Canadian workers faced an uphill battle trying to keep pace with inflation in 2022, jobs figures show, a struggle that experts say forces hard decisions for low-income workers who aren’t making a living wage.

Statistics Canada’s labour report showed Friday that average hourly wages were up 5.1 per cent in December over the previous year.

Though cooler than the 5.6 per cent hike seen in November, Canadian workers marked the end of the year with a seventh straight month of wages growing above the five per cent bar.

But even the strong November growth failed to keep pace with inflation that month, which clocked in at 6.8 per cent annually.

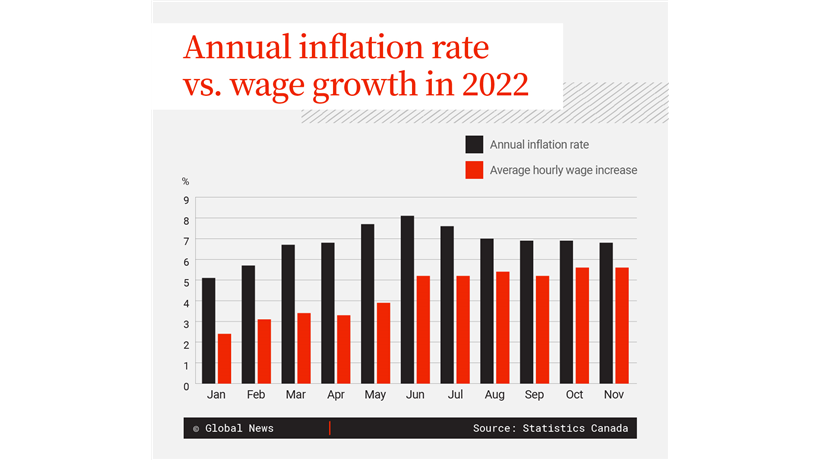

As inflation surged and eventually started to cool through 2022, wage growth steadily crept higher most months, yet never quite matched the pace of price pressures.

Economists who spoke to Global News said that when wages fail to keep pace with inflation, Canadians who aren’t able to find higher-paying employment or negotiate a raise are forced to tighten their belts.

“It’s important to keep in mind that those are real reductions in the purchasing power of workers,” says Iglika Ivanova, senior economist with the Canadian Centre for Policy Alternatives (CCPA) in B.C.

“Especially in this year, with these enormous increases in the cost of living … people earning more modest incomes have really been squeezed, for lack of a better word.”

Many Canadian workers failing to make living wage

While December’s jobs report shows the average wage in Canada was just over $32 per hour, breaking the figure down by demographic shows many vulnerable populations making a living well below that bar.

On average, those aged 15 to 24 recorded hourly wages of $19.61 last month, temporary employees earned $25.65 per hour, and women brought in $30 hourly compared with men’s $34.07.

Ivanova says these demographics, as well as recently arrived immigrants and racialized workers, are more likely to be earning below the living wage for their community.

The living wage is distinct from the minimum wage, which Ivanova says is a bar “often set arbitrarily” by provincial governments.

Get weekly money news

The calculation for a living wage is distinct based on where a family lives, she explains, and factors in costs for housing, rent, transit and food, as well as specific government supports.

The wage works out to the hourly, full-time wage needed for both working members of a four-person household to earn for a “basic level of economic security” in their community, Ivanova says.

The Ontario Living Wage Network reports that for Toronto in 2022, the living wage was $23.15, compared with the province’s minimum wage of $15.50, which rose in October. The living wage fluctuates around the $20 mark for most Canadian cities where it’s tracked but tends to be lower in Saskatchewan and Manitoba.

According to the CCPA, a third (34 per cent) of families in Metro Vancouver were earning under that city’s 2022 living wage of $24.08 per hour. That figure rose $3.56 or 17.3 per cent from the previous year — significantly outpacing headline inflation, which peaked at 8.1 per cent in June.

Ivanova explains that the living wage calculations weigh not just the representative basket of goods Statistics Canada uses to calculate its consumer price index, but lifestyle needs as well.

For example, the living wage factors in costs for healthier food choices needed to support children with a proper diet. Here, Ivanova says the prices for healthier choices at the grocery store in 2022 accelerated faster than the typical Canadian family’s basket.

Without a living wage, Ivanova says lower-income Canadians are forced to make some impossible choices, like between feeding their children a healthy diet, paying soaring rent and being able to use public transit.

“When workers don’t earn a living wage, when wages are too low and don’t comfortably meet basic expenses, then we’re seeing constant stress, spiralling anxiety,” she says.

Will wages keep rising to meet inflation?

Whether wages will start to keep pace with inflation as it shows signs of cooling is a matter of great debate — and for some, consternation — among economists.

Amid efforts to cool inflation and reduce demand in the economy, Bank of Canada governor Tiff Macklem has said Canada’s tight labour market is “unsustainable.”

Speaking to business owners in July 2022, Macklem warned against baking prolonged high inflation into payroll decisions in an effort to rein in expectations for price growth and avoid a so-called “wage-price spiral.” This economic phenomenon would see workers bid up their wages to raise their purchasing power and businesses pass those higher costs onto consumers — thereby feeding the spiral.

Macklem’s comments earned the ire of union leaders in Canada, some of whom interpreted his remarks as undermining workers’ bargaining power.

Armine Yalnizyan, an economist and Future of Workers fellow at the Atkinson Foundation, says she understands why Macklem set that tone for businesses amid the central bank’s inflation fight.

“That’s the big story of what the Bank of Canada is trying to do, is trying to control our expectations. ‘Don’t expect prices to stay up. Don’t build in your wage demands based on higher prices forever, because we’re going to bring the prices down.’ That’s what the drum beating is,” she said in an interview with Global News.

But Yalnizyan also pushed back against putting the blame for inflation on workers’ wages.

Historically, she says, wages have risen in response to high inflation — not the other way around.

Often, Canadians will initially respond to inflation by tightening their belts until they reach a breaking point and must seek higher wages from their employer or change jobs entirely, Yalnizyan notes. She argues wage growth will tend to lag inflation, not precede it.

Yalnizyan says she’s “conflicted” as to where wages go next. On one hand, Canada’s very tight labour market gives workers the best bargaining power they’ve had in decades to negotiate raises.

On the other, the Bank of Canada’s efforts to cool the economy by raising interest rates could ultimately push the country into a recession, leading to job losses and less leverage for workers. Renewed pushes for higher immigration targets and more foreign workers also increases the supply of available labour, further reducing bargaining power.

“There’s all these countervailing forces that make it very difficult to predict where wage growth will go,” Yalnizyan said.

She added, however, that she expects the record-tight labour market to keep the rate of wage growth above levels seen in the two decades before the pandemic for the next while.

Ivanova notes that the solution to achieving a living wage is not necessarily to raise the minimum wage in each jurisdiction to match those levels — though she does say the minimum wage could use a boost across the country.

Rather, she says the living wage can be lowered by top-down approaches from governments providing support that makes transit and housing more affordable, and through benefits that help with child care and other routine expenses.

“It’s a combination of higher earnings and better public programs or public investment that helps reduce the cost of living,” Ivanova says.

“All these things reduce the pressure on wages.”

Comments