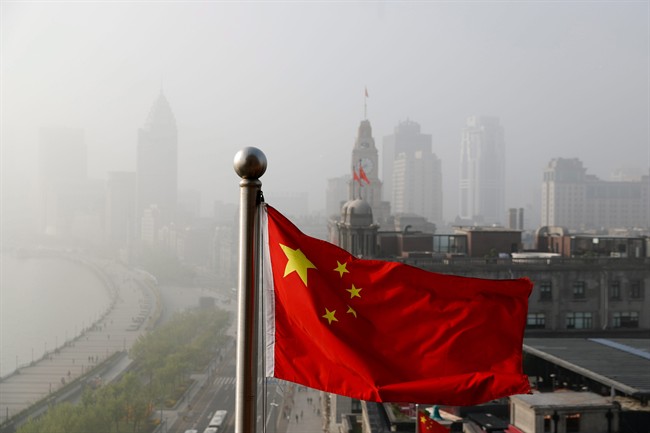

China faces bigger economic challenges than its trade war with the U.S.

Even before tit-for-tat tariffs, growth in the world’s No. 2 economy was already forecast to cool from 6.8 per cent last year to a still-robust 6.5 per cent this year.

Communist leaders who are trying to engineer slower, more self-sustaining growth clamped down last year on a bank lending boom that encouraged businesses and families to borrow and spend beyond their means. But it is a tricky balance to strike and communist leaders worry the economy is weakening too much.

Growth in retail sales, a bigger part of the Chinese economy than exports, was weaker than expect in July and close to a 14-year low. Factory output and other sectors also decelerated. Beijing responded by easing lending and boosting government spending.

“We expect the economy to get worse before it gets better,” said Nomura economists in a report.

WATCH: U.S., China impose new tariffs, escalating trade war

Trump’s advisers say the slowdown gives Washington leverage in the trade battle.

“Their economy looks terrible,” said Trump’s top economic adviser, Larry Kudlow, at a Cabinet meeting this month.

But analysts closer to China say it is doing better than Americans might think.

“A lot of this economic slowdown is really the result of an intended policy,” said Tai Hui of J.P. Morgan Asset Management in Hong Kong. “The overall growth momentum is still relatively healthy and certainly broadly in line with the authorities’ plans.”

Here is a breakdown of China’s economic strengths and weaknesses:

Economic slowdown

July’s downturn was more abrupt than policymakers wanted.

Growth in factory output slowed to 6 per cent from May’s 6.8 per cent. Investment in factories and other fixed assets rose at the slowest rate in 19 years. Retail spending and corporate profits weakened.

With less demand from Chinese steel mills, global prices for iron ore are off 14 per cent this year — and down 60 per cent from their 2010 peak. That cuts revenue for Australia and other producers.

WATCH: Trump announces new tariffs on $200B in Chinese products as trade dispute continues with China

Chinese leaders want to shift emphasis from the headline growth number to poverty reduction, energy efficiency and the environment. But they need to keep the expansion above 6 per cent to hit their target of doubling incomes from 2010 levels by 2020.

China’s yuan has sunk in value against the dollar. That helps exporters by making Chinese toys, appliances and other goods cheaper for American consumers. But regulators worry it will trigger an outflow of money, making it harder for companies to borrow.

China’s response

Regulators eased credit controls, promised more spending on public works and announced policy changes aimed at making Chinese industry more productive.

Banks have been told to lend more freely to small exporters that might be hurt by Trump’s tariffs. That temporarily backtracks on government efforts to rein in rising debt.

Beijing sees the “growth slowdown as a bigger near-term risk,” said UBS economists in a report.

The government is pumping money into the economy with plans to spend more on building roads, bridges and other public works.

This month, sales of infrastructure bonds raised 280 billion yuan (US$41 billion), more than the total for the first seven months of the year, according to Macquarie Bank’s Larry Hu.

Beijing has sped up the rollout of plans to ease restrictions on foreign ownership in auto manufacturing, banking and insurance.

The moves are not, however, intended to address American complaints at the center of the trade war. Those hinge on U.S. objections to Chinese plans for state-led creation of global champions in robotics, electric cars and other technologies. American officials complain those violate Beijing’s market-opening commitments and might erode U.S. industrial leadership.

Instead, China is trying to reduce reliance on foreign markets and technology by promoting domestic consumption and industry development.

Tumbling stocks

While Wall Street sets records, China’s stock market is 2018′s worst global performer.

WATCH: What is a trade war? How do tariffs work? And why it will impact Canadian consumers

The market benchmark tumbled 25 per cent from its January peak to mid-August. It has gained 3.7 per cent since then after government spending plans helped to revive investor confidence.

The biggest decliners are real estate, construction and other companies hardest-hit by Beijing’s lending controls.

Shares in Poly Real Estate Group, one of China’s biggest developers, have lost 40 per cent of their value this year. Aluminum Corp. of China Ltd., the country’s biggest aluminum producer, is down by half.

The biggest gainers are smaller tech companies that look set to benefit from official industry plans. Shares in Zhongshi Technology Ltd., a Beijing-based maker of insulators for telecoms, medical and automotive equipment, are up 400 per cent this year.

Trade impact

July exports to the United States rose 13.3 per cent over a year ago despite a tariff hike. Forecasters expect exports to soften but say that will be due more to flagging global demand than to American controls.

The tariffs target Chinese goods such as medical equipment and factory machinery that Washington says benefit from improper industrial policies. But U.S. officials have tried to limit the blow to consumers by avoiding penalties on Barbie dolls, Apple iPhones and many other brand-name products made in Chinese factories.

China is the world’s No. 1 trader, but exports have shrunk as a share of the economy.

Last year, they were equal to 19 per cent of gross domestic product, down from 38 per cent in 2005. Exports supplied 0.6 percentage points of GDP growth of 6.8 per cent, while consumption accounted for more than half.

The United States buys about 20 per cent of China’s exports. Sellers of low-margin goods such as surgical gloves and handbags say American customers are canceling orders. But producers of higher-technology goods such as factory machinery and medical equipment report little impact.

Chinese leaders are encouraging exporters to sell to other markets, especially in Asia and Africa. That will be a challenge, because their consumers buy lower-value goods than Americans.

So far, U.S. tariff hikes have had little impact on a Chinese economy that is bigger than Japan and Germany combined. The first round hit July 6 and Trump says they could spread to cover up to $250 billion of Chinese imports.

Credit Suisse says if all threatened U.S. tariffs are imposed, that might trim 0.2 percentage points off Chinese growth this year and 1.9 percentage points in 2019.

“I don’t think Beijing is willing to yield significantly,” said Hui of J.P. Morgan. “Especially to pressure from another country. You know the historical precedent of that is just not acceptable.”

Comments