Freeze yourself and re-emerge three decades later.

If you invest your money wisely, that might be the best way to save up for a down payment on any kind of home in Vancouver, a city where prices just kept climbing in October, according to a report released by RBC on Monday.

Coverage of Vancouver real estate on Globalnews.ca:

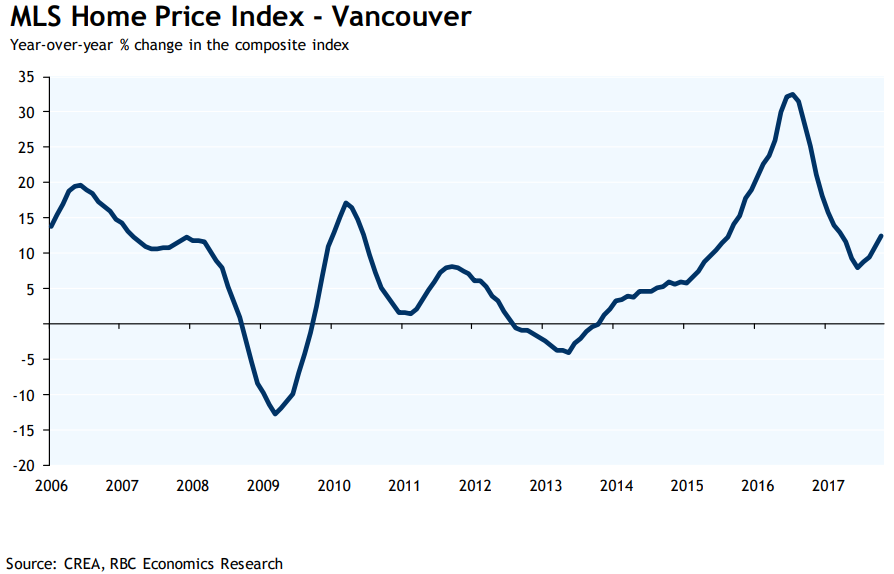

RBC’s Monthly Housing Market Update showed the city’s home price index climbing by 12.4 per cent year-over-year in October, as home resales jumped by 34.5 per cent and new listings by 14 per cent in the same time period.

Vancouver saw the fastest price growth of any major Canadian city, beating Toronto (9.7 per cent), Montreal (5.7 per cent) and Calgary (12.4 per cent).

Get breaking National news

The city’s home prices kept climbing as “demand continues to exceed supply,” the report said.

The report came weeks after National Bank released data showing just how long people would have to save money for a down payment in Vancouver — and how that compares with other cities.

The bank’s Housing Affordability Monitor showed that, based on the median price of all home types in Vancouver, it would have taken 353.6 months — or 29.47 years — to save for a down payment in the city in the third quarter.

For a down payment on a condo, it would have taken 54.5 months, or 4.5 years.

For all other dwellings, it would have taken 437.4 months, or 36.45 years.

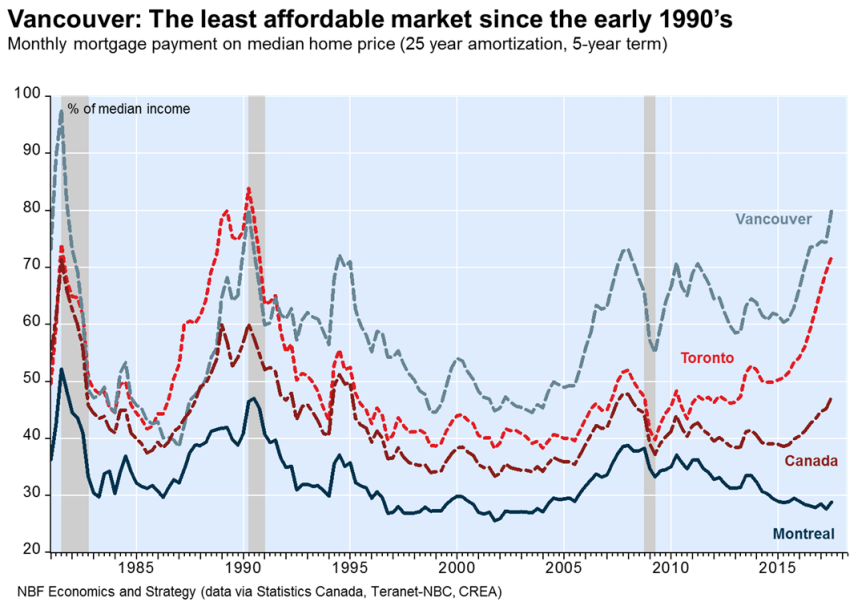

And that’s without considering the chunk that a monthly mortgage payment took out of people’s incomes.

Based on the median price in Vancouver, servicing a monthly mortgage payment would have taken 79.9 per cent of household income.

For condos, it was 44.4 per cent.

READ MORE: In Metro Vancouver, 43 per cent of renters are living in homes they can’t afford: Census

Neither would be considered affordable by the Canada Mortgage and Housing Corporation (CMHC).

The mortgage authority considers shelter affordable if it takes up less than 30 per cent of pre-tax household income.

But Vancouver isn’t the only B.C. city where affordability is eroding.

It’s also happening in Victoria, where saving for a down payment on all dwellings would have taken 115.7 months, or almost 10 years.

For a condo, it would take 50 months (4.2 years) and for all other dwelling types, it would have taken 126.8 months (10.6 years).

Comments