Insurance premiums have increased by 35 percent for Manitoulin Centennial Manor, due to COVID-19. The entire long-term care sector in Ontario has seen across-the-board increases, said Manor Administrator Don Cook.

“Premiums have gone up substantially,” agreed Mr. Cook. “It was an industry-wide decision that insurance companies have made. We renewed our insurance policy and that’s what the premiums are this year.”

The Manor does have an insurance broker that shops around to find the best rates but there’s not a lot of insurance companies that insure long-term care, he said. “With the pandemic situation, the ones that are there decided that’s where insurance risk is for the industry,” Mr. Cook continued. “They set the pricing and, unfortunately, we have to just go with it.”

The Manor receives financial support from Island municipalities, as a municipally-funded facility, but the increase does not mean it will be asking those municipalities for additional funds. “Nothing like that,” said Mr. Cook. “We work with our budget and it’s an increase in the budget this year but it’s not un-doable or anything like that. We notice it on the budget but it’s not going to make a major difference to our operations.”

Donna Duncan, chief executive officer for the Ontario Long-Term Care Association (OLTCA), which represents nearly 70 percent of Ontario’s 630 long-term care homes, said homes across the province are seeing increases between 30 and 50 percent among members, as well as a marked increase in deductibles and a reduction in coverage.

- Ontario transportation minister has ‘100% confidence’ in Eglinton Crosstown LRT builders

- Porsche owner gets run over in shocking video of suspected Ontario car theft

- Ontario sports minister, ex-CFL player Lumsden will donate brain to concussion research

- As losses mount in toxic opioid crisis, Ontario cities memorialize overdose victims

“I would say the majority of long-term care homes in Ontario today have no infectious disease coverage or limited coverage,” she said. “No homes have coverage for a pandemic and COVID-19 in particular, and a majority of homes have lost coverage for infectious diseases.”

Get breaking National news

Insurance is necessary for any financing needed, including construction insurance, and making sure non-profit homes have appropriate coverage is significant, she noted. “If you don’t have coverage for infectious diseases or pandemics, then that does have a bearing in terms of exposure of your boards.”

The reinsurance market is a global one and there are only five insurance companies in Canada that insure long-term care, Ms. Duncan noted. “It’s a very limited market so we’ve been working with the Insurance Bureau of Canada (IBC), with insurance companies as well as with the insurance brokers. We’re all very committed. We’ve been working with our partners in other associations across Canada on this issue and trying to get support both federally and provincially to make sure that our long-term care homes have insurance.”

Facility operators should talk to elected officials so they’re aware this is an issue, Ms. Duncan encouraged. “We need to make sure we have long-term care homes in our small communities and insurance is a big issue. We know that our smaller homes in small Northern and rural communities across Ontario already face significantly higher costs for inflation, for staffing and energy and other costs, and this is one more cost layered on them as well when they can least afford it.”

You can’t drive a car without insurance, she pointed out. “We want to make sure we’re protecting our residents, we’re protecting our staff and that we’ve put the mechanisms in place that we can restore and rebuild the sector. Insurance is not that sexy but it is still important.”

A spokesperson for the IBC told The Expositor, “The pandemic has exposed significant underlying problems within the long-term care sector. A number of long-term care facilities are well-managed and have the appropriate strategies in place to protect their residents. But there are many others which struggle to operate safely within existing government regulations to reduce the spread of contagious viruses.”

“Canada’s insurance industry wants to ensure that long-term care homes can continue to provide their vital services. IBC and its members are working with stakeholders to help address the risk management challenges that the pandemic has presented within the long-term care sector. Insurers want to be part of the solution to these challenges,” the IBC stated.

The Manor itself has not experienced any issues. To date they’ve had no residents with COVID-19. “So we’ve had no internal COVID issues,” Mr. Cook added. “We’ve had some staff that have been off with some positives but we haven’t had anything with residents and we haven’t had any staffing issues out of the ordinary.”

Manor board chair Pat MacDonald said staff at the home has been excellent throughout the pandemic. “I do want to give kudos to our direct care and administrative staff,” she said. “They have all gone above and beyond to make sure our residents did not suffer in any way because of the pandemic.”

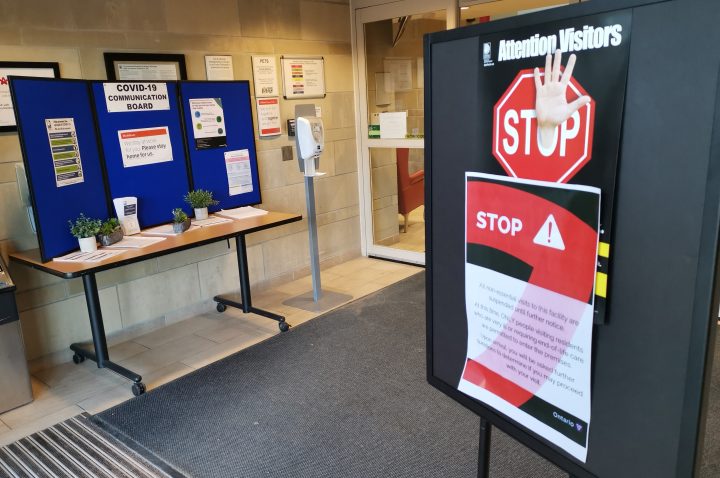

Pandemic precautions remain in effect at the nursing home at this time.

Comments