The company that operates one of Canada’s largest networks of residential mortgage brokerage firms is under federal investigation amid allegations it has adopted anti-competitive business practices to thwart an emerging rival.

The Competition Bureau is investigating Dominion Lending Centres Inc. (DLC), a company whose franchise network includes 7,981 brokers working in 10 provinces through 544 franchises. Collectively, DLC brokers helped Canadians get $140 billion in home loans in 2021 and 2022.

In an interview, Dominion Lending co-president James Bell denies his firm is engaging in anti-competitive conduct or trying to block an emerging rival.

Instead, Bell alleges that a giant U.S. mortgage competitor muscling into Canada has tapped the Competition Bureau to make mischief for Dominion Lending — and stick it with big legal defence bills as the housing market slows.

“When you’re a small Canadian company and a regulator targets you, unfortunately, you don’t have many options but to comply and spend significant sums of money,” Bell says. “In a case like this, you’re guilty until proven innocent.”

The bureau’s investigation, described in documents obtained by Global News, is shining light into the shadowy but fiercely competitive world of mortgage brokers.

It comes as thousands of desperate Canadians turn to mortgage brokers for help to get deals on loans amid surging interest rates and a national housing crisis.

What emerges from records about the investigation might concern consumers.

Mortgage broker networks like Dominion Lending and its rivals also own software firms which have technology side-deals with favoured banks and other lenders.

These agreements include financial incentives that encourage brokers to use their software platforms to steer borrowers to specific financial institutions when submitting online loan applications. For doing this, the broker networks get so-called “connectivity fees.”

These incentives are tied to volumes of mortgage applications that brokerage networks ultimately get approved and signed by customers with their favoured banks.

Most consumers, who pay nothing for a mortgage broker’s services, are typically unaware of any side technology deals and related fee payments. They also may not know that other lenders could have better deals that might result in cheaper loans better suited to their financial situations.

A sworn affidavit by Competition Bureau investigator Krisna Tolentino reveals that her agency has been investigating several actions Dominion Lending has taken since 2020 to “impede” its own brokers from using rivals’ mortgage application platforms or deal submission software to submit client loan applications to lenders.

Tolentino’s affidavit alleged these actions may have breached Competition Acts sections 77 and 79, which ban companies from trying to impede a rival’s entry or expansion into a market.

Dominion Lending Centres Inc. operates four different businesses, including three mortgage franchise networks, Dominion Lending Centres, the Mortgage Centre (Canada) Inc., and MA Mortgage Architects Inc. The company also owns a mortgage application software platform company, Newton Connectivity Systems Inc.

DLC network brokers use Newton’s Velocity platform to upload completed consumer mortgage applications directly into banks’ loan underwriting computer systems for review and approval. Newton also provides other broker support, including training and payroll services as part of its platform. Brokers earn commissions on individual loans, while DLC gets its own connectivity fees based on loan volumes.

What the Competition Bureau is investigating

Tolentino stated her team of investigators is scrutinizing four different Dominion Lending actions to determine if the company — not its brokers — “is employing a strategy that harms competition” among mortgage technology platform providers. Investigators want to know why DLC:

- Started charging its brokers $200 “nonstandard transaction fees” if they use a rival’s software platform.

- Started asking its franchisees to sign deals pledging to only use Dominion and Newton’s Velocity platform. (The Bureau noted that while Dominion franchise deals now include such a clause, it is not currently enforced.)

- Warned brokers that loan commissions might be delayed by using competitors’ systems.

- Blocked emails from unidentified rivals trying to reach Dominion brokers.

Get weekly money news

In May, the Competition Bureau used Tolentino’s affidavit to obtain a Federal Court order to force Dominion Lending to disclose internal documents about activities and deals involving DLC companies and Newton.

They included reports, Teams, Slack or mobile phone text messages, emails and other documents and communications of dozens of senior Dominion Lending executives.

Probe is 'absurd and unfortunate'

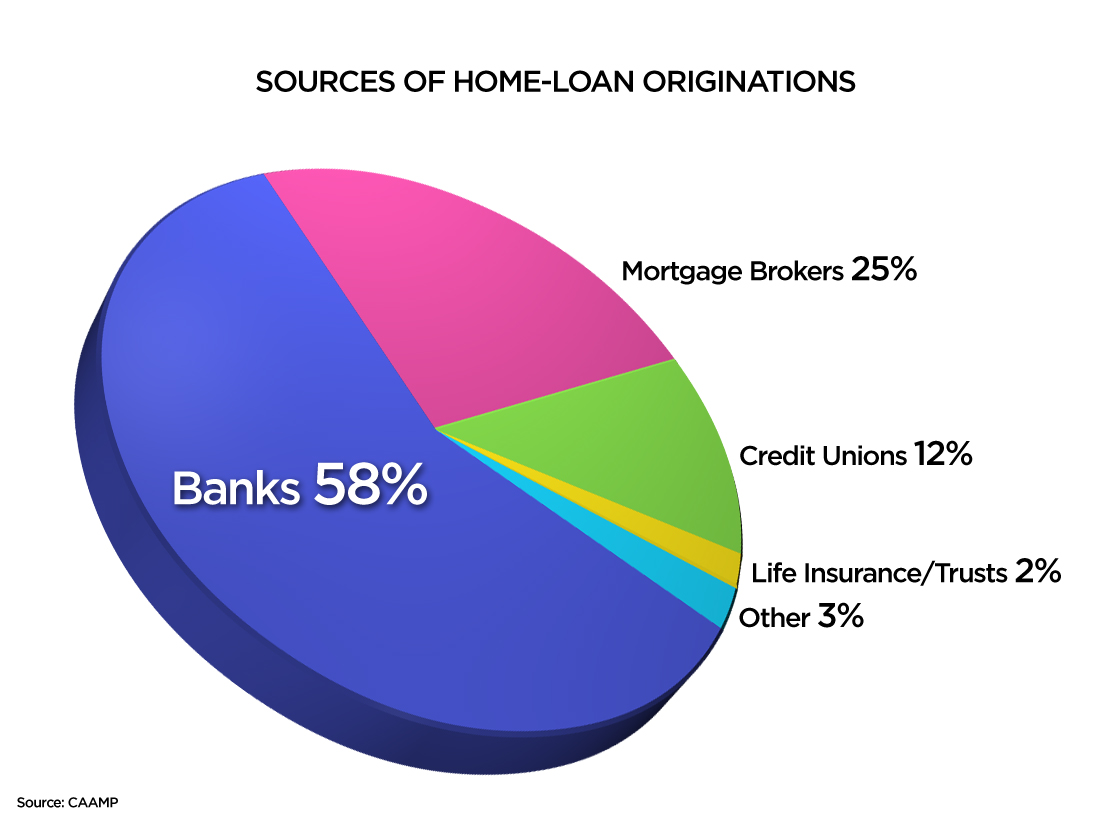

Dominion Lending’s co-president Bell says DLC neither dominates Canada’s mortgage market, nor the mortgage application software or “deal submission” market.

That is what makes the Competition Bureau’s probe “absurd and unfortunate,” Bell added.

Bureau spokeswoman Sarah Brown says the federal law enforcement agency’s probe is active and ongoing but declined further comment.

The Competition Bureau’s sworn affidavit does not state who lodged the complaint about Dominion Lending Centres that triggered its inquiry. It was launched in January.

Investigators stated only that they have gathered information and records from a variety of sources, including public records and unidentified “market participants.”

However, one “market participant” repeatedly mentioned in the bureau’s affidavit is a Vancouver, B.C., mortgage software platform firm called Lendesk Technologies that was acquired by Rocket Mortgage, the U.S.-based behemoth.

Rocket Mortgage is the main unit of the US$16.4-billion Detroit-based Rocket Companies fintech empire. By comparison, Dominion Lending is a much smaller Vancouver-based mortgage brokerage franchisor and software company whose shares trade on the TMX Exchange. It has a C$99-million market capitalization.

As the Competition Bureau probe unfolded, Dominion has bitterly complained to government attorneys in writing that Rocket is driving the case to hamstring Dominion Lending while Rocket works to expand its new Canadian business.

Valery Pesonen, a U.S.-based Rocket Mortgage spokeswoman, did not respond to several requests for comment.

DLC has also attacked the core premise of the Competition Bureau probe, calling it “a fishing expedition” that imposes “grossly unwarranted costs” on the company.

In one letter, Kevin MacDonald, a Toronto-based lawyer with Blake, Cassels & Graydon LLP who is helping defend DLC, derided bureau investigators’ concerns about DLC brokers’ being free to choose rivals’ technology.

Allowing Dominion Lending Centre-affiliated mortgage brokers to pick the mortgage software system of their choice is like arguing that Tim Hortons franchises should be allowed to sell any brand of coffee and doughnuts they want, MacDonald argued. Or, continuing the analogy, allowing McDonald’s restaurants any type of burgers their franchisee-owners wish to flip.

“Such an argument undercuts the very purpose of franchising and surely cannot be the Bureau’s intent,” MacDonald wrote.

In a second letter to the government, Blakes lawyer Randall Hofley alleged that Rocket Mortgage had “weaponized” the Competition Bureau and its Canadian law to serve the U.S. giant’s own expansion and corporate interests.

Rocket seeks “a free ride” on more than $12 million that Dominion Lending had invested in its own mortgage software platform, franchise network and lender connectivity, Hofley suggested.

The Bureau’s affidavit alleges that Rocket’s Lendesk tried but failed to get its mortgage application platform fully integrated into Dominion and Newton’s Velocity’s payroll processing system so DLC brokers who submitted deals approved through Lendesk would get commissions paid automatically.

The Bureau suggested that DLC’s rejection of Lendesk’s request appears designed to protect the lucrative “connectivity fees” for its own Newton Connectivity Systems, instead of those fees flowing to Lendesk and Rocket.

Mum on connectivity fees

Dominion Lending’s co-president Bell declined to answer questions about connectivity fees, none of which are disclosed on DLC’s consumer mortgage application forms.

“That’s not something, as a public company, that we disclose. It’s proprietary. There’s no fixed fee, just volume-based deals with certain vendors,” Bell says.

The affidavit suggests that Dominion Lending-affiliated mortgage brokers who now submit deals through the Rocket-owned Lendesk platform must pay the new $200 “nonstandard transaction fee.”

Dominion Lending told the Competition Bureau it processed approximately 1,000 “nonstandard transactions” in its fiscal 2022 year, generating $200,000 in fees. It defended such fees as necessary to cover extra administrative costs.

Rocket's litigation record

DLC’s own allegations of dirty pool by Rocket as it enters Canada are not the first accusations of unethical conduct levelled at the U.S. giant. It has recently faced three class action lawsuits and a U.S. federal consumer probe.

One shareholder class action lawsuit alleges Rocket Mortgage founder and chairman Dan Gilbert improperly engaged in $500 million worth of insider stock sales in 2021 after his CEO Jay Farner misrepresented business prospects on an earnings call. Farner said business was great. Then, the company announced a sharp drop in profits and its stock plummeted 28 per cent afterwards.

A second, class-action lawsuit by Rocket workers claims they were not paid overtime after attending mandatory after-hours meetings. A third alleged breaches of no-call list laws.

In December, the Electronic Privacy Information Center filed a complaint against Rocket with the U.S. Consumer Financial Protection Bureau. The center alleged Rocket Money engages in unfair, deceptive, and abusive trade practices in violation of U.S. consumer protection laws. Rocket also allegedly used “dark patterns” to deceive U.S. consumers into giving up private financial data.

Rocket denies wrongdoing in all cases.

Comments

Want to discuss? Please read our Commenting Policy first.