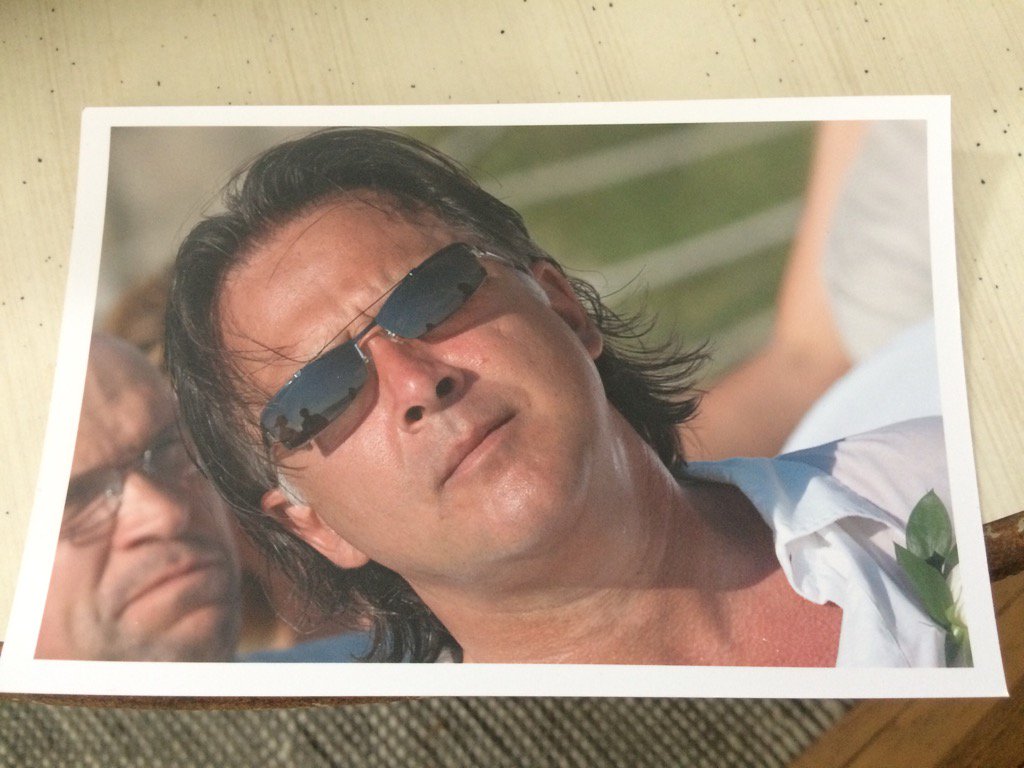

The family of an Edmonton man who lost his life savings to an offshore fraud scheme are speaking out to prevent other Canadians from being victimized.

Fred Turbide was looking to invest his money. He began to interact with a broker who identified himself as “Julian Wellington.” It soon became apparent Wellington was not a broker.

Skype transcripts obtained by Global News show how their relationship went from trusting to sour in a short span of time.

On Dec. 21, 2016, Turbide messaged Wellington frantically: “Julian, I cannot breathe anymore…” and hours later continued “You have yet to reply or call. I am going to take a shower then go to my garage and finish myself off. I’m giving you one hour to call…”

Turbide lost nearly $330,000. No return phone call ever came from Wellington.

The father of four went to his garage and shot himself in the chest.

“I wouldn’t wish that on my worst enemy. I don’t care what kind of person you are. I get wind of you thinking about something like that, I’m at least going to pick up the phone and make an anonymous call,” Turbide’s son Tomas Ferreira said.

Ferreira had never heard of binary options trading before his father’s death. Since then, he’s been researching it at length.

READ MORE: Top 10 scams of 2016 reveal Canadians lost more than $90M last year

“They lure you in. They really make you feel like you’re getting educated,” Ferreira said. “When I went through his computer, he had webinars set up.”

Get weekly money news

The Alberta Securities Commission (ASC) received 114 complaints about binary options fraud last year. However, the vast majority of cases go unreported.

“What they don’t tell you is they literally don’t make a dime unless you lose.”

There are no binary options firms registered in Canada. The online trading platform Turbide dealt with, 23Traders, was based in Israel. The website no longer exists.

READ MORE: ‘Can you hear me?’: Don’t say ‘Yes’ in new telephone scam

“I think there was about 10 to 12 transactions for every major play they were making,” Ferreira said. “They were literally made within seconds.”

The family is in talks with an Israeli lawyer whose specializes in asset recovery.

“Whether or not we’re successful in that… We’re not counting on it. Our main objective is to get the word out and honour dad in that way.”

Maria Chaves-Turbide said her husband had been sick that week. Afraid of making her ill, he wouldn’t kiss her. That afternoon, he acted differently.

“I said ‘Why are you kissing me? You told me I can’t kiss you.’ And he just said ‘because I love you.'”

Those were the last words he said to her. Before he died, Turbide wrote a note to his family, instructing them to go after the people who had taken advantage of him. They are now fulfilling that wish and hoping to save other lives with their actions.

“I don’t want anyone to go through what I’m going through,” said a tearful Chaves-Turbide.

“Why and how could you do something like this to another human being? Was money that important that you took a life? I would like them [the scammers] to answer those questions.”

READ MORE: Edmonton minor hockey association thwarts costly email scam

Her message to those who have been victimized by scam artists: You’re not alone.

Chaves-Turbide and her children are hoping anyone else feeling overwhelmed will re-consider the importance of their life to those around them.

“There are a lot of caring people. There’s a lot of resources out there. It’s just taking one step and that step will lead you to many more.”

Securities commissions across Canada have banded together to take on binary options frauds. They are working with the Israeli government, regulatory authorities in the United States and major websites like Google and Yahoo to stem the flow of fraud-laden advertisements in North America. They have also been reaching out to social media portals like Facebook.

“In theory, a binary option is when you place a wager as to whether the value of a security is going to go up or down,” said Alison Trollope, director of communications and investor education with Alberta Securities Commission.

“Ultimately, these websites that are approaching Canadians are essentially scams, in that the house will always win.”

Red flags include promises of high rates of return with low or no risk, unsolicited emails and requests for credit card information.

Trollope adds, once an individual’s money has left the country, it is essentially impossible to recoup.

Another piece of advice she has for anyone considering investing is to check the company’s registration. That can be done by heading to websites like CheckFirst. If you do not see the company listed, contact your provincial securities commission.

Comments