A new report on real estate trends says foreign investors may start looking beyond Toronto and Vancouver to target other markets and property types beyond condos and houses.

Montreal and Saskatoon are two centres that could see more foreign buyers looking for residential real estate, a new report from PwC Canada says. But other forms of real estate could see non-resident buyers showing up cheques in hand, notably for farmland.

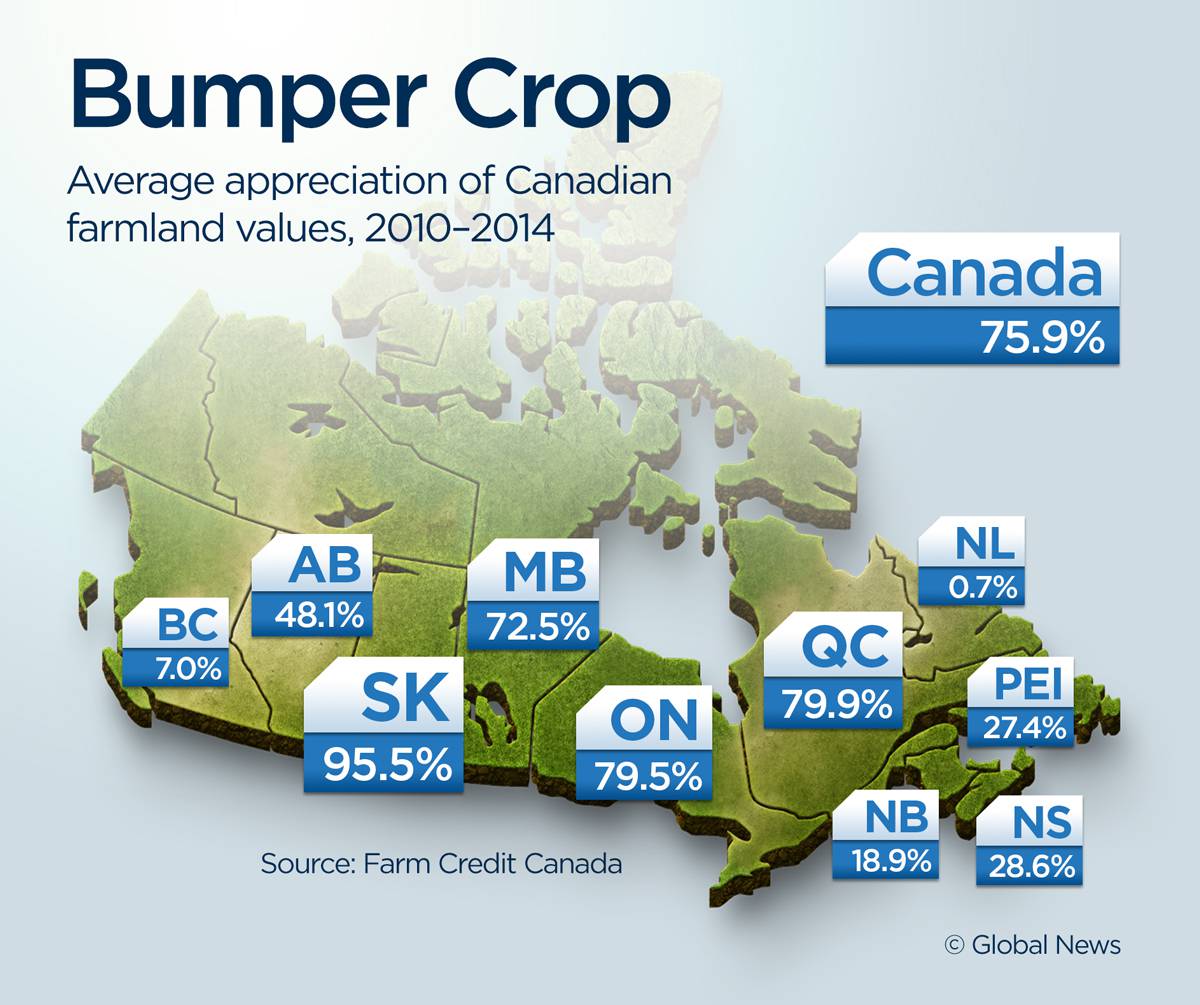

Chris Potter, a partner at PwC Canada, said agricultural property around Saskatoon is becoming attractive to foreign investment as the value of that land has soared.

“Sometimes people scratch their head about Saskatoon, but over the last several years we’ve seen a lot of interest in Saskatoon, from an agriculture and timber perspective,” Potter told reporters during a roundtable.

The same might reasonably be said for agricultural land in several provinces, as commodity prices for grains, oilseeds and pulses have soared in recent years.

MORE: Seeds of crisis? Historic boom for farmland raises red flags

Farm expansion

The principal source of farmland inflation has been farmers themselves, experts suggest — not speculative foreign buyers or big investment funds. Investors are playing a role, but the data that’s available show it’s not a meaningful one.

Recent research from the University of Guelph suggests that less than one per cent of landowners are foreigners, a number that corresponds to ownership levels in the United States.

Instead, many farmers have been emboldened to buy land as their bank accounts have filled amid banner crop prices in recent years.

“The period we went through has built expectations of high incomes. That’s a big thing from a psychological point of view,” Stephen Duff, a senior economist at Ontario’s ministry of agriculture, said at a farming financial conference at Guelph in late May.

Growing risks

There are growing risks that could temper foreign demand — or demand in general — for Canadian farmlands now though, some experts say, most notably a downswing in commodity prices for everything from oil to agricultural products.

Scotiabank said late last month it’s agricultural price index was down 12.7 per cent year-on-year, while the U.S. Department of Agriculture has said it expects another record year for global wheat production — the third in a row.

Lower commodity prices could pull the plug on the boom, and actually see land values fall in some areas, experts suggest.

“We can’t know for certain” if land values will fall, Brady Deaton Jr., an agriculture economics professor at the University of Guelph said last spring. “We can’t rule out that possibility.”

An influx of foreign cash into Saskatchewan farmland could draw the ire of some local residents, according to a recent provincial government consultation.

Eighty-seven per cent of more than 3,200 people who participated in the consultation said they don’t support foreign ownership of the province’s farmland.

WATCH: Farm land prices have almost doubled in some places in recent years. Reid Fiest reports.

— With files from The Canadian Press

Comments