Not only can Metro Vancouver lay claim to the most expensive housing in Canada, it’s also the most expensive place in which to build a new single-detached home.

Addressing that issue could be one way to make the region more affordable, if a new report out of a national think tank can be believed.

Coverage of Vancouver housing on Globalnews.ca:

“Through the Roof: The High Cost Barriers to Building New Housing in Canadian Municipalities” was published by the Toronto-based C.D. Howe Institute on Tuesday.

Written by Ben Dachis and Vincent Thivierge, it outlines the cost to build a single-detached home in metropolitan regions across the country.

And just like the region’s home prices, the cost of building in Metro Vancouver comes out looking more expensive than any other region in Canada.

The report estimated the cost of barriers to home construction by looking at two main metrics: the market price of housing, and the “Minimum Profitable Production Cost” (MPPC).

The MPPC was derived by taking construction costs, which were based on the value of building permits and the number of new single-detached units in different Census Metropolitan Areas (CMAs), as reported by Statistics Canada.

This number was then added to the cost of buying land. Together, they were then multiplied by the margins developers earn as profit to produce the MPPC.

Then, that metric was substituted from the market price of housing.

This is how Canada’s CMAs stacked up against each other thanks, in part, to that calculation:

“For most CMAs, our cost measure, which is simply the difference between the building construction cost per square foot and the market price per square foot, is close to zero,” the report said.

“This minimal difference is to be expected in a normally functioning municipal housing market.

Get breaking National news

“However, for a few CMAs such as Abbotsford, B.C. and Vancouver, single-detached house prices exceed the construction cost of new units by $150 per square foot or more. In Vancouver, the cost gap is $300 per square foot.”

READ MORE: Vancouver home prices fell twice as fast as a bank thought they would after BC NDP’s new taxes

The authors used a second table to illustrate just how much more they said it costs to build a single-detached home in Vancouver than in any other metropolitan area.

And this one showed that the cost barrier to build a single-detached home in Vancouver is more than double what it is in any other region.

The table took the average living size of a single-detached home in these areas, as provided by Brookfield RPS.

Then, it used permit values as reported by Statistics Canada. The total value of permits was divided by the number of units to produce permit values per new house.

That value was then divided by the square footage of homes in the CMA.

READ MORE: There’s only 1 home on this massive Vancouver lot. There may be enough room for 21 homes

Additional amounts were added to the per square footage for developer profits and land servicing costs.

That amount was, finally, subtracted from the sale price per square foot of new housing.

The calculation resulted in an increase in cost-per-new-house of CAD$644,000 in Vancouver. That was double the costs in the next-closest metropolitan region: Abbotsford-Mission, where it was CAD$311,000.

In an interview with Global News, Dachis said the report focused on single-detached homes — a form of housing that is already well out of reach for many across Metro Vancouver — because calculations were trickier for townhomes and condos.

Nevertheless, it provides a glimpse and just how much it costs to build across the region.

“When you see the price that people actually end up paying being way more than what it feasibly costs to build something, what that is is a sign of market dysfunction,” Dachis said.

In Abbotsford, for instance, the cost to build is one of the lowest in the country, he noted.

But it still comes out with one of the highest costs to build in this study.

“So you’ve got lots of land available around Abbotsford, but it’s far more difficult for developers to get access to it than it otherwise should be,” Dachis said.

“When it’s tougher for developers to get access to that land, the price of the land goes up and up and up, and that gets reflected in the final house price.”

READ MORE: Buying vs. renting in Vancouver — moneywise, it doesn’t make much difference: analysis

Dachis identified a few factors leading to land constraints that could be helping to drive up values — but his examples largely applied to Ontario.

One is development charges — which in B.C. are known as development cost charges (DCCs) — tools that allows regional districts and municipalities to collect money from developers that can offset costs related to increased demands on infrastructure.

The report called on local governments to reduce such charges, introduce user fees and let new residents pay for services through property taxes, such as area-specific ones.

Another factor included in the calculations is agricultural land. In Ontario, the report noted, there are numerous municipalities with a high share of land previously zoned for agriculture that have higher housing costs.

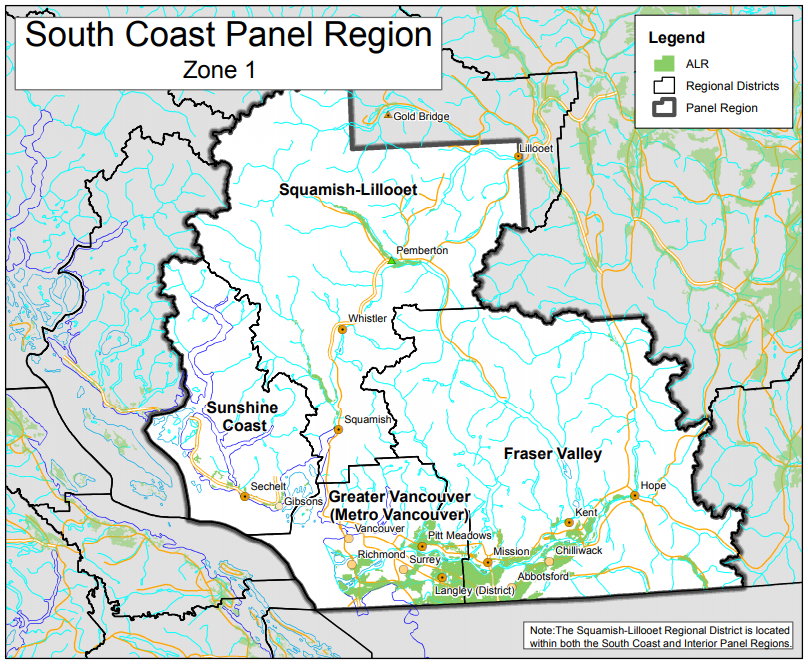

B.C. has its own tool to protect agricultural land — the Agricultural Land Reserve (ALR), an area of 4.6 million hectares of land suitable for farming across the province.

Development is severely restricted on these lands, and in certain municipalities, like Richmond, there are concerns about the size of the homes being built on them and taking away the ability to farm some of the property.

Plenty of agricultural land is concentrated around Abbotsford — where Dachis said there’s lots of land available for development.

READ MORE: Metro Vancouver housing starts on track for record year: home builders

Ultimately, Dachis felt that, when it comes to creating more affordable housing, there’s less focus on supply than there is on demand-side measures, such as B.C.’s property transfer tax on foreign buyers and the speculation tax, which has yet to be implemented.

- ‘Ghosted’: Canadians stranded in Puerto Vallarta say they are abandoned by WestJet

- Parents of 4-year-old killed in Horseshoe Bay bus crash still waiting for answers

- Myles Gray was injecting unprescribed testosterone, doctor tells hearing into patient’s death

- Canadian government considers police increase in small communities like Tumbler Ridge

However, there are still questions about how much adding new supply will help with affordability.

StatsCan data on non-resident buyers last year showed that non-residents, who are known to own property that’s valued higher than that possessed by residents, owned as much as 19 per cent of condos built between 2016 and 2017 in the City of Vancouver alone, and 24 per cent of new condos in Richmond.

Asked how more supply can help with non-residents taking a higher and higher share of new condo units, Dachis said this example actually “completely proves the point of the methodology of the paper.”

“As long as there’s the ability for people to build more, it doesn’t matter what the demand is,” he said.

“If the supply keeps entering, the supply of housing keeps increasing to meet that demand, prices aren’t going to go up, prices will stay at what it costs to build the house.”

But how much supply would be needed to meet that demand? And what if units are being left empty, and used to park money?

“Developers are in this to make money,” Dachis said.

“If these foreign buyers are willing to park money there, developers should be able to look at that as a business opportunity and keep on building more.”

Comments

Want to discuss? Please read our Commenting Policy first.