Trying to sift through the federal budget documents is an exercise in frustration. It’s always surprised me that we spend so much time covering a document that details what governments say they are going to spend and so little time looking at what they actually spend.

Governments will almost never hit the targets they say they will. If the economy is performing better than expected, they find new goodies to spend money on and taxpayers are left never knowing whether all the hyped-up economic news is telling the full story. Is the economy doing well or not? Is the federal government cash strapped or not? Is there enough money to pay for new massive government programs promised during an election or not?

READ MORE: Balanced budget? A look at why federal leaders aren’t in a rush

There is one source I use as my go-to for an easy reference for how the federal government is doing managing our tax dollars. If you want to do your own analysis, bookmark this link to the Fiscal Reference Tables on the Department of Finance website.

It’s sobering to look back and see that in the year I was born, 1971, federal government revenues were $17.1 billion and program spending was $16.8 billion. At the time, we had $22.1 billion in debt and we were paying $2.1 billion in public debt charges. In the context of today, it all seems so manageable.

It is stark to see how quickly government revenues and spending have grown over time, in part due to inflation and in part due to population and economic growth, and how such a small debt ballooned into a big one.

In the last fiscal year 2018-19, federal government revenues were $332.2 billion, program spending was $322.9 billion, we paid $23.3 billion in public debt charges and debt has ballooned to $685.4 billion, the highest level ever.

READ MORE: Federal government ran $14 billion deficit in 2018-19

A few things stand out for me in looking at these numbers.

In 1971, if all federal government revenue was directed to paying off the debt, it would have taken 1.3 years to pay it off. Today it would take 2.1 years of total federal government revenue to pay off the debt. Debt is clearly worse today than it was back then.

In 1971, finance charges consumed 12.4 per cent of revenues. Today they consume 7.0 per cent. That appears better, and it probably explains why everyone is so cavalier about the level of debt we are shouldering. If we can manage the interest payments, what’s the big deal with adding more?

Maybe it’s because I became politically aware in the mid-1990s that I have a built-in anxiety over government debt. To me, the most important line on the fiscal reference table is budget year 1995-96. That is the year every one of all political stripes realized if we didn’t get our fiscal house in order we were going to have our economy managed for us by the International Monetary Fund. Stories were written about the Canadian peso. The prospects for attracting investment and economic growth looked grim.

In fiscal year 1995-96, federal government revenues were $140.3 billion, program spending was $120.9 billion, and finance charges peaked at $49.9 billion. Think of that: more than one-third of every tax dollar went to pay interest on the debt, which grew to $554 billion that year — nearly four times total government revenue.

Years of surpluses followed but the financial crisis changed everything. Canada hasn’t run a surplus since 2008. Since then, the federal debt has grown an additional $228 billion with no end in sight.

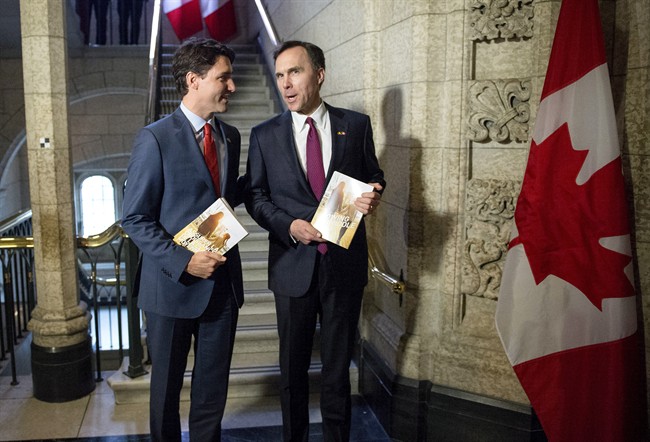

It would not take much to get back to balanced budgets. Revenues increased from $279 billion to $332 billion in the time Justin Trudeau’s been in power — that’s a $53 billion increase. That, more than anything, is a measure that the economy has been doing well.

But when the economy is doing well, that is also the time for governments to run surpluses and pay down debt.

ANALYSIS: ‘Real change’ for Liberals much different in 2019 with no balanced budget in sight

To run surpluses, all Trudeau had to do was just slow the rate of growth in spending. He wouldn’t have even needed to cut.

The economy is doing well. Government revenues are at an all-time high. Interest rates are near record lows. This is our window to get it together and we are about to blow it — again.

Maxime Bernier is correct to say the budget could be balanced in two years. The problem is, there is no political will to do it. As for the others, the Conservatives and the Greens say they would balance the budget in five years, while the NDP and the Liberals talk only about keeping debt low relative to GDP.

That’s why I find the platforms of all the political parties so anxiety-inducing. We can’t afford all the goodies they want to give us.

Let’s hope we don’t have to hit another debt wall to figure that out.

Danielle Smith is host of The Danielle Smith Show on Global News Radio 770 Calgary. She can be reached at danielle@770chqr.com.

Comments