One of the first things people do when they get a new job offer or a big raise is to try to figure out what their income taxes are going to be. Why? Because we all know that what really matters is net pay. Somehow, however, this principle tends to fall by the wayside when we deal with our savings.

More than 65 per cent of Canadian households contribute either to a Registered Retirement Savings Plan (RRSP) or a Tax-Free Savings Account (TFSA), recent census data suggests. Those are the two options for sheltering your investments from tax, and it looks like most Canadians are aware of them. But what if you need to hold money outside an RRSP or TFSA?

READ MORE: How much do you really need for retirement? We did the math

It isn’t hard to imagine why you would. RRSPs are meant for retirement and generally do not lend themselves to shorter-term savings goals like buying a car or maintaining a rainy day fund. And perhaps you’re already maxing out your TFSA for something else, like saving up for a down payment. Or maybe, lucky you, you max out both your RRSP and TFSA every year and still have savings to stash away.

READ MORE: Money123 – the easy way to be smart with your money

If you have any savings sitting outside an RRSP and TFSA, you should be aware of the tax bite. Different types of investments are taxed differently, and this can make a significant difference to your actual investment returns.

To illustrate the concept, let’s look at a fictional example.

SIGN UP FOR ERICA ALINI’S UPCOMING WEEKLY MONEY NEWSLETTER:

Meet Jane Canuck

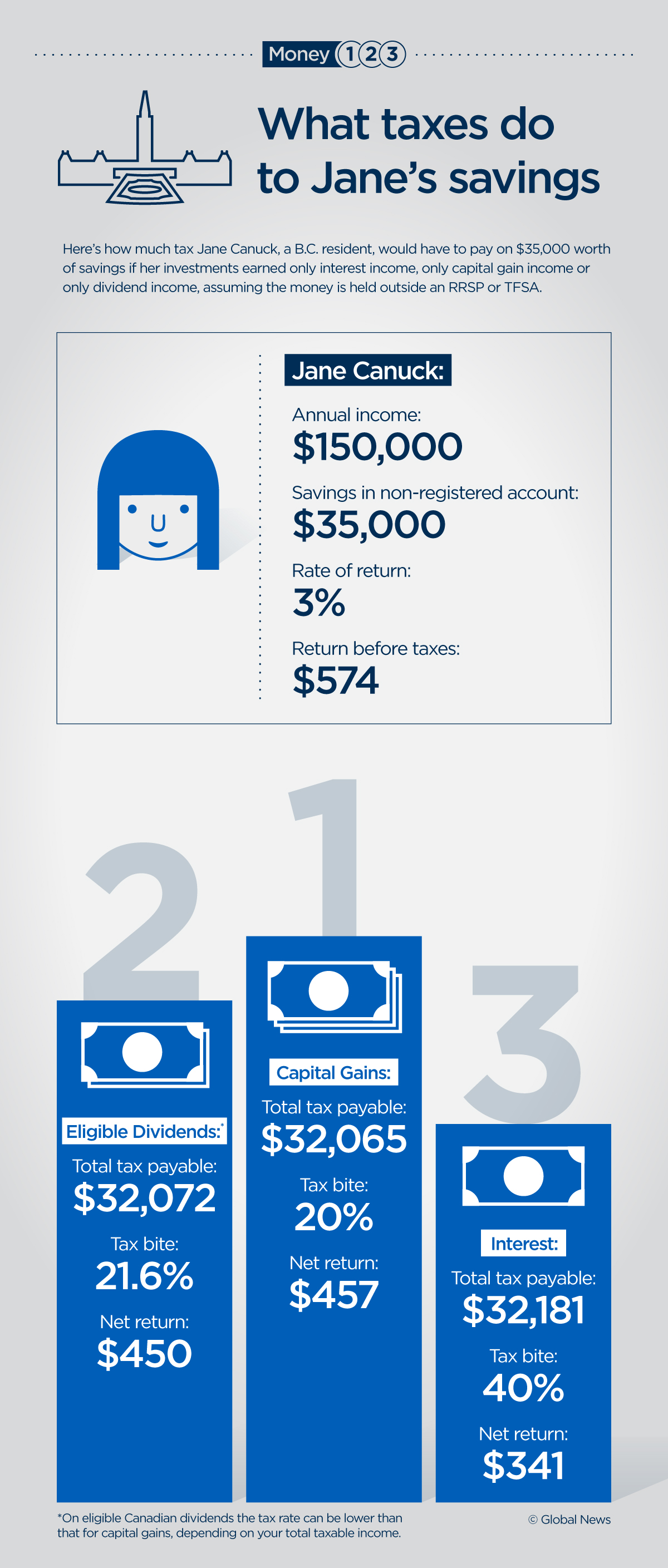

Jane Canuck is an imaginary Canadian based in B.C. Earning $150,000 a year, Jane is doing quite well and manages to use up all of her RRSP and TFSA contribution room every year. But Jane sets herself a goal of saving another $35,000 in a year for a large expense that’s coming up.

READ MORE: Plan to use your RRSP for a down payment on a house? Don’t do it.

Get weekly money news

To meet her goal in one year, Jane needs to squirrel away just under $2,917 per month. Now let’s look at three scenarios: Jane invests her $35,000 so that it only earns interest income; only earns capital gain income; or only earns eligible dividend income.

How much money does Jane go home with at the end of the year? We asked Julia Chung, a certified financial planner and partner at Surrey, B.C.-based Spring Financial Planning to do the math.

READ MORE: When saving into an RRSP instead of a TFSA could cost you dearly

We’re going to assume that Jane earns a three-per-cent return in all three scenarios so that we’re comparing apples to apples. However, “this means that we’re not being the least bit realistic about what rates of return are possible with different kinds of investments, and that we are not making a recommendation for how she should invest these savings,” Chung noted.

Before taxes, Jane would make $574 over the course of the year. How much of that she gets to keep after tax, though, is a different story:

Different kinds of investments come with different tax rates

Interest, capital gains and dividends are the three basic types of investment income:

Interest income: This is the interest you earn from your deposits in savings accounts, guaranteed investment certificates (GICs), or bonds. From a tax point of view, interest is treated like your regular income. In the first scenario, Jane is being taxed as if she had earned $150,574 ($150,000 + $574).

Capital gains: A capital gain is an increase in the value of the investments you hold. For example, if you bought Apple shares at $100 and now they’re worth, say, $170, your capital gain is $70 per share. You’d only get taxed on that $70 if you decided to sell or transfer your Apple stocks. If you did, you’d be taxed at your marginal rate, but only half of the capital gain would be subjected to tax.

With capital gains, Jane’s tax bite is exactly half of what she would have had to pay by earning exclusively interest income.

Eligible dividends income: Dividends are amounts that companies pay to their shareholders on a regular basis out of their profits. Dividends from shares of taxable Canadian corporations – so-called eligible dividends – have a preferential tax treatment. How it works is a bit complex, but “suffice to say that, depending on your total taxable income, the tax rate applied is often lower than that for interest income and higher than that for capital gains,” Chung said.

WATCH: RRSPs aren’t for everyone – here’s a look at which registered account might suit you better

Takeaways from Jane’s story

There are a couple of fundamental lessons Chung sees in Jane’s example:

If investing outside an RRSP or TFSA, be aware of taxes. Taxes shouldn’t necessarily be the leading consideration when deciding how to invest, but they should be part of your math, said Chung.

The return on safer investments could be even lower than it looks. In our scenarios, all three types of investments earn the same return. In real life, riskier investments like stocks tend to yield higher returns than safer bets like bonds and GICs. This has been especially true in the past couple of decades of very low interest rates. For example, the S&P 500 Index gained 11.2 per cent (in Canadian dollars) last year. By comparison, the best rate you can hope for in a one-year GIC held outside an RRSP or a TFSA is 2.50 per cent, according to rate-comparisons site Ratehub.ca. When you consider after-tax returns, though, the spread becomes even larger, Chung noted. Your meagre GIC return would be fully taxable, while only half of your plump capital gain would face tax.

TO CELEBRATE THE LAUNCH OF THE MONEY123 NEWSLETTER WE’RE GIVING OUT $500:

Disclaimer – Global News provides the information contained in this series for informational purposes only. It is not to be used or construed or relied upon as financial, legal, tax, accounting or other professional advice or recommendations regarding the suitability, profitability or potential value of any particular investment, product, service or course of action. The information provided does not replace consultations with professional advisors and it is recommended that you seek appropriate independent advice from qualified professional advisors before making any financial or other decisions. Global News shall not be responsible or liable in any way for any loss or damage directly or indirectly incurred as a result of, or in connection with, the use of such information by you.

Comments