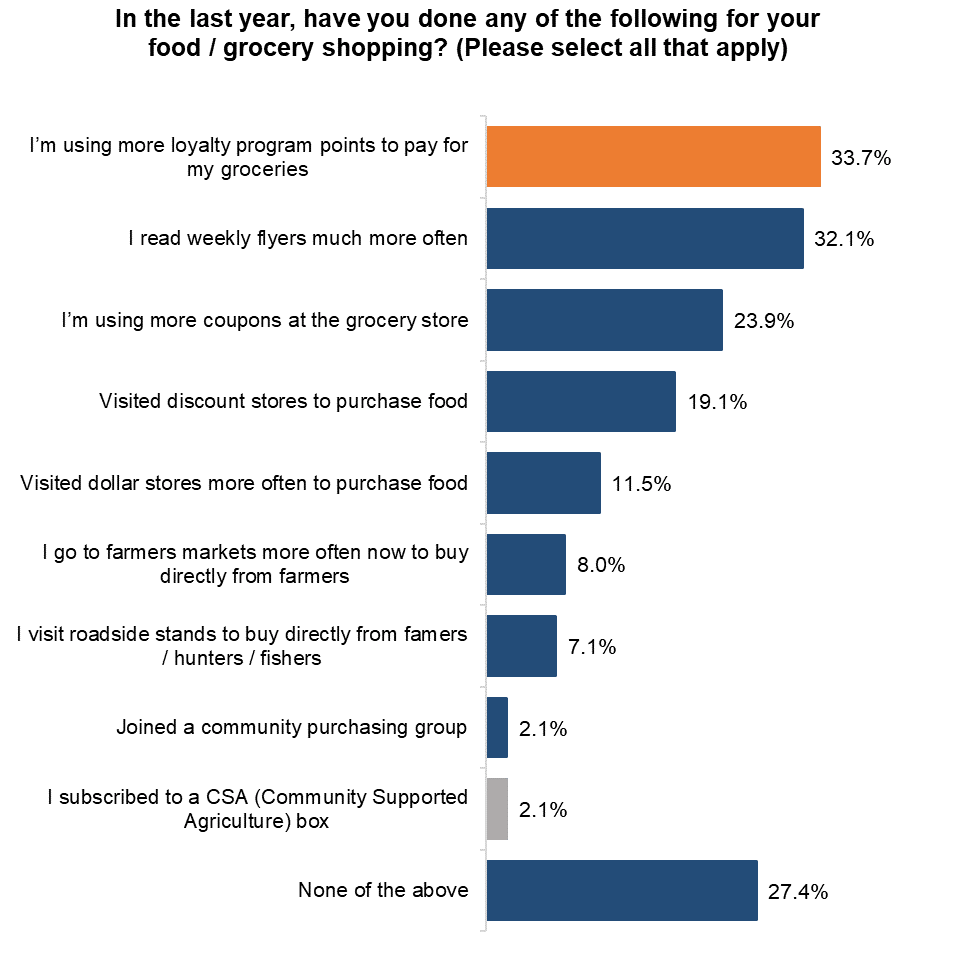

The survey also looked at newly-adopted shopping habits. While 8.0 per cent of Canadians changed their primary grocery store where they buy most of their food, 12.9 per cent of Canadians have started to visit more than one store in the last 12 months.

People are also started using things like loyalty points, coupons and flyers to save money, according to the survey.

Global News asked some Winnipeggers outside a grocery store what they are doing to try and curb the sting of food prices.

“It appears Canadians are proactively seeking different ways to save at the grocery store,” Charlebois said.

“Options were always there, but inflation just made many options, like loyalty programs and coupons, more attractive,”

Outside of saving at the till, people are also investing in kitchen and food items that help them cook better meals at home instead of ordering takeout.

“So a lot of people have actually renovated their kitchens and seven per cent of kids have actually bought a deep freezer for the first time.” he said.

“So you can see that really the market is becoming more domesticated and the intent is to save more money.” Charlebois added.

Additionally, a new survey from the National Payroll Institute finds more and more Canadians are living cheque to cheque while practicing poor financial habits.

The fourteenth annual study found ten per cent fewer Canadians consider their financial situation “comfortable” while eleven per cent are currently spending more than they make.

Most people aren’t familiar with having to navigate through tough times like these, according to the institute.

“We’ve been used to a really low-interest rate regime and inflation being kept in check so it is really new territory for them,” said the Institute’s Peter Tzanetakis.

The survey also found that nine per cent of Canadians aren’t saving away any money at all, while 34 per cent save only one to five per cent of their pay.

— with files from Global News’ Skylar Peters and Michelle Karelnzig

Comments

Want to discuss? Please read our Commenting Policy first.