When Prime Minister Justin Trudeau announced he would restore the age of eligibility for Old Age Security (OAS) from 67 to 65 years old, he said he was doing it for Canada’s “most vulnerable” population.

It’s also Canada’s fastest-growing population.

The latest release from the 2016 Census showed the country marking the “largest increase in the proportion of seniors since Confederation.”

For the first time, it showed more seniors than children living in Canada. People over the age of 65 represented a 16.9 per cent share of the population; children aged zero to 14 years old took a 16.6 per cent share.

It’s a trend that’s expected to continue right up to 2061, when people of retirement age are expected to make up over a quarter of the population, while children only represent 15.5 per cent, as illustrated in the graph below.

A trend like this has implications for many facets of Canadian society, from the labour market, to health care and retirement programs, Statistics Canada noted.

And with an aging population that keeps growing, Trudeau’s decision to tack two more years back on to the age of OAS eligibility could mean the program will cost an additional $3.25 billion in 2025; and an extra $15.31 billion in 2050.

With the youngest members of Generation X hitting retirement age around 2046, it’s a financial burden that could fall disproportionately on millennials and other generations to come.

A report out of the C.D. Howe Institute has an idea for how to lower the bill for millenials. But the federal government doesn’t sound very interested in hearing it.

Demographic pressures

OAS is one of three components of Canada’s public pension system — a system that is starting to feel the pressure from an aging population and slumping birth rates.

From 1992 to 1994, Canadians were expected to spend about 18 years in retirement. From 2010 to 2012, they were expected to spend two decades in retirement.

The report recommends a fundamental shift in how Canada looks at eligibility for retirement programs: by changing it from a set age of eligibility to a proportion of life spent as a retiree.

The idea is outlined in a report titled “Greener Pastures,” by authors Robert L. Brown and Shantel Aris. The report authors caps the proportion of life spent in retirement at 34 per cent.

The Canadian context

But limiting the time in which people receive retirement benefits would necessitate a gradual increase in the age of eligibility for Canada’s retirement programs as life expectancy goes up.

Using life expectancy projections, the report authors estimated the age of eligibility for OAS would rise to 66 years old in 2025. It would rise further, to 67 years old, around 2050.

So what are the purported benefits?

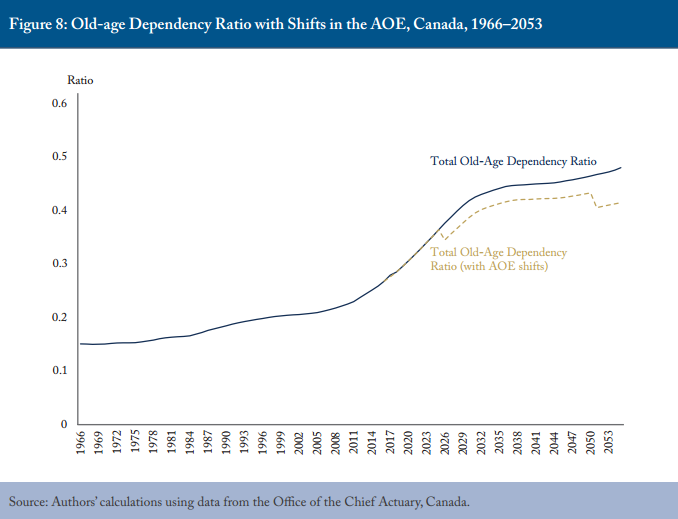

For one, growth in the old-age dependency ratio, which looks at how many workers there will be for every retiree, would be “curbed drastically” over the next 40 years, they claimed.

There were approximately 4.4 people aged 20 to 64 for every one aged over 65 in 2010, according to a Canadian actuarial report.

That ratio is expected to fall to 2.2 people for every retiree in 2050, which means there will be fewer working people supporting one retirement income.

Capping the share of life that Canadians spend in retirement could mean the old-age dependency ratio would stabilize to just over three workers for every retiree.

The proposal would ensure “equity across generations” for financing retirement, they wrote.

READ MORE: Federal budget rains money on seniors … and only drips it on the young: study

And it could also save money, they argued.

The proposal could shave as much as $3.25 billion off OAS expenses in 2025; over $5 billion in 2030; another $5 billion in 2040; and over $15 billion in 2050, Brown told Global News in an email.

Brown and Aris are far from the first to recommend raising the age of eligibility for Old Age Security.

The federal government’s own economic advisory council recommended raising it earlier this year.

But proposals to raise the age meet with a blunt response from Finance Minister Bill Morneau’s office.

“Reversing the previous government’s arbitrary decision to lower the age of eligibility was a commitment we made with the middle class and the most vulnerable Canadians in mind, and it was absolutely the right thing to do,” Daniel Lauzon, director of communications in the minister’s office, told Global News.

“We’ve made that decision already. The retirement age is 65. We clarified that following the Advisory Council’s recommendations as well.”

It also doesn’t meet with much support from CARP, an organization that advocates on behalf of retired people.

“CARP strongly cautions against ad hoc changes that will impact the financial security of our seniors,” Wanda Morris, CARP’s VP of advocacy, told Global News.

“Unlike many other countries, such as Australia, Britain, China, Denmark, France and Iceland,” Canada does not mandate that employers provide pensions for their employees. This means that OAS, GIS (and CPP) are particularly critical to keep seniors out of poverty.”

READ MORE: B.C. has Canada’s worst-performing economy for young people

But the authors think these changes would be beneficial for various reasons: the proposal would result in “equity in financing retirement across generations” and make Canada’s retirement programs even more sustainable, they wrote.

Comments