The City of Calgary is facing a problem: it is no longer as attractive a place to do business for companies looking to do business in industrial lands.

“Based on data from Colliers International, over the past 15 years, we have seen an erosion of this industrial market share to surrounding municipalities,” senior city planner Abdul Jaffari said.

“Moreover, a number of third-party forecasters are expecting this trend to accelerate in 2021 and beyond without significant actions.”

Calgary’s industrial sector contributes to 15 per cent of the city’s tax revenue and employs more than 66,000, while only occupying 8.5 per cent of the city’s land mass. The city’s industrial real estate market has doubled in size since 2000.

On Wednesday, the city’s planning and urban development committee heard a report that areas outside city limits like Balzac are priced lower than within city limits. It was part of the ongoing development of a city-wide growth strategy.

“It’s important that we take a multi-pronged approach to increase our competitiveness within the region and reduce red tape where we can,” Calgary Economic Development’s Leslie Shier said.

“We can’t afford to sit back and watch the region grow and prosper in a relatively short period of time while we enjoy modest, or worse, suffer no growth.”

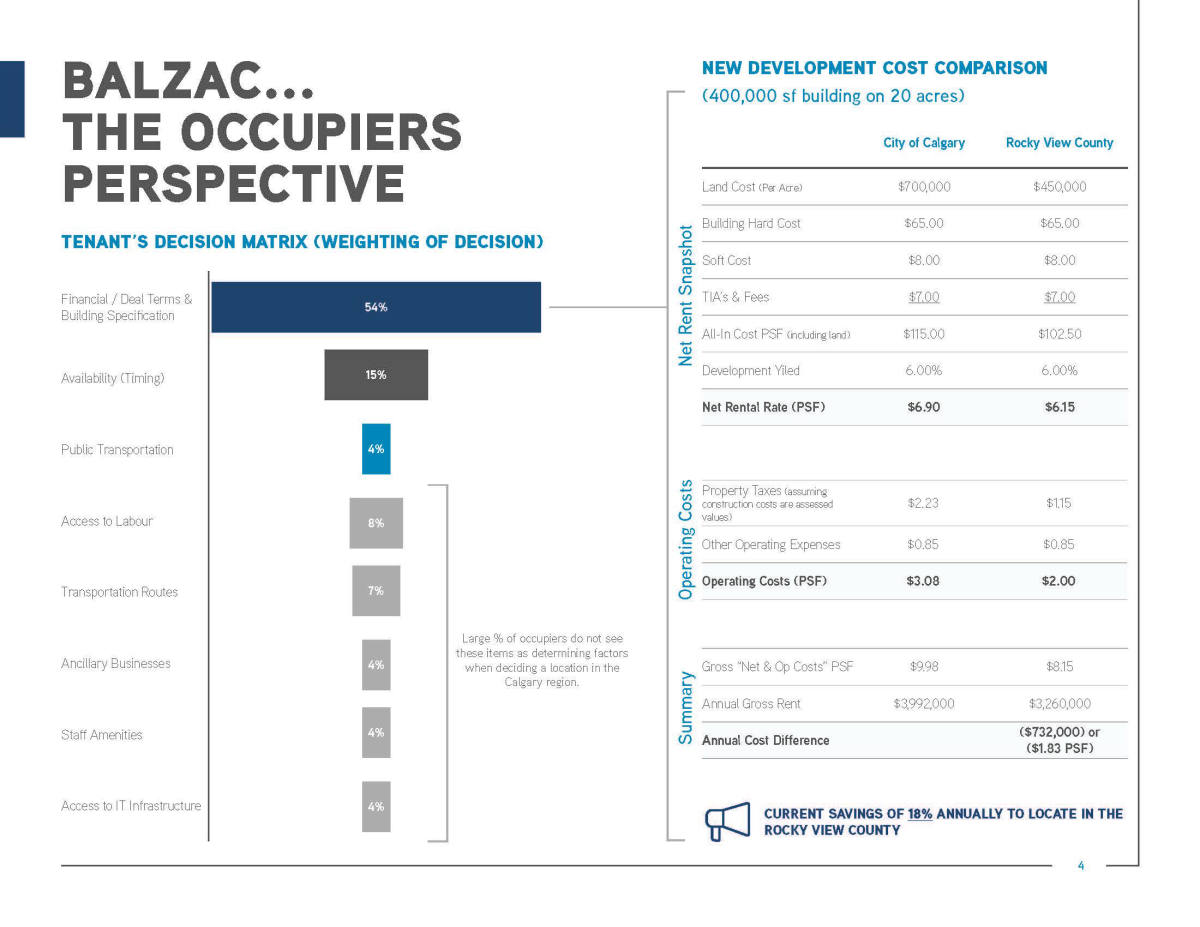

An industrial working group, including members from Calgary Economic Development and developer associations BILD Calgary and NAIOP, said among factors like availability, transit, access to labour, transportation infrastructure and other amenities, finances drove a majority of decisions for companies.

“Economics are the single most important factor when determining where a user will go in the industrial market,” Paul Marsden of Colliers International said. “Frankly, on a national basis, it’s what’s pulling users to Calgary today.”

The working group’s presentation compared Calgary and Rocky View County in terms of net rental rate and operating costs, showing companies find 18 per cent savings by being outside of the city in communities like Balzac.

Get daily National news

A city-commissioned study by Cushman Wakefield also confirmed that “the costs to develop an industrial building in east Balzac are less than the same facility (located) in the city of Calgary.”

Companies go to Balzac for other reasons, like lower development standards, large parcels of land and Calgary’s place as a logistics hub. But access to those sites for transit and emergency services is limited, and developing spaces smaller than 50,000 square feet is still “unproven.”

Companies like Lowes, Sobeys and GFS have already relocated outside of the city. Walmart, Home Depot and Amazon are already “one foot out,” the working group said. And corporations like Loblaw, Saputo, Federated Co-op and Coca Cola are all at risk of leaving the city.

Committee chair and Ward 3 Coun. Jyoti Gondek said the question of how the city can stay competitive with its neighbours through measures like lowering taxes or offering incentives inevitably includes a discussion about the city’s finances.

“How do we do this to stay competitive in a region where it’s a free for all and not compromise the taxes that we’re already collecting?” Gondek told reporters. “Will we actually sacrifice our revenue stream if we start to offer the types of incentives that are needed by those folks that are taking their industrial business just across our border? That’s a very good question to ask.

“And I wonder if the types of incentives that are offered through things like Bill 7 could help us attract some new business for a limited period of time, offer a break in taxation. But if we do that, we’ve got to make up the revenue somewhere else.”

It’s a problem that has been simmering in the background for years, she said.

“Those of us who have been watching regional partnership opportunities for the past couple of decades have been raising the alarm bells on this for a very long time,” Gondek said. “And I think if the province has not yet realized that stepping in to facilitate a proper regional partnership that includes economic opportunities is not a priority, it definitely should be.”

The Alberta government established municipal growth management boards in 2018 to coordinate planning for and servicing growth in metropolitan regions of Calgary and Edmonton. Calgary, along with Airdrie, Chestermere, Cochrane, High River, Okotoks, Strathmore, Foothills County, Rocky View County, and Wheatland County make up the Calgary Metropolitan Region Board.

“If the government of Alberta actually is interested in making sure that we have economic success in all our jurisdictions, they need to step in here,” Gondek said. “It wasn’t enough to create a metropolitan regional growth board that only looked at planning and servicing. The economics has been entirely left out of the equation.

“I’d be interested in partnering with our neighbouring municipalities to get this right, because I think it benefits us all. This is about making sure that it’s fair for every taxpayer in every jurisdiction.”

In a statement to Global News, Municipal Affairs Minister Ric McIver said he had “no interest in participating in the mayoral race in Calgary.”

“My advice is that Coun. Gondek get support within her own council and among other councils within the region before bringing this to the province,” the statement read.

City council will hear the report in the coming weeks and decide whether to have city officials start an action plan, with a report to come to council within a year and changes to go into the city’s 2023-2026 budgeting cycle.

Comments