The B.C. government has put tax relief at the centre of its plan to help businesses affected by the novel coronavirus pandemic.

“Businesses need help now,” said Premier John Horgan Monday as he and Finance Minister Carole James announced that $2.2 billion of a $5-billion aid package would go to help companies stay afloat.

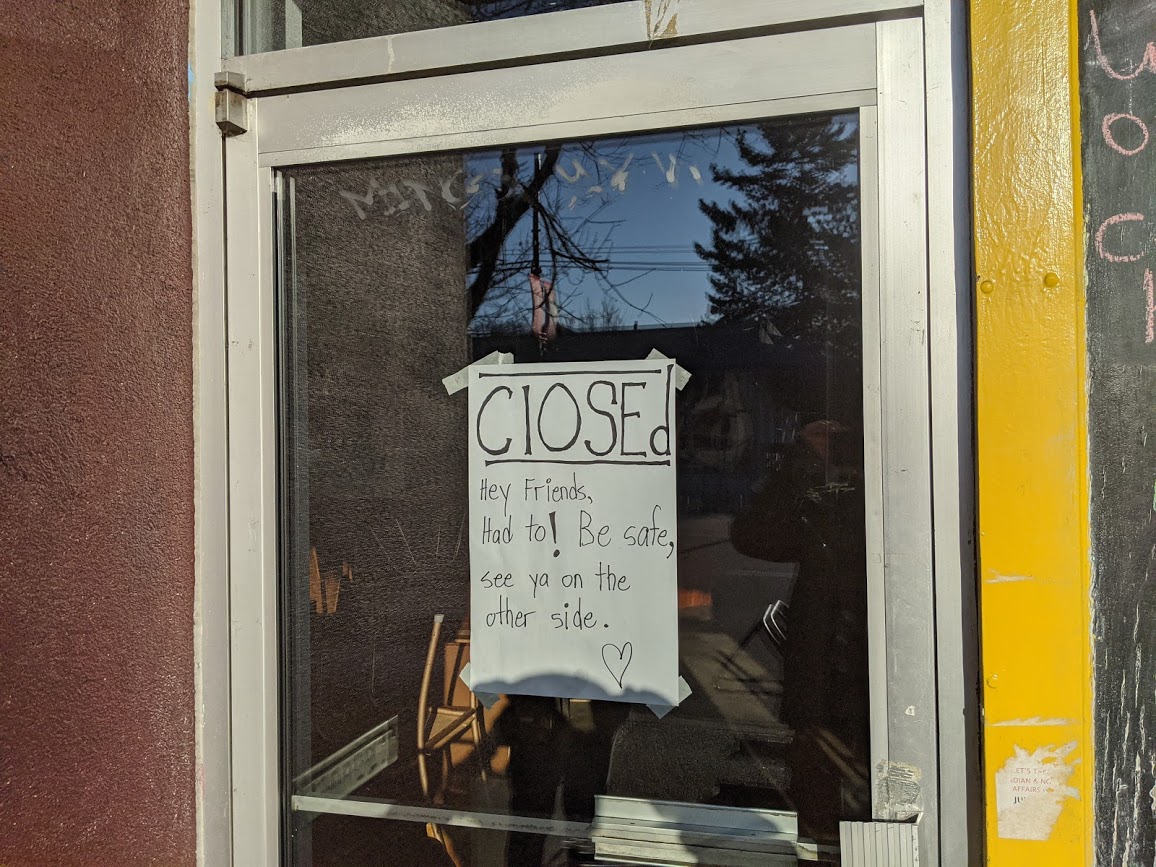

B.C. businesses have been devastated by the COVID-19 outbreak, with bars, restaurants and personal service businesses shutting down under a provincial health order.

Other businesses remain open, but to a major drop in customers because of provincial health orders banning gatherings of more than 50 people and requiring people to practice social-distancing measures.

Earlier this month, the virus prompted the B.C. Business Council to slash its projected economic growth rate for the province, and warn of a possible recession.

Tax deferrals

The core of the NDP government’s plan for industry involves deferring a slew of tax payment deadlines to Sept. 30, 2020.

That includes the PST, municipal and regional district tax, carbon tax, motor fuel tax, tobacco tax and the Employer Heath Tax.

The province is also delaying the implementation of PST on sugary drinks and online services like Netflix, and will look at a new timeline in September.

Property and carbon tax relief

Another key piece the business aid involves slashing property taxes for commercial real estate.

The school tax will be cut in half for light- and major-industry property classes (Class 4, 5 or 6).

“This relief tax savings … for the average urban commercial property owner is going to be about $4,000,” said James.

“We do expect that these savings will flow through to tenants who have triple-net leases, providing support to them as well.”

The province is also delaying an increase of the carbon tax from $40 per tonne to $45 per tonne that was scheduled to go into effect on Apr. 1.

Details vague on tourism, hospitality support

B.C.’s tourism, hospitality and cultural sectors have been among the hardest hit by the pandemic, as international travel grinds to a halt, the cruise season goes adrift, and restaurants and theatres shut their doors.

The province has earmarked $1.5 billion for longer-term economic recovery, some of which will go to those sectors, but James provided few details.

Tourism is worth about $19 billion to B.C.’s economy, while the hospitality sector is estimated at around $13 billion. The BC Restaurant and Foodservices Association has warned the pandemic could prompt 15 per cent of restaurants to close for good.

Good ‘first step’

Bridgitte Anderson, president and CEO of the Greater Vancouver Board of Trade, called the government’s package an important “first step.”

“Cash flow is the highest priority right now for any business,” Anderson said. “They are trying to shore up what they have, so deferral of payments is certainly helpful.”

But she said she’d like to see some of the tax payments reduced, rather than just delayed.

And she said much remains unclear about the long-term plan for recovery.

“We do need need other measures to keep businesses moving along, and also some clarity around which businesses can keep working, and workers themselves — how they can work safely and be able to continue earning a living?” said Anderson.

As of Monday morning, B.C. had recorded 472 confirmed cases of COVID-19, and 13 deaths, as well as 100 people who have fully recovered.

Comments