Some young drivers say they’re struggling with the price of ICBC auto insurance, despite the public insurer have among the lowest overall rates in Canada.

Standing outside an ICBC office, Delta’s Prarna Dhillon said if her parents didn’t pay for her insurance, she wouldn’t be able to afford it herself, noting the increased cost of gas, vehicles, and tuition.

“If I want to spend money on other things, like myself or whatever I need, I don’t think I’d be able to afford it. It’s just really expensive,” she explained. “I work at McDonald’s, I’m a manager there.”

White Rock’s Iman Irabangje, 19, told Global News he pays about $400 a month, but would struggle to take public transit to get to his job in North Vancouver. He said he wished he could allocate his monthly insurance money elsewhere.

“We could put that money into different things, education, stuff like that … The cost of living is just really, really bad right now. As soon as I save enough money to move somewhere else, I’m definitely going to be moving for sure.”

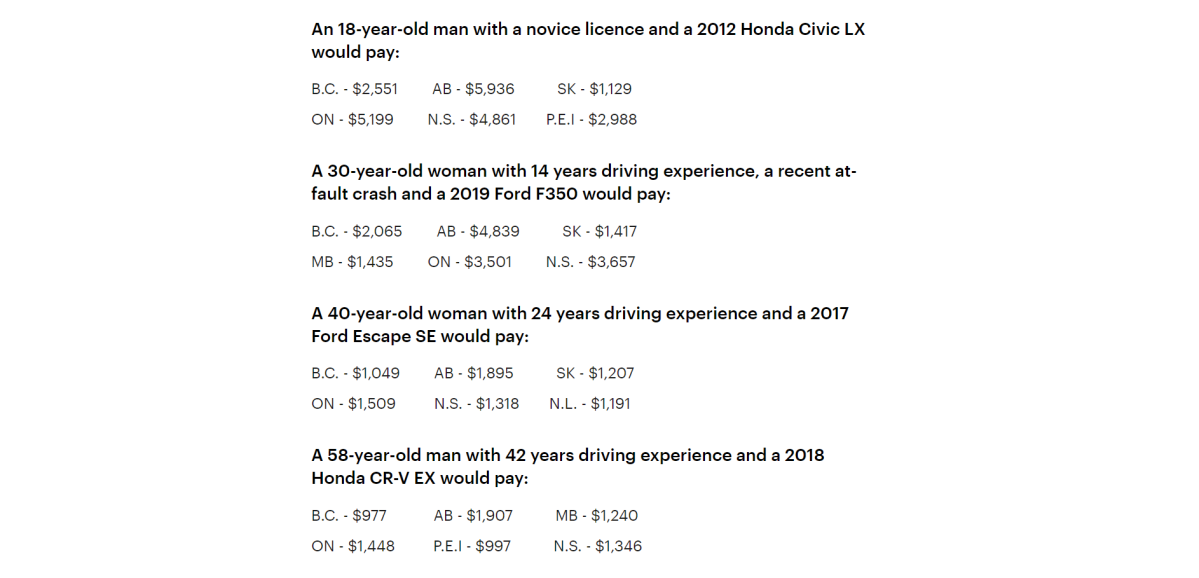

The comments come as ICBC touts a recent report it commissioned, which found its rates are among the most affordable in Canada. The Ernst & Young report compared a sampling of different driver profiles and their estimated insurance costs in different provinces across the country.

Manitoba and Saskatchewan, which also have public, no-fault insurance systems, had consistently more affordable rates than B.C., the report found.

ICBC’s offerings, however, regularly beat Ontario, Alberta, Nova Scotia and New Brunswick, it found.

“Customers have saved an average of approximately $490 or 28% on their full coverage personal auto insurance when renewing for the first time under Enhanced Care,” said ICBC spokesperson Brent Shearer in an emailed statement.

Get daily National news

“Drivers with five years or less of driving experience saw savings of approximately $1,200, far more than the $490 savings for all drivers.”

Auto insurance rates were most often among the cheapest in Canada in Nanaimo, Prince George and West Kelowna, according to the report.

B.C. public utilities analyst Rick McCandless, however, has since analyzed the findings of the Ernst & Young report, and flagged a significant gap between the insurance rates for young drivers in B.C. and its no-fault counterparts in the Prairie provinces of Saskatchewan and Manitoba.

According to the report’s numbers, an 18-year-old male driver in Vancouver’s West End would pay $3,044 annually for insurance, which is 54 per cent less than he would pay in Edmonton, but 170 per cent more than he would pay in Saskatoon, and 98 per cent more than he would fork out in Winnipeg.

A 22-year-old driver would pay $2,680 annually — 39 per cent lower than in Edmonton, but 82 per cent higher than in Saskatoon and 80 per cent higher than in Winnipeg.

A 50-year-old driver would pay 22 per cent less, than in Edmonton, but 33 per cent more than a similar Saskatoon driver and 16 per cent more than an equivalent Winnipeg driver.

Read more: After hit-and-run, B.C. woman in wheelchair claims ICBC is granting her the ‘bare minimum’

- Live Nation, U.S. DOJ to settle lawsuit alleging music industry monopoly

- How the Iran war impacts your grocery bills: ‘Everything is going to go up’

- Oil prices soar as G7 ministers to meet on strategic reserves and Iran war

- ‘They did it in a very sneaky way’: Uber rider deletes app after cleaning fee dispute over pet

ICBC’s claim of having some of the lowest rates in Canada is only true for certain age groups, McCandless told Global News. He said the no-fault model introduced in 2021 places young drivers in a high-risk category, and determines rates based on that, rather than their actual records.

“B.C., for the younger drivers, looks a lot more like the private sector models when compared to Manitoba and Saskatchewan,” the former public servant explained.

“There are other public policy objectives that are impacted by this, especially today when it’s so difficult for younger and those with lower income to live in any kind of urban centres.”

He acknowledged that younger people take greater risks behind the wheel, but said young people still need to be able to afford to get to work.

In its statement, Shearer said ICBC does not consider driving age in its rating model, but years of safe driving experience. Drivers with five years of experience or less saved about $1,200 under the new no-fault, Enhanced Care insurance model adopted in 2021, he added.

“In 2019, we made changes that placed a greater emphasis on driving experience and crash history in determining the cost of a customer’s auto insurance,” he wrote.

“We adjusted premium prices to be more aligned with a driver’s risk, so drivers with many years of crash-free driving benefited, while inexperienced drivers and those who cause crashes paid more for their auto insurance.”

ICBC will not be changing its rating model anytime soon, he said.

Meanwhile, the B.C. government is requesting a two-year freeze to basic insurance rates at ICBC in an attempt to tackle the rising cost of living across the province.

Public Safety Minister Mike Farnworth acknowledged that younger drivers in B.C. pay more for auto insurance than they do Saskatchewan or Manitoba, but they also pay “significantly less” than drivers in Alberta and Ontario.

“British Columbia is a significantly different province than Saskatchewan or Manitoba. We live in a province that’s full of mountains and different kinds of terrain than either of the two Prairie provinces,” he told Global News.

“When we moved to Enhanced Care, the group that saw the biggest reduction in their insurance rates from the old system to the new system were in fact, younger drivers,” he added.

Comments

Want to discuss? Please read our Commenting Policy first.