A Halifax judge says he will grant one of Canada’s best-known cryptocurrency exchanges protection from creditors as it deals with the fallout from its founder’s death.

Nova Scotia Supreme Court Justice Michael Wood on Tuesday granted QuadrigaCX a 30-day stay of proceedings to stop any lawsuits from proceeding against the company.

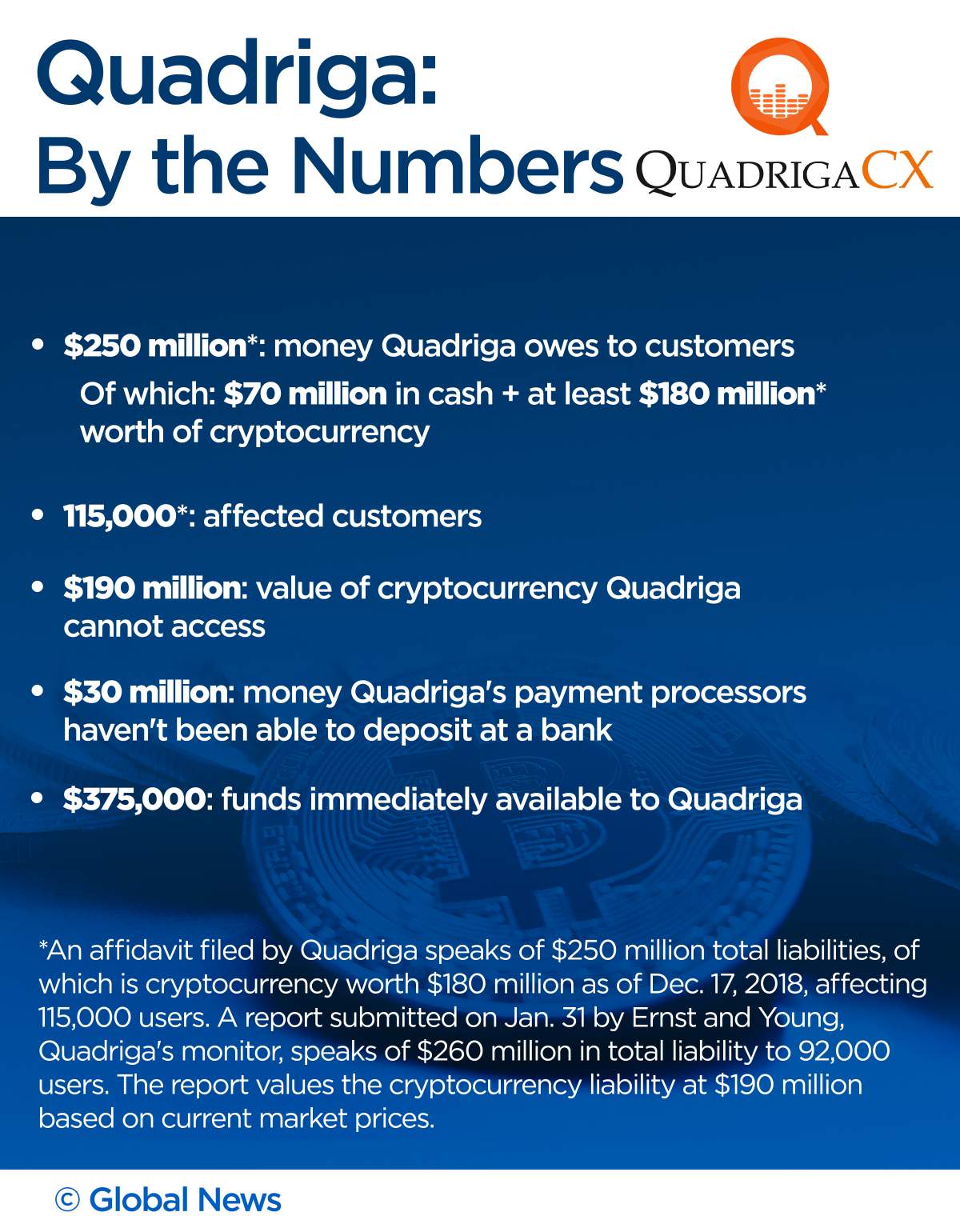

Maurice Chiasson, who is representing QuadrigaCX, told Wood the company needed time to find at least $250 million it owes customers.

READ MORE: How crypto exchange QuadrigaCX lost access to $190 million of customers’ money

QuadrigaCX filed for creditor protection on Jan. 31, and Wood confirmed Tuesday that he would grant that order.

The company has been unable to retrieve much of the money since the passing of its co-founder and CEO, Gerald Cotten, who held sole access to tens of millions worth of cryptocurrency. Cotten unexpectedly died in December during a trip to India.

READ MORE: ‘I just want my money back.’ Couple had $100K wire stuck for months after trying to buy Bitcoin

Quadriga believes most of the missing funds are stored in so-called “cold wallets,” a type of offline storage commonly used to hold cryptocurrency deposits and protect them from hacks and other digital threats. Cotten, who was the sole officer and director of Quadriga and its parent companies, held the virtual keys needed to access the cold wallets and was solely responsible for transferring funds between cold storage and a “hot wallet” maintained on the company’s server, according to the documents.

The Vancouver-based exchange owes $70 million in currency and an additional amount of cryptocurrency valued at approximately $180 million as of Dec. 17 to roughly 115,000 users, according to an affidavit by Cotten’s widow Jennifer Robertson. A Jan. 31 report filed Ernst and Young, now Quadriga’s monitor, valued the cryptocurrency at $190 million and speaks of 92,000 customers with outstanding balances.

WATCH: What is blockchain? The technology that supports cryptocurrency?

‘It’s just insanity,’ crypto expert says of missing funds

Get weekly money news

The apparent lack of a contingency plan to retrieve the keys to the cold wallets is unusual, said Anthony Diiorio, founder of Toronto-based fintech and cryptocurrencies company Decentral.

That a single person would have exclusive access to tens of millions with no way for others to recover the keys, “is just insanity for me,” Diiorio said.

While it’s common for cryptocurrency users and businesses to rely on cold wallets to protect their funds, it’s also easy to devise systems that would ensure access to the money by authorized third parties in an emergency.

A single virtual key, for example, can be split and stored onto separate USBs held in safety deposit boxes at different institutions, Diiorio said, adding that he hoped further evidence would emerge in Quadriga’s case showing that a similar system was, in fact, in place.

READ MORE: Bitcoin is crashing – and selling it is not easy

Still, the predicament in which Quadriga depositors currently find themselves runs against the decentralized nature of cryptocurrency, Diiorio added.

“The whole movement for crypto is to empower people to be in control of their digital life,” Diiorio said.

Blockchain, the technology that underpins cryptocurrencies like Bitcoin, is a way to keep track of who owns what and when that ownership is transferred, which creates a decentralized network for moving value that doesn’t need to rely on a central authority or intermediaries.

But cryptocurrency exchanges like Quadriga manage digital wallets for their users, which concentrates control of the funds in a single, lightly regulated entity, Diiorio said.

Court filings show that some Quadriga customers have very large balances, with the largest affected user claim reportedly valued at approximately $70 million.

Lawyers for some of the affected users were in the Halifax court.

WATCH: Bitcoin 101 – what is it and how does it work?

Liquidity crisis

Court documents show Quadriga had been facing liquidity issues over the past year. CIBC froze roughly $25.7 million of its funds held in the account of a third-party processor in January 2018.

CIBC said it was unsure whom the funds belonged to after receiving wire recalls from several depositors asking for their money back. By early December, the court released most of the funds back to one of Quadriga’s payment processors in the form of bank drafts. The company, however, has not been able to find a financial institution willing to accept the drafts, according to court documents.

In a past interview with Global News, Quadriga’s CEO, Gerald Cotten, had blamed the company’s processing delays on a lack of support from Canada’s banks for the country’s crypto-related businesses.

WATCH: Could Bitcoin bankrupt you?

While the CIBC funds are a small portion of the money that is believed to be locked in the cold wallets, Quadriga seemed to be struggling to convert cryptocurrency into regular currency, Diiorio said.

“When the banks are reluctant to work with you, it’s very difficult to get cash in the hands of the customers,” he said.

Attempts by an expert retained by Quadriga to recover access to the funds and the company’s business records have been fruitless so far, the court documents show.

— With files from the Canadian Press

Comments

Want to discuss? Please read our Commenting Policy first.