Vancouver city councillors joined by phone for an unusual tele-council meeting Tuesday as they sought to navigate the city’s imperiled finances during the COVID-19 pandemic.

Mayor Kennedy Stewart was forced to physically head to city hall to participate, after an early technical glitch delayed the meeting.

Councillors are grappling with a projected funding shortfall of up to $5 million per week, with parking, permit, bylaw fine and park board revenue all in free fall.

The city is also concerned as many as 25 per cent of homeowners could default on their property taxes, while the city remains beholden to other levels of government to pass those dollars on.

The city has appealed to the provincial government for grants to shore up its operating costs, but Mayor Stewart said Sunday that request had been denied.

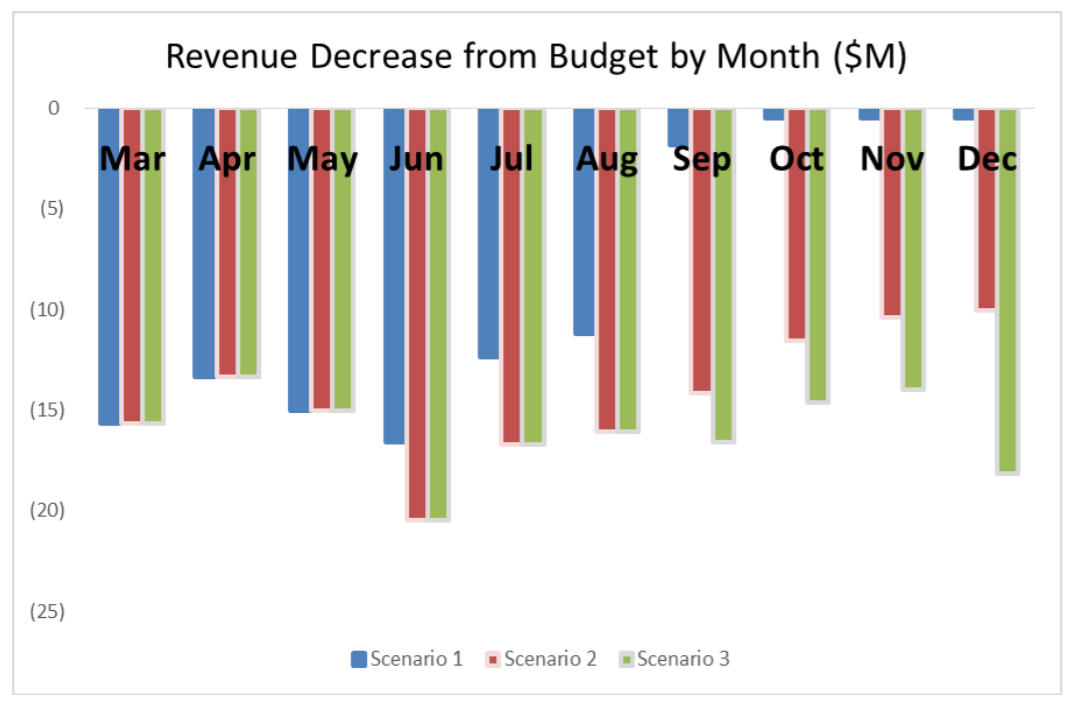

Councillors are considering a staff report that lays out three possible scenarios for the pandemic to play out.

They include restrictions being lifted at the end of May followed by three months of recovery, restrictions until the end of August and six months of recovery or restrictions lasting until the end of December and a year of recovery.

Under the most optimistic of the scenarios, the city would lose $92 million in revenue, $26 million of which would be offset by layoffs, reduced power use and other savings plus $5 million in provincial support for the DTES.

That outcome would leave the city $61 million in the red for 2020.

Should the lockdown last until the end of summer, the city projects a loss of $152 million in revenue, offset by $40 million in savings and $11 million in provincial support for the DTES.

But the projected recovery phase would drag into 2021, leaving the city with an anticipated shortfall of $111 million in this and next year’s budgets combined.

The most pessimistic scenario envisions the city losing $168 million in revenue, offset by $36 million in savings and $17 million in provincial support for the DTES.

The recovery phase would drag through all of 2021, leaving the city a combined $189 million in the red for this and next year’s budgets.

The City of Vancouver is not legally empowered to run a deficit.

However, the report being considered Tuesday does not speak to possible cuts save to say that if the pandemic persists, council will need to “consider further reductions including grants, discretionary spending and additional reductions in services to the public resulting in additional layoffs.”

Councillors are slated to vote Tuesday on pushing Vancouverites’ property tax due date from Jul. 3 to Sept. 2.

Councillors will also vote on asking the province to expand its property tax deferral program so that fewer homeowners default on taxes.

Vancouver is legally required to pass a large portion of the taxes it collects, including the B.C. school tax and contributions to TransLink and Metro Vancouver, by July — and the report recommends the city push the province to move that date, as well.

If approved, the report would also see the city appeal again to the province for direct operating grants, and to financially backstop those other taxing authorities the city is expected to remit taxes to, should it prove unable to come up with the funds.

Comments