If you’re thinking of buying a new car or light truck in the near future, you may want to check the latest news on the global semiconductor chip shortage that has sent automakers across the world scrambling.

In your car-shopping experience this spring and summer, you may run into lower inventories, slightly less fuel-efficient vehicles and auto dealers who may be less inclined to haggle over price, says Shawn DuBravac, chief economist at IPC, an electronics manufacturing trade association.

“If there’s only one model, one car that you really want, the dealer may be apprehensive to really mark that car down,” DuBravac says.

READ MORE: Insurance apps that track your driving could now yield premium increases

The reason?

Several of the world’s largest automakers are running short on semiconductors, an essential component of electronic devices that have are also vital for new vehicles’ infotainment modules, engines and fuel management systems.

“It isn’t uncommon to see upwards of 50 semiconductors in a vehicle today,” DuBravac says.

The problem is auto manufacturers are having trouble getting their hands on enough of these chips lately.

How the chip shortage came about

The chip shortage has its roots in the precipitous collapse in auto sales that followed the onset of the pandemic in early 2020, according to DuBravac.

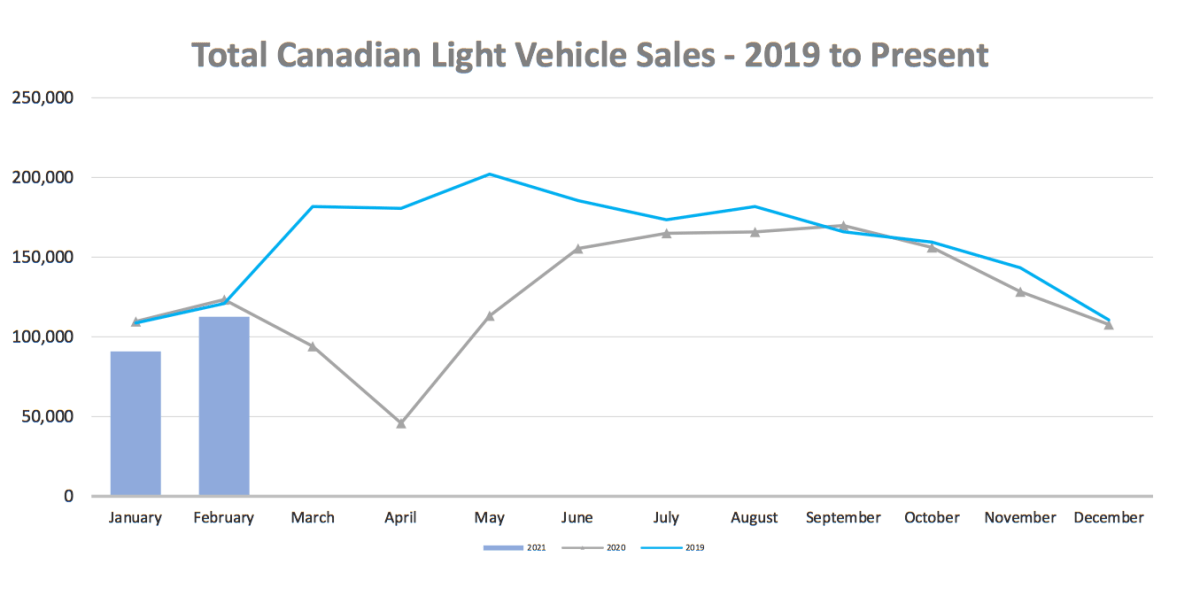

In Canada, light vehicle sales volumes in April 2020 were less than one-third of what they were during the same month in 2019, according to data from DesRosiers Automotive Consultants.

In response, automakers around the globe rushed to scale down production, which included dialing back their orders of semiconductors, DuBravac says. At the same time, as millions of people heeded lockdown and stay-at-home orders, the demand for tablets, laptops and cloud-computing services soared, quickly filling in the semiconductor demand gap left by the auto sector, he adds.

READ MORE: Insurance apps offer big discounts but want your data. Should you download?

Get weekly money news

But auto sales rebounded very quickly, according to DuBravac.

“We saw that the auto sector, in particular, experienced a V-shaped recovery,” he says.

By September, sales in Canada slightly surpassed their level in September of 2019, although they subsequently dipped back below 2019 volumes, according to figures from DesRosiers.

Automakers rushed to increase production in response to the quick consumer bounce-back, ramping up orders to all their parts suppliers. The problem, though, is that there are often lead times of between 12 and 20 weeks for semiconductors, DuBravac says.

READ MORE: Your car-loan payment may be way too high. Here’s what’s happening

“It takes some time from the time you place an order to the time you receive the order,” he says.

Soon, several automakers started running short of key chips.

Fewer vehicles and fewer chips

General Motors, Ford, Honda, Volvo, Volkswagen and Stellantis — the car company born out of the merger of PSA Peugeot and Fiat Chrysler — are among the automakers that said they’ve had to slow or suspend some production due to the chips supply crunch.

GM has announced downtime on all shifts at three of its production plants, including its CAMI facility in Ingersoll, Ont., located about 30 km east of London.

The Brampton Stellantis plant, which builds the Chrysler 300, Dodge Charger and Dodge Challenger, has also had to temporarily idle production.

Auto manufacturers are trying to shield pickup trucks and full-size SUVs from the effects of the shortage as much as possible, as those are their most popular and profitable vehicles, DuBravac says. GM, for example, has said it has not paused or reduced shifts on any of its truck plants.

READ MORE: How to buy a car without getting swindled

On the other hand, consumers might run into low inventories for smaller vehicles.

“The Nissan Kicks, the Toyota Corolla, Honda Accords — those are some of the areas where you’re most likely to see an impact,” DuBravac says.

But truck lovers may also find some of their favourite models are a little different this year.

GM said on March 15 it is building certain 2021 light-duty full-size pickup trucks without a fuel management module due to the semiconductor shortage.

The lack of the module means affected models, equipped with the 5.3-liter EcoTec3 V8 engine with both six-speed and eight-speed automatic transmission, will have lower fuel economy by one mile per gallon, spokeswoman Michelle Malcho told Reuters.

Malcho emphasized all trucks are still being built. The change would not have a major impact on the Detroit automaker’s U.S. corporate average fuel economy (CAFE) numbers, she added.

The modification runs through the 2021 model year, which typically ends in late summer or early fall, Malcho said.

Ford has said the scarcity of chips, coupled with other weather-related part shortages, is forcing it to build F-150 trucks and Edge SUVs in North America without certain inputs. The automaker says it will build and hold the vehicles for a number of weeks and ship them to dealers once modules with hard-to-find semiconductors become available.

Tight inventories shouldn’t affect new vehicle sticker prices, but they may make auto dealers leery of negotiating on price, especially if they see solid consumer demand, DuBravac said.

READ MORE: 3 numbers you should check before deciding whether to lease or buy a car

Still, not all automakers have been caught off-guard by the chips shortage. Toyota, which pioneered the just-in-time manufacturing strategy, surprised rivals and investors in February when it said its output would not be disrupted significantly by chip shortages.

The auto manufacturer made the decision to stockpile key vehicle components years ago, after experiencing the Fukushima disaster of 2011, Reuters reported.

After the catastrophe severed Toyota’s supply chains on March 11, 2011, the world’s biggest automaker realized the lead-time for semiconductors was way too long to cope with devastating shocks such as natural disasters.

“Toyota was, as far as we can tell, the only automaker properly equipped to deal with chip shortages,” a person familiar with Harman International, which specializes in car audio systems, displays and driver assistance technology, told Reuters.

— With files from the Canadian Press and Reuters

Comments

Want to discuss? Please read our Commenting Policy first.