Canada’s massive run-up in housing prices during the COVID-19 pandemic had more to do with investor demand and rock-bottom interest rates than oft-talked about concerns of insufficient housing supply, according to the Bank of Montreal’s top economist.

Doug Porter published a short note Wednesday morning exploring the surging home prices seen in Ontario cities such as Chatham-Kent over the two years of the pandemic.

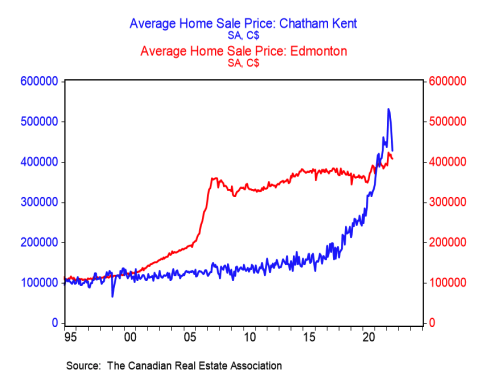

Home prices there ballooned roughly 90 per cent in that time, Porter wrote, contrasting the city with Edmonton, which experienced more moderate growth during the pandemic.

Though the value of homes in Chatham briefly surged past those of Edmonton, prices have seen a sharp decline in the southwestern Ontario town since the Bank of Canada began hiking interest rates earlier this year.

Porter concluded that with little change in the supply of housing units in towns like Chatham over the course of the spring, while rising interest rates dampen buyer demand, the ultimate cause of higher prices during the pandemic was not a lack of homes to go around.

“Our view, and I know this is not a popular one, is that this was more of a demand story than a supply story,” he told Global News in an interview Wednesday.

Canada’s housing supply gap is regularly raised as a barrier to affordability in Canada’s residential real estate market.

The Canada Mortgage and Housing Corp. (CMHC) released a report in June projecting that, when it comes to the goal of affordable homes for all residents, Canada will be short 3.5 million units by 2030.

Scotiabank chief economist Jean-Francois Perrault released an analysis at the start of 2022 showing that Ontario’s housing supply deficit is the worst in the country — and Canada already sits at the bottom of the G7 in per capita housing stock.

Get weekly money news

“If we don’t fix this, if we don’t right-size the number of homes in Canada or Ontario relative to population needs, things are never going to be more affordable,” Perrault told Global News at the time.

- Can Trump decertify aircraft? What experts say amid Bombardier threat

- Corus to seek court approval of recapitalization plan after shareholder vote narrowly fails

- Bombardier warns of ‘significant impact’ to travellers from Trump’s threat

- Canadians have billions in uncashed cheques, rebates. Are you one of them?

In April, the federal government put a significant focus in its 2022 budget on boosting Canada’s housing supply, unveiling plans for a $4-billion housing accelerator fund to get more homes built.

Porter said there is definitely a need for a strong housing pipeline, especially given Canada’s ambitious immigration goals. But evaluating Canada’s housing gap from the perspective of the pandemic — when low interest rates made mortgages cheap and investors saw a chance to enter the market — might not be the most accurate picture to assess demand.

“I think we should move away from this view that we’re not building enough to house everyone. We may not be building enough to meet all the investment demand out there, but I think that investment demand is about to crumble as a result of the run-up in interest rates that we’ve seen in the past six months,” he told Global News.

“The fact that prices have turned … so violently in the last couple of months as a result of a moderate increase in interest rates, tells me that things are wildly overheated. And now we’re going to get back to reality in fairly short order, I think.”

Porter also acknowledged that supply is not a singular problem across Canadian cities. But while it makes sense to discuss density and supply concerns more fervently in cities such as Toronto and Vancouver, shortfalls in cities such as Chatham do not have the leverage to hike prices by 90 per cent over two years.

“It’s strange to be talking about supply constraints in a lot of the areas outside of the major cities,” he said.

“I think when you get outside of the Greenbelt, supply is just not a major issue.”

Mike Moffatt, senior director at the Smart Prosperity Institute, did not disagree with Porter that rock-bottom interest rates and a fear of missing out on the hot housing market fueled activity through the pandemic. But he told Global News in an email Wednesday that he’s “puzzled” by arguments that supply has not been a major factor in price growth in these regions.

Moffatt said markets in southwestern Ontario have suffered “substantial shortages” that drove up prices dating back to 2017 — well before the pandemic.

Porter reiterated that he is not against policies that promote a healthy level of housing supply, but said he would like to see a shift in conversation that places the role of the Bank of Canada’s monetary policy and other demand-side factors at the heart of the pandemic price gains.

“Don’t get me wrong, with some of the aggressive targets we have for immigration and strong population growth, we definitely need a steady supply of new housing. There’s no two ways about that,” he told Global News.

“I think as much focus should be on … trying to constrain the demand side as well and try to skirt some of the financialization of housing.”

Comments