The federal government is urging any business planning on receiving a federal wage subsidy to use a new online calculator this week that will help speed them through the application process when it opens next week.

All businesses — large or small, for-profit or non-profit — can apply for the Canada Emergency Wage Subsidy (CEWS) and, if the application is successful, could have 75 per cent of the wages of their employees paid by the federal government for up to 12 weeks. The subsidy is capped at a maximum of $847 a week per employee.

The Canad Revenue Agency (CRA) website with the online calculator also provides detailed information for applicants about what employers are eligible and how they should count eligible employees.

CRA officials said Tuesday that businesses which go through the process of using the calculator will be able to print out the information the calculator collects and that printout will then help speed businesses through the online application on Monday. The application window will open at 6 a.m. ET on Monday but officials said that businesses need not rush to apply. Applications will not be processed on a first-come, first-served basis. Instead, all applications received from April 27 to May 3 will be batch-processed at the same time on May 4.

“This is the most important economic program that the federal government has ever designed or implemented,” said Treasury Board President Jean-Yves Duclos.

- Trudeau tight-lipped on potential U.S. TikTok ban as key bill passes

- Canadian man dies during Texas Ironman event. Her widow wants answers as to why

- Hundreds mourn 16-year-old Halifax homicide victim: ‘The youth are feeling it’

- On the ‘frontline’: Toronto-area residents hiring security firms to fight auto theft

Indeed, the scale and complexity of the program is one reason why it will have taken more than a month to implement from the time it was first announced.

The program is expected to cost the federal treasury a whopping $73 billion this year, roughly three times as much as the amount the federal government spends in a year on national defence. The government’s other major relief program — the Canadian Emergency Response Benefit (CERB) — is expected to cost about $24 billion this year. The CERB, which pays a flat-rate of $500 per recipient, is already being paid to more than 8 million Canadians.

CRA officials could not say how many businesses they expect to apply for the CEWS — government officials pronounce that acronym with a hard-c as in “cues” — except to say that they are expecting hundreds of thousands to use it. The CRA said it normally processes as many as 5 million tax forms from businesses at this time of the year and believes that its computer infrastructure, managed by Shared Services Canada, is capable of handling the demand.

CRA officials also said that the businesses who have had their application approved during the automatic verification process that will take place May 4 can expect to receive cheques via direct deposit on May 6 or May 7.

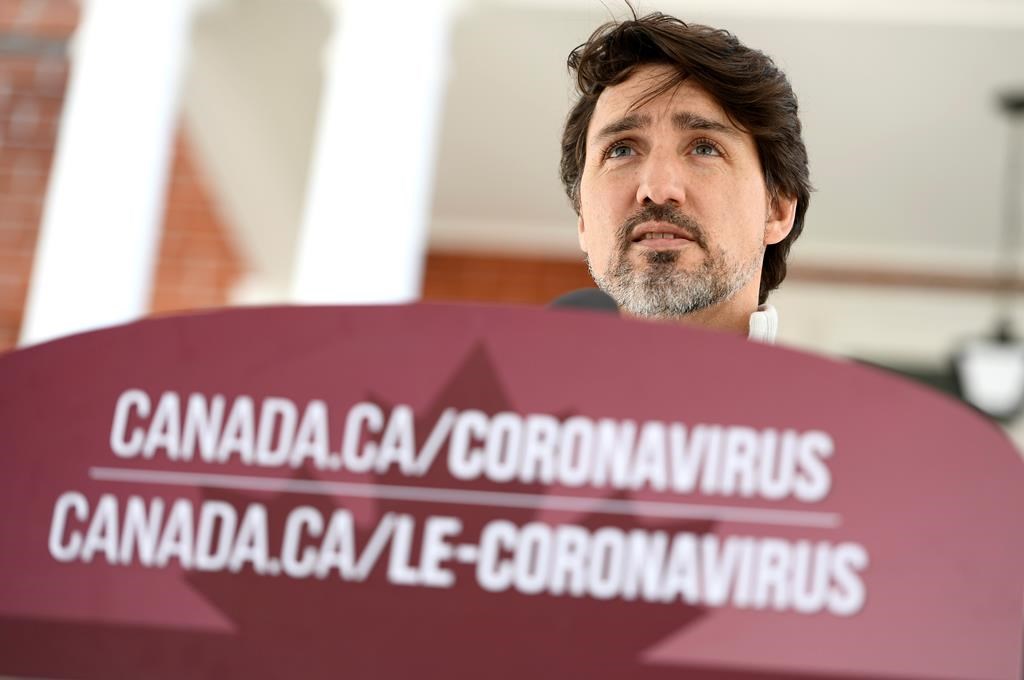

And while the federal government will pay 75 per cent of an employee’s wage, retroactive to March 15, employers are being encouraged to pay as much of the remaining 25 per cent of an employee’s wage as they can. Prime Minister Justin Trudeau has said that employers that attempt to abuse the program will face serious sanctions, a view reinforced Tuesday during a technical briefing CRA officials held with reporters.

The objective of the program is to get businesses to rehire workers they may have already laid off or prevent employers from having to furlough employees. And, if it’s successful, it could mean that some Canadians will forego the CERB and get back on their employer’s federally-subsidized payroll where they may also be eligible for other benefits such as continued pension contributions and medical plans.

But the CRA is also warning individual Canadians who get hired back and receive retroactive wages that they will be asked to re-pay any CERB funds they might have received if the period for which they received a CERB cheque overlaps with the period for which they might be getting any government-subsidized paycheque from their employer.

For example: An individual might have been laid off on March 15 and subsequently applied for and received the CERB. That individual’s employer applies for and receives the CEWS, recalls the worker and then retroactively pays that individual wages owed since March 15. The individual would then have to repay all of the $500-a-week CERB funds received.

Air Canada and WestJet are among the highest-profile businesses to already announce they will take advantage of the CEWS to bring back thousands of workers they had laid off last month.

Any wage subsidies paid to a business will be treated as business revenue for tax purposes.

Businesses can apply for the CEWS for three distinct periods: To cover wages paid from March 15 to April 11; from April 12 to May 9; and from May 10 to June 6. Businesses will have to re-apply for each period. Qualifying for the CEWS in one period automatically qualifies a business to receive the CEWS in a subsequent period, officials said.

To qualify, businesses have to demonstrate that their revenues dropped 15 per cent in any given period compared to earlier this year or the same period last year.

The CRA has built in some automated verification controls to guard against fraud and abuse.

As a result, the CRA believes that about 10 per cent of businesses which apply for the CEWS will not make it through the automated verification process but will require a manual verification. An applicant, for example, who submits payroll information that is substantially different than what CRA already has on file for that business would trip the manual verification process.

Additionally, any employer with annual sales of more than $250-million will be subject to a manual claims verification. And any employer that makes a claim for a large sum — CRA officials would not say how high that sum has to be — will also be subject to manual verification, which will delay the payout of the CEWS.

The CRA has re-assigned 3,000 auditors to handle manual verification. These are auditors, officials said, who normally would be making in-person visits to businesses across the country but cannot do that because of COVID-19 restrictions.

The CRA has also re-assigned 2,000 call centre employees, most of them experienced auditors, to handle CEWS calls from business applicants.

Comments