Editor’s Note: This story has been updated with a clarification response on Patron Gaming Fund account activity from B.C. Lottery Corp. that was sent to Global News after the story was first published. The original story included an info-graphic with a title that said $1.7 billion in bank drafts flowed through BCLC Patron Gaming Fund Accounts, from Jan. 1, 2013 to November 2017. That info-graphic has been removed and a clarification added.

Regulators believe about $1.7 billion flowed through special B.C. Lottery Corp. high-roller accounts with large amounts funded by loan sharks and criminal bank drafts, a Global News investigation shows.

The new information, which is revealed in B.C. Gaming Enforcement Branch audit documents obtained by Global News, means that estimates for the totals laundered in B.C. casinos will skyrocket.

WATCH: Exclusive: Money laundering flowing through back door channels in B.C. casinos

Previously, official money laundering estimates in B.C.’s casino scandal have focused on loan sharks and gamblers using bundles of dirty cash and suspicious transactions in casino high-limit cash cages.

But documents obtained through freedom-of-information requests show that regulators believe organized crime loan sharks and Chinese high-rollers are now using more sophisticated channels to launder cash into bank drafts and through B.C. Lottery Corp. “patron gaming fund” accounts.

In this new method, criminals are exploiting Canadian banks, money services businesses, and lax B.C. Lottery Corp. money laundering controls, according to documents.

The Lottery Corp. patron gaming accounts — which were started in 2009 as an alternative for massive cash transactions — had $1.7 billion in funds flow through from 2013 to 2017, mostly sourced from bank drafts.

Regulators believe the majority of these bank drafts are questionable, because they came from a small circle of Chinese high-rollers that are associated with B.C. loan sharks.

Already, with the cash-only transaction laundering methods used by Chinese VIPs and loan sharks, over $600-million in suspected dirty money washed through B.C. casinos from 2010 into 2016, Gaming Enforcement Branch documents show. Most of this cash was in $20 bills, the favoured currency in B.C.’s illegal drug trade.

But now, by adding the “suspected dirty money” that regulators believe has flowed through $1.7 billion worth of questionable patron gaming funds, estimates of money laundered through B.C. casinos from 2010 to 2018 could reach $2 billion.

This means that the B.C. government’s already low official estimate of just $100 million laundered in B.C. casinos — which came from former Mountie Peter German’s independent casino money laundering review — will become increasingly problematic for Premier John Horgan’s government to stand by.

WATCH: Were B.C. casino staff connected to money-laundering suspects?

B.C.’s government did not answer questions from Global News about increased estimates of Lottery Corp. casino money laundering revealed in Global’s investigation.

Get daily National news

“Peter German’s report on money laundering provides us with a strong foundation to take the actions needed to eradicate this criminal activity in our casinos,” a statement from the government said. “We accept his recommendations in principle and are leading implementation in coordination with the B.C. Lottery Corporation.”

“Only funds sourced to a recognized financial institution may be placed in a patron gaming fund (PGF) account at account opening,” the Lottery Corp. said in a statement. “BCLC monitors play activity and PGF account activity and investigates unusual activity — including by requesting proof of source of wealth.”

The Lottery Corp. added that Patron Gaming Fund figures included significant funds from so-called “churn” — or money that was recycled through betting — therefore they do not believe $1.7 billion worth of bank drafts were deposited into these accounts.

And in a response disputing the analysis of Global News in this story, the BC Gaming Industry Association asserted that over $1-billion of funds flowing in Patron Gaming accounts in the time period, are attributed to “re-deposited” funds that VIPs sometimes won in casinos bets and should not be included in any estimate of ‘dirty money’.

The BCGIA also disputed any suggestion that all bank drafts deposited to PGF accounts would be ‘dirty money’, noting that banks issuing the drafts must comply with anti-money laundering regulations. The BCGIA also disputes the possibility that all of the $600 million in suspicious cash transactions is “dirty money” saying there is no evidence to support this.

Suspicious bank drafts

Documents show that Lottery Corp. “patron gaming accounts” are almost exclusively used by dozens of Chinese high-rollers who have been pouring extreme sums from murky origins into Vancouver-area casinos.

These new gambling accounts were ramped up in 2013, after B.C. Gaming enforcement branch investigators and police started complaining to B.C.’s government about gamblers visiting from China flooding the casinos with suspicious cash.

According to the Lottery Corp., the new non-cash accounts were supposed to be funded with wire transfers and bank drafts run through reputable financial institutions. The idea was to reduce the prevalence of bulk cash transactions in Vancouver casinos, and establish an audit trail that would discourage money launderers.

But according to audit documents, the patron gaming accounts were mostly funded with bank drafts, and often these drafts were suspicious.

There were “concerns around money services businesses,” and patrons “bringing in bank drafts from multiple different banks.”

Other problems included anonymous “third-party” gamblers using “nominees” — meaning stand-in buyers — to fund patron gaming accounts. And these nominees were “bringing in bank drafts that do not have the bank customer/account holder name on it.”

According to the documents, funds were often quickly withdrawn from the accounts with minimal gambling, which is a red flag for money laundering.

But according to regulators, the biggest indicator of money laundering in patron gaming accounts is the gamblers who use them, and their method of going to B.C. loan sharks as funding sources to avoid China’s capital export controls.

Documents indicate that an incredibly small number of foreign high-rollers — the top 10 VIPs from China — accounted for almost half of the $1.7 billion that flowed through patron gaming accounts from 2013 to 2017.

One patron alone could have accounted for a total of $200 million in patron gaming fund activity, a redacted document suggests.

Documents and gaming investigators say these Lottery Corp. patrons were the biggest “whale” gamblers from China. There was a rotating cast of about 50 high-rollers at any given time, who typically visited B.C. to gamble for several weeks or months before returning to China. And they liked to bet millions per night in Vancouver-area Lottery Corp. casinos.

Lottery Corp. documents show that officials suspected some of the biggest whales continued to use loan sharks and bags of cash for chip transactions of over $500,000 per night, even while also using patron gaming accounts at the same time.

And alleged Chinese Triad loan sharks associated to these top Chinese VIPs were arrested by B.C.’s anti-illegal gaming unit in Richmond residences, where police say they seized large quantities of suspicious bank drafts. The Crown is now reviewing the case, and it’s not known if charges have been laid.

WATCH: How organized crime groups launder suspected drug money in B.C. real estate

Suspected Lottery Corp. money laundering explained

A fall 2017 B.C. Gaming Enforcement Branch internal memo reveals new details explaining exactly how gaming regulators believe large scale money laundering from China is occurring in B.C. casinos and assets such as real estate.

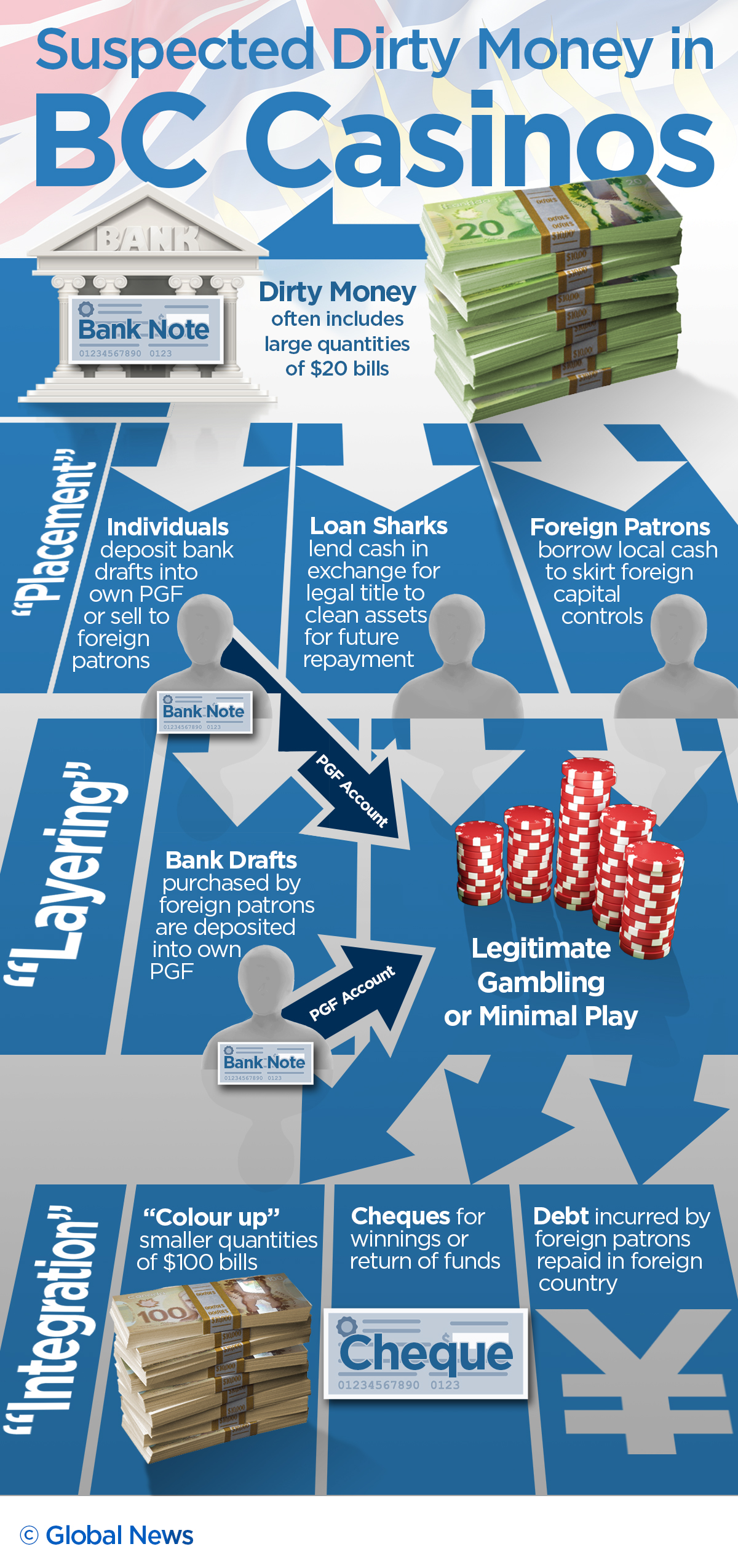

The chart breaks down the three general stages of money laundering:

- Placement, meaning how dirty cash enters the legitimate economy

- Layering, meaning how criminals make complicated transactions to obscure dirty money trails

- Integration, meaning how cleaned money is invested in large assets, so that gangsters can hide and enjoy the fruits of their crime

Pools of dirty money “often include large quantities of $20 bills,” the chart explains. Criminals store this cash in underground banks, and from there loan sharks can withdraw and distribute the cash into money services businesses and banks, where “anonymous bank drafts are acquired.”

After financial institutions issue these drafts, “individuals deposit banks drafts into their own Patron Gaming Fund, or sell to foreign patrons.”

Another path for the dirty $20s is directly to casino loan sharks, who “lend cash in exchange for legal title (of real estate or luxury vehicles for example) to clean assets, or (secure) future repayment.”

- B.C. 2026 budget ‘neither’ big cuts nor tax increase, minister says

- Former Conservative leader John Rustad says he’s not running for his old job

- Parts of B.C.’s South Coast set to see snow-rain mix with ‘rapidly changing’ travel conditions

- Survivor of one of Canada’s first school shootings reflects on Tumbler Ridge grief

“Foreign patrons borrow local cash to skirt foreign capital controls,” the chart shows.

In both methods — distribution by loan sharks of cash loans or bank drafts — Chinese high-rollers have evaded rules barring them from exporting large amounts of funds from China to Canada.

In the patron gaming fund method, “bank drafts purchased by foreign patrons are deposited into their own patron gaming fund,” the chart says. Now with funds successfully placed in B.C. casinos, gamblers can do “legitimate gambling or minimal play.”

And in the final stage, VIPs who win on their gambling bets strike it rich, walking out with big confirmed winnings cheques. But gamblers who only flowed funds through patron accounts “with minimal play” can get “return of funds” cheques, the document says.

The final way of getting cleaned money, according to the chart, is when high-rollers deposit $20 bills for casino chips, and cash out with $100 bills. This is a type of money laundering transaction referred to as refining or “colouring up.”

In the last “integration” phase, gamblers have successfully cleaned dirty money, and can buy homes in Vancouver and do business in Canadian banks.

And finally, the chart shows a symbol for the Chinese Yuan currency and says: “debt incurred by foreign patrons (from casino loan sharks) is repaid in foreign country.”

sam.cooper@globalnews.ca

Comments

Want to discuss? Please read our Commenting Policy first.