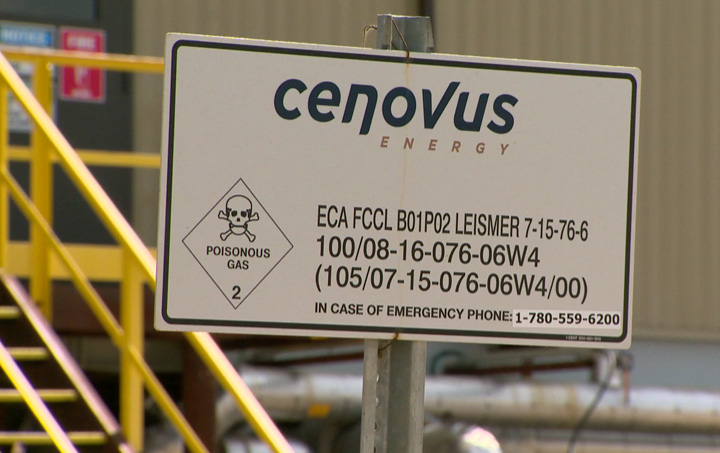

CALGARY – Surge Energy Inc. is buying some oil assets in southern Saskatchewan from Cenovus Energy Inc. for $240 million.

As of last month, the Lower Shaunavon assets produced about 3,600 barrels of oil per day.

Cenovus (TSX:CVE) announced in April it was putting its non-core Saskatchewan holdings on the block, but warned that market conditions were making it hard to get a deal done.

At the time, CEO Brian Ferguson said many potential buyers were looking at the assets but having trouble getting the capital they needed to make an offer.

Get weekly money news

Cenovus’ assets in the Bakken, an oilfield elsewhere in the province, are still up for sale.

The Lower Shaunavon deal is expected to close by mid-July.

To finance the deal, Surge (TSX:SGY) has entered into a $225-million bought deal with a syndicate of underwriters led by Macquarie Capital Markets. Members of the Surge team also took part in the financing.

Also Tuesday, Surge announced its “orderly transition” to a “sustainable, moderate growth, dividend paying oil and gas company.”

As a result of the acquisition and the new strategy, Surge is forecasting a “significant increase” to its 2013 production exit rate and a “substantially higher” dividend than management had been modelling.

Once the Cenovus sale closes, Surge will begin paying an initial monthly dividend of 3.33 cents per share.

On the Toronto Stock Exchange, the company’s shares closed down two cents at $5.42.

Comments