Earlier this week, Cannabis NB CEO Patrick Parent appeared in Fredericton to give provincial lawmakers some bad news.

More than a year after legalization, he told them, New Brunswick’s government-owned cannabis monopoly was still losing money, and had no prospect of making money in the current fiscal year. The closest thing he had to offer as a glimmer of hope was the possibility that Cannabis NB might start to turn a profit in the 2020-21 fiscal year.

For the moment, though, Cannabis NB — which the cash-strapped province once hoped would be a revenue source — is bleeding money, with a $1.5-million loss in the second quarter.

“We’re losing our shirt,” Premier Blaine Higgs complained in October. This week, before Parent’s appearance, he grimly told reporters that “we’re not going to keep losing money on this.”

READ MORE: ‘We’re not going to keep losing money’: New Brunswick premier mum on future of Cannabis NB

All other provinces that opted for government-run cannabis systems are doing better than New Brunswick, so what ails Cannabis NB?

Observers point to an expensive network of retail stores in communities that may not be able to support them — and very high prices compared to other provinces.

Other public-sector provinces do better

The three other provinces that opted to sell cannabis only in government-owned stores have had better results.

In September, the Société québécoise du cannabis, Quebec’s government-owned monopoly cannabis retailer, announced that it had gone into the black in the second quarter of 2019 and made a $1.4-million profit.

Government-owned PEI Cannabis expects to make money in the 2019-20 fiscal year, said provincial spokesperson Spencer Lee.

Nova Scotia, which opted to sell cannabis in liquor stores — except for one stand-alone cannabis store in Halifax — sells much more cannabis than next-door New Brunswick. Nova Scotia’s Q2 cannabis revenue was $18.1 million, or $18.98 per person, as opposed to $10.7 million, or $13.30 per person, in New Brunswick.

It’s hard to tell what Nova Scotia’s profit on cannabis is, though it’s fairly clear there is one. Since cannabis is so integrated with the liquor store system, the cost side of the equation can’t be easily broken out, said spokesperson Beverley Ware.

What’s the difference? Price stands out

Get breaking National news

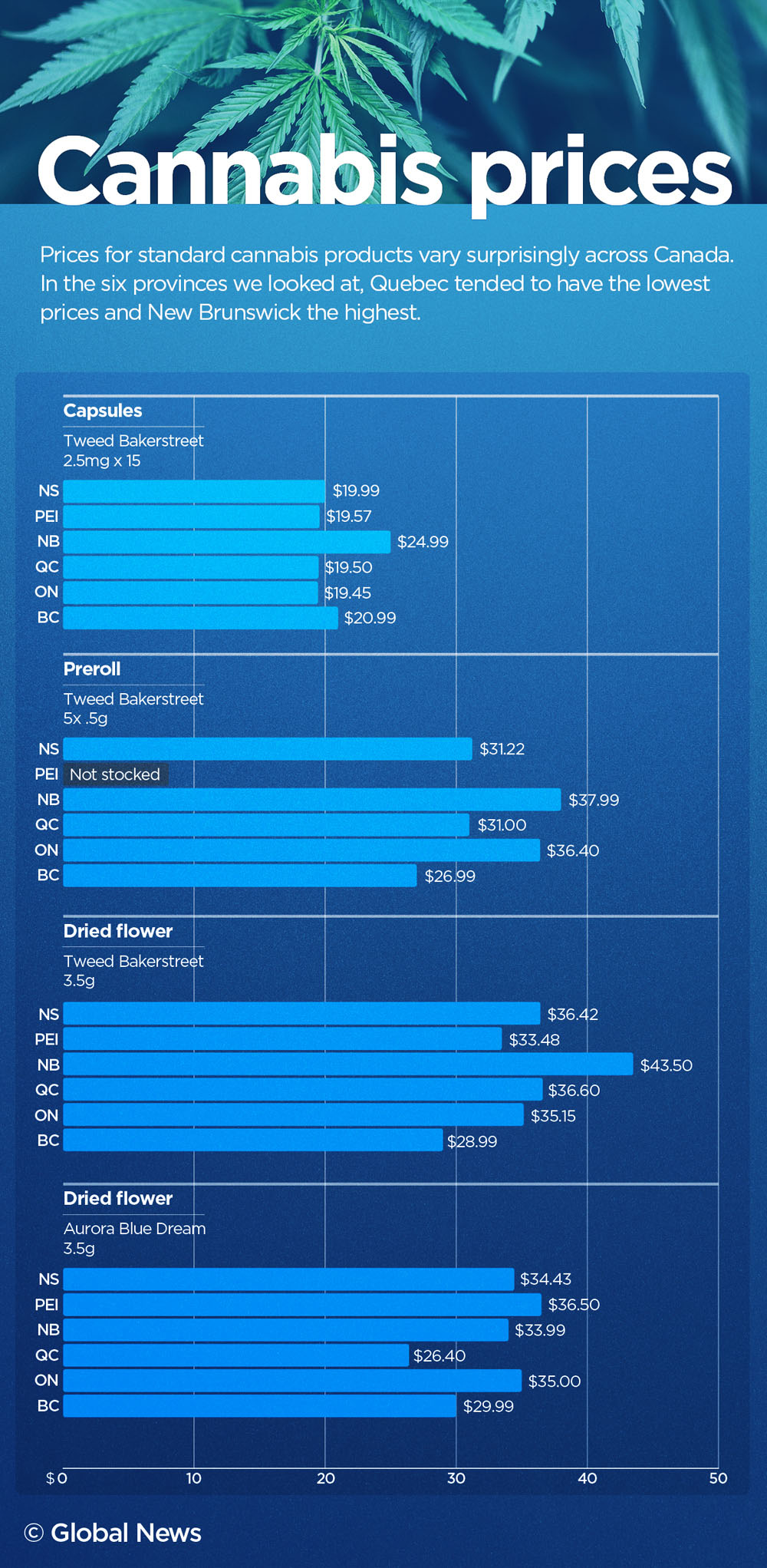

A Global News analysis of retail prices for four standard cannabis products in six provinces showed that Quebec tended to have the lowest prices, and New Brunswick usually had the highest. Next-door Nova Scotia mostly has prices more in line with the rest of the country.

P.E.I. has a government-owned cannabis system that’s identical to New Brunswick’s, even down to the number of residents per store: about 38,000.

Other than doing better on the business side, there’s only one difference that stands out: by New Brunswick standards, P.E.I.’s cannabis shoppers are getting a bargain. In a price comparison of identical products between P.E.I. and New Brunswick, New Brunswick had higher prices in nearly all cases.

Sometimes the difference is startling. In one case, 3.5 grams of dried flower from Ontario-based producer 7ACRES cost $39.10 in PEI and $56.99 in New Brunswick.

“There is a lot of evidence that shows that price is one of the biggest predictors in terms of moving folks from the unregulated market, which isn’t that surprising,” says Jenna Valleriani, CEO of the National Institute for Cannabis Health and Education.

“When the price difference is just too drastic, you’re not going to see those shifts.”

Would cutting prices, maybe to Quebec levels, cut into the illegal market’s share enough to put Cannabis NB in the black?

“They would undoubtedly sell more volume, in terms of kilograms of dry flower and litres of oil,” says Brock University business professor Michael Armstrong. “They might increase sales revenues, they may or may not increase profits. It could go either way.”

Can New Brunswick support so many retail stores?

New Brunswick opened a complete province-wide network of 20 retail stores on the first day of legalization, which Armstrong sees as a mistake.

“That definitely hurt them in the first six months or so, when the product shortages were the worst,” he says. “Not only did they have a relatively high-cost network, they couldn’t get enough product to stock it.”

With product shortages a thing of the past, will Cannabis NB’s stores start to do better? Armstrong isn’t optimistic: outside a few major centres, he doubts that New Brunswick can support stand-alone retail stores.

Armstrong argues that Nova Scotia’s system of selling cannabis in liquor stores makes more sense for a largely rural province where smaller communities may not be able to support a cannabis store.

“If New Brunswick switched to selling cannabis in liquor stores, or allowing other kinds of retailers to sell cannabis, like grocery stores, that would drastically drop the base costs of how much sales you have to have per site,” he says.

Newfoundland and Labrador allows for this. In Clarenville, N.L., cannabis is sold out of an Esso station, and in St. John’s it’s sold out of a grocery store.

“That would probably make them profitable right away, except for the obvious cost of having to close a bunch of stores,” Armstrong says.

New Brunswick could also allow ‘farm gate’ sales to the public directly from producers, says Deepak Anand, CEO of Materia Ventures, a cannabis supply and distribution company.

Newfoundland and Labrador allows farm gate sales now, and Ontario said Wednesday that it was moving toward allowing them.

“You look at a city like Atholville, which is in northern New Brunswick where we set up Zenabis, there’s a Cannabis NB store in the strip mall. There’s no reason why that Cannabis NB store needs to operate, or have high overheads on cost,” Anand says.

“That’s a classic example of an area that could deal with privatization and allow Zenabis to sell cannabis at the farm gate. That might be a viable option for a community like that.”

Anand also argues for privatizing New Brunswick cannabis retail more broadly.

“I think the solution is privatization – let the market decide where pricing is, as well as having more points of access.”

One lesson may be that while the law may say that a province’s cannabis retailer is a monopoly, it can’t afford to act like one.

“Cannabis is in some respects like any other product,” Armstrong says. “You have to compete against other vendors. In the cannabis case the other vendors are the black market.”

Comments