TD will start charging compound interest on all its branded personal credit cards, Global News has learned.

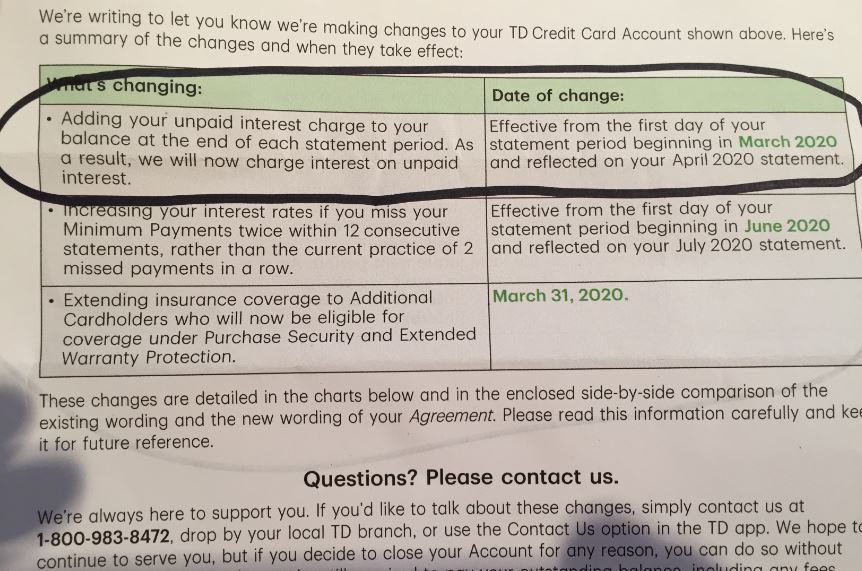

In a letter sent out to a TD Visa credit card holder, the bank explains it will add unpaid interest charges to cardholders’ balances at the end of each statement period beginning in March.

While many Canadians assume all credit cards charge compound interest, that is not always the case.

If interest applies, TD currently calculates it based on a cardholder’s average daily balance until that amount has been paid in full. With the change, the bank will start to add any unpaid interest charges to the cardholder’s balance at the end of each statement period.

“As a result, we charge interest on unpaid interest,” the notice reads.

Federally regulated financial institutions such as banks must notify customers of an upcoming interest rate increase, according to Canada’s financial consumer watchdog, the Financial Consumer Agency of Canada (FCAC).

In comments to Global News, TD linked the change to the need to remain “competitive.”

“From time to time we review our products and services, ensuring we remain competitive in the marketplace while providing value to our customers,” the bank said in an emailed statement. “When pricing changes are made, we don’t make the decision lightly and look to provide our customers with options to avoid or reduce the impact of the changes.”

The bank said customers experiencing financial challenges are encouraged to reach out directly “about ways we can help.”

RBC and CIBC told Global News they do not currently charge interest on interest on credit cards.

Scotiabank said it does not charge interest on unpaid interest on its Visa or American Express credit cards, which comprise the majority of its customer base. The bank added it currently charges interest on interest on the Scotia Momentum Mastercard Credit Card.

Get weekly money news

“This is an interest calculation that was inherited by Scotiabank as part of the acquisition of this credit card portfolio in 2015,” the bank said in an emailed statement.

BMO did not respond to a request for comment by time of publication.

Federally regulated banks must provide credit card statements that include itemized transactions, as well as the amount cardholders must pay by the due date in order to avoid interest charges, according to the Canadian Bankers Association (CBA).

When cardholders make a new purchase, they have an interest-free grace period that begins on the last day of their statement period and lasts at least 21 days.

Interest rates vary depending not just on the card but also on the type of transaction. For example, in addition to purchases, consumers can also use their card to withdraw cash, called a cash advance. There is no grace period for cash advances, according to the FCAC.

TD confirmed to Global News that its upcoming interest calculation change applies to all interest charges for affected credit cards.

Consumers who do not pay their balance in full on time are usually charged interest for every day from when the transaction took place to the day the amount they owe is paid off.

The interest banks charge is based on a borrower’s average daily balance: the bank adds the amount a cardholder owes each day and divides that by the number of days in the statement period.

The bank then calculates the applicable daily interest rate. For example, a credit card with an annual interest rate of 20 per cent on purchases would have a daily interest rate of around 0.055 per cent on purchases (that’s 20 per cent divided by 365 days in a year).

If that credit card had an average daily balance of $1,000 over a 30-day statement period, the applicable interest charge would be $16.50, or 1.65 per cent of $1,000. (The cumulative interest rate, 1.65 per cent, is calculated as 0.055 per cent multiplied by 30 days.)

Yet some banks charge compound interest, adding unpaid interest charges to the principal balance, then charging interest on that.

In TD’s case, the notice seen by Global News states the bank will add unpaid interest charges to customers’ balances at the end of each statement period.

Frederick Crease, the North Bay, Ont., TD Visa card customer who received the letter, said he worries about what it will mean for borrowers struggling with debt.

The change, he said, “will put an extra burden on those that can least afford it. Those on fixed incomes … single parents and families below the poverty level.”

Canadians hold an average credit card balance of around $4,200, according to TransUnion.

As of 2018, there were almost 76 million credit cards in circulation in Canada, of which 38 million had a balance, including those that are paid off every month, according to statistics from the CBA.

Comments