Alberta Premier Jason Kenney has pledged to remove the province’s carbon tax by May 30. Once that happens, the federal backstop is expected to take its place.

So if you’ll be paying a carbon tax one way or another, which is easier on your wallet?

Spoiler alert

Economists say the federal plan is overall better for the average Albertan’s pocketbook.

The biggest differences lie in the rebate systems and in current prices per tonne of carbon pollution.

How do the costs compare?

Carbon taxes assign a price to the carbon pollution released by various fuel sources.

The current provincial rate is $30 per tonne of carbon dioxide. The 2019 federal price is $20 per tonne. That means slightly lower costs under the federal plan at the gas pump and for natural gas.

But any relief from the lower federal rate will be short-lived. In 2020, the federal carbon price rises to meet $30 per tonne.

Do I get a tax rebate?

Under the federal plan, yes, even if you do not currently qualify for a rebate from the Alberta government.

Alberta’s plan returns 40 per cent of the tax collected as rebates. Under the federal plan, 90 per cent goes to rebates in the province in which money was collected.

LISTEN BELOW: Global News’ Jennifer Crosby joins Ryan Jespersen on 630 CHED

How much of a rebate will I get?

The rebates are roughly the same dollar amount under both plans.

Economists Jennifer Winter and Trevor Tombe from the University of Calgary’s School of Public Policy forecast rebates for a typical Alberta family.

Get weekly money news

“We estimate that for a family of four (two adults and two kids), the federal rebate would be roughly $530 this year, $800 next year, rising to over $1,300 per year by 2022,” Tombe said.

READ MORE: Most Canadians will get more money from carbon rebate than tax will cost them: PBO

The 2019 Alberta rebate adds up to $540 for that same family of four.

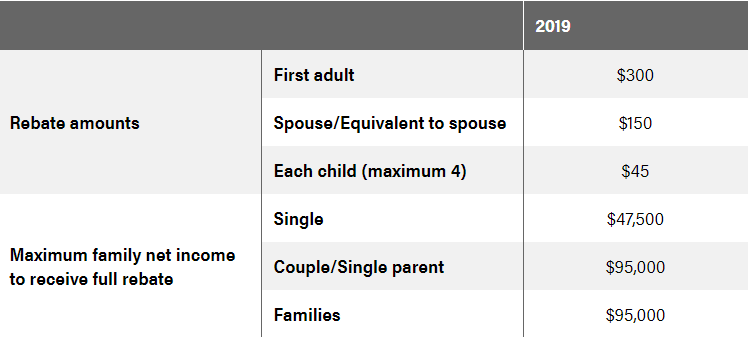

But there’s a key difference: Alberta’s rebates are limited to those making less than $47,500 a year, or below $95,000 for a family.

Under the federal plan, all Canadians can claim the climate active incentive payment on their tax return.

“Should the backstop go into effect, the model (including how the Climate Action Incentive can be claimed) would be the same as it is in other jurisdictions where the backstop applies, and eight out of 10 families would be better off,” said Sabrina Kim, press secretary for federal Minister of Environment and Climate Change Catherine McKenna.

Why are governments collecting taxes only to give the money back?

Tombe says the tax is designed to affect your behaviour more than your bottom line.

“Carbon taxes don’t work because they make us poorer, they work because they change prices,” Tombe explained.

“A rebate is not a refund.”

Watch below: Trevor Tombe explains how and why carbon taxes work

Will I pay more under the federal plan?

It’s tough to estimate how much carbon tax an individual will pay due to vast differences in household energy use, buying decisions and driving patterns.

READ MORE: Confused about carbon taxes and rebates? Here’s what you need to know

Alberta’s NDP government estimated the 2018 cost of the carbon levy for a family of four at approximately $500.

“The two taxes are largely the same in almost every way that Alberta families will see, in terms of gasoline, home heating, and so on,” Tombe said.

“But the federal carbon tax is actually slightly broader than the provincial carbon tax.

“For example, there are certain types of activities for conventional oil and gas that will be covered by the federal carbon tax that aren’t covered by the Alberta one.”

After rebates, where does the rest of the tax money go?

With Alberta’s tax plan doling out 40 per cent of the tax collected as rebates, the remaining 60 per cent goes to climate-action programs.

Likewise, the 10 per cent left in the federal fund after rebates goes to organizations and small business programs.

READ MORE: Solar companies concerned with Alberta rebate program uncertainty

With the Kenney government’s promise to kill both the carbon tax and the agency that doles out the proceeds, there’s confusion around what happens with programs that have relied on those funds.

Watch below: Alberta Premier Jason Kenney has said the provincial carbon tax will be gone by May 30. But, once a province removes its price on carbon, the federal carbon tax kicks in. Tom Vernon explains.

How quickly will the federal tax take effect?

The timeline is unclear.

Global News asked the federal government how soon their backstop would be applied once Alberta’s tax is lifted. The Ministry of Environment and Climate Change did not provide details on the timeline during our initial inquiry or in a follow-up email.

“Once a decision is taken to implement the federal system, we will move as quickly as possible in order to minimize a gap in coverage,” Kim said.

“Our government will review Alberta’s legislation carefully, however, we have always been clear that in Canada, it will no longer be free to pollute,” she added.

READ MORE: COMMENTARY: How Canada’s carbon tax works

What happens next?

The Alberta government is still weighing a court challenge.

“We continue to explore Alberta’s options for challenging the federal price on carbon,” Alberta Finance Minister Travis Toews said in a statement.

“We have committed to repeal the carbon tax and fight the federal carbon tax with every tool at our disposal,” Toews said.

We asked if any carbon pricing plan from the new UCP government might satisfy federal requirements.

“While we are repealing the economy-wide carbon tax, our government will be introducing the Technology Innovation and Emissions Reductions (TIER) regime for large, industrial emitters, which will have a compliance price of $20 per tonne,” Toews said.

READ MORE: UCP wins Alberta election – here’s a look at the promises made by Jason Kenney

The fall federal election may also affect future tax plans. Conservative Leader Andrew Scheer has vowed to ax the tax if elected.

With files from Caley Ramsay and graphics by Tonia Gloweski, Global News.

Comments