Crude-by-rail shipments by oilsands producer Cenovus Energy Inc. jumped to 120,000 barrels per day in January from 106,000 in December but the company says it did it without buying any Alberta provincial rail contracts.

On Tuesday, the United Conservative government said it would take a loss of $1.3 billion on deals to unload contracts struck by the previous NDP government to lease more than 4,000 rail cars to transport 120,000 bpd of crude to the U.S. Gulf Coast.

“In January, we were able to move about 120,000 barrels per day. I just want to reiterate that was on our existing contracts that we had through that time,” Keith Chiasson, Cenovus’s executive vice-president, downstream, told a conference call to discuss the company’s fourth-quarter results Wednesday.

He said the company used a provincial program announced last fall that relaxed quota constraints on production if it was shipped out on new rail capacity.

“We’re pleased with the supplemental production allowance, that basically allows us to unconstrain our (oil production) program… We obviously had a look (at the government contracts), but we’re happy with where we’re at right now,” he said.

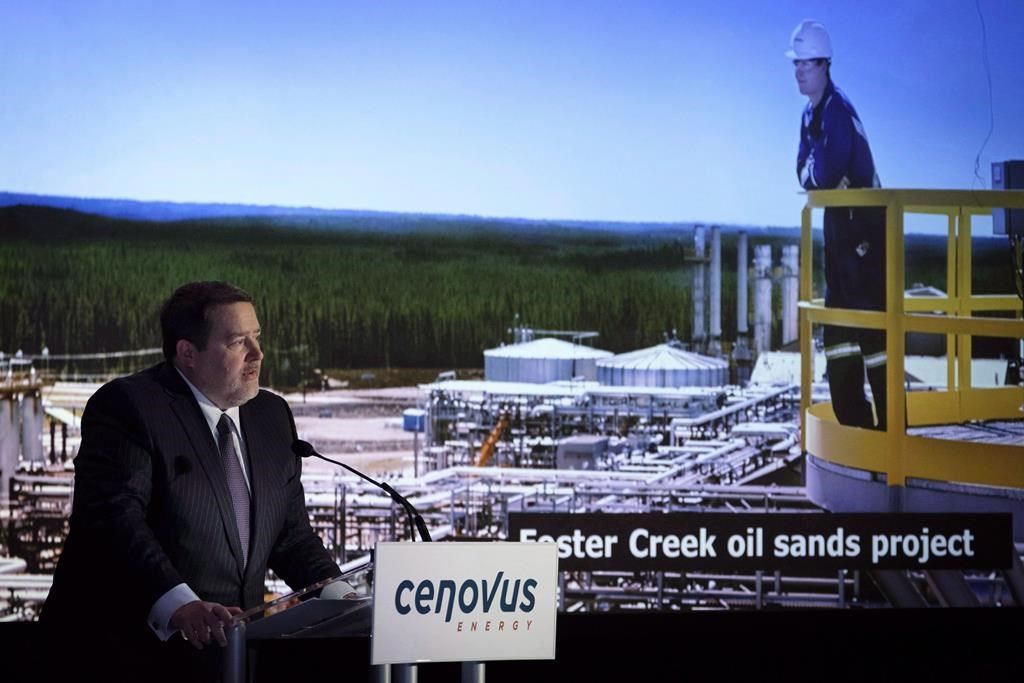

WATCH BELOW (Aug. 1, 2019): Imran Mulji from Acumen Capital Partners discusses the ads taken out in newspapers across Canada by energy giants MEG, Cenovus and CNRL.

Last month, the Canada Energy Regulator reported crude-by-rail exports increased to 297,500 bpd in November, up by about 10 per cent from October, but well behind the record level of 353,800 bpd in December 2018.

Two weeks ago, oilsands producer Imperial Oil Ltd. said it increased crude-by-rail shipments to more than 100,000 bpd in January from zero in October and planned to continue to add railcars if the transportation option remained profitable.

READ MORE: ‘Tragedy for Canada’: Energy company Encana to move headquarters to U.S.

Imperial co-owns a rail terminal in Edmonton with capacity to move 210,000 barrels per day, but it has cut its usage to zero or near zero at least three times in the past year as price differentials tightened with Alberta production curtailments, storage levels and rail and pipeline disruptions.

The difference between Western Canadian Select bitumen-blend heavy oil and New York-traded West Texas Intermediate oil prices had widened to as much as US$52 a barrel in October 2018 before the then-NDP government implemented production limits in Alberta to better match growing output with limited pipeline space, thus drawing down overflowing storage.

Cenovus CEO Alex Pourbaix said Alberta’s oil curtailment program is working and it should be used to win better prices and higher royalties for the government until sufficient pipeline capacity is in place. The province has said the program will end this year.

READ MORE: Calgary-based oilsands producer Cenovus aims for ‘net zero’ GHG emissions by 2050

“To achieve fair value, we believe the government should manage the WTI-WCS price differential at Hardisty (Alberta) to approximately US$10 per barrel, or essentially the crude quality difference, plus the cost of pipeline transport from Alberta to the Gulf Coast,” he said.

“Any differential higher than that means Alberta is transferring value to the downstream buyers.”

The curtailment program has been opposed by oilsands firms with downstream refining operations that dull the impact of lower Alberta oil prices, such as Imperial, Suncor Energy Inc. and Husky Energy Inc.

Cenovus reported fourth-quarter oilsands output rose to more than 374,000 bpd, up from 355,000 bpd in the third quarter, as it began ramping up production from an oilsands expansion project it had delayed bringing on stream because of curtailments.

Cenovus’s financial numbers matched analyst expectations as it reported a fourth-quarter net profit from continuing operations of $113 million compared with a loss of nearly $1.36 billion in the same quarter a year earlier.

Analysts had expected $108 million, according to data firm Refinitiv.

Total production amounted to 467,448 barrels of oil equivalent per day, up from 432,713 boepd in the last three months of 2018.

Comments