Canada’s main stock index climbed on Friday, buoyed by strength in the energy sector, while U.S. markets also rose following a speech by U.S. Federal Reserve chair Jerome Powell, who said future decisions on interest rates will be based on what the incoming data says about inflation and the economy.

Markets breathed a sigh of relief after Powell spoke at an annual symposium, sending stocks a little higher Friday after a rocky week, said Philip Petursson, chief investment strategist at IG Wealth Management.

Investors had been anxiously anticipating the speech at Jackson Hole, as Powell’s hawkish comments last year took them by surprise. This year, however, the chairman didn’t offer anything new, said Petursson.

“No news is good news,” Petursson said.

“He didn’t try and disappoint or throw water on the market. He just came out and said the exact same thing that he’s been saying for the last six months.”

The S&P/TSX composite index was up 59.92 points at 19,835.75.

In New York, the Dow Jones industrial average was up 247.48 points at 34,346.90. The S&P 500 index was up 29.40 points at 4,405.71, while the Nasdaq composite was up 126.67 points at 13,590.65.

Powell reiterated in his speech Friday morning that the Fed will be data dependent and that further rate hikes are not out of the question. He didn’t mention cuts, noted Petursson.

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- Do you need to own a home to be wealthy in Canada? How renters can get ahead

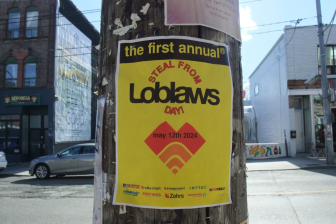

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

The market flip-flopped in the morning, dipping somewhat after the speech, before rising throughout the afternoon.

“Today, I would say the market kind of put aside what Powell said, because he wasn’t saying anything new,” said Petursson. “Really, what investors have been doing is, I think, just diving in and buying some of … this dip that we’ve seen since the beginning of the month.”

The Fed remains locked on its two-per-cent inflation target, he said.

The gains Friday capped an interesting week on the markets. On Wednesday after the bell, chipmaker Nvidia released an expectation-defying earnings report, despite already heightened expectations after the previous quarter.

However, the next day, the company’s stock didn’t soar the way it did last time. Investors had likely already priced in the gains and could be thinking this is as good as it gets for now with Nvidia, said Petursson.

“They delivered, and now people are taking their chips off the table,” he said.

The comparatively tepid reaction is also reflective of a broader sense of caution among investors, he said.

It’s getting harder and harder to remain optimistic in the face of weaker economic data that the rally of earlier in 2023 will continue, said Petursson.

“I think it’s getting harder to believe that the rally can extend itself much further than where we’ve already come this year.”

However, though the volatility seen in August is likely to continue into September, Petursson said there’s still a good case to be made for a soft landing. Next up, investors will be eyeing data on GDP and jobs in the U.S. for a sense of where the Fed might take rates at its September meeting.

The Canadian dollar traded for 73.50 cents UScompared with 73.72 cents US on Thursday.

The October crude contract was up 78 cents at US$79.83 per barrel and the October natural gas contract was up two cents at US$2.66 per mmBTU.

The December gold contract was down US$7.20 at US$1,939.90 an ounceand the September copper contract was down a penny at US$3.76 a pound.

Comments