A former colleague and friend of QuadrigaCX CEO Gerald Cotten says Cotten mused to him about being kidnapped for the vast fortune he controlled.

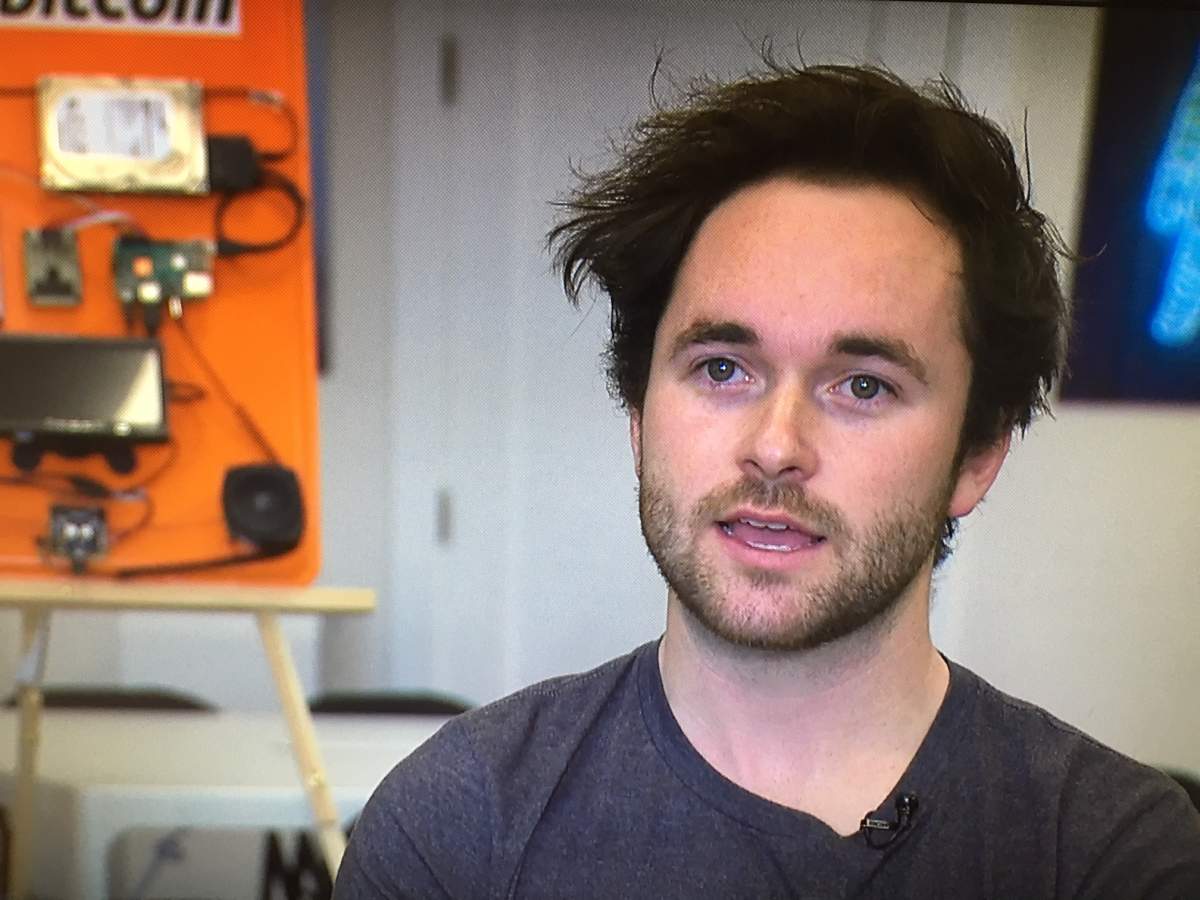

Adam O’Brien, who owns an Edmonton-based cryptocurrency business, says it was difficult to know how seriously to take Cotten’s references.

“Gerry was holding, we know, over $100 million, almost $200 million dollars in funds,” O’Brien said. “That makes people do some pretty crazy things. And I think Gerry was aware of that, and I think he was kind of worried that something might happen.”

Investments in the QuadrigaCX exchange are locked behind computer passwords that apparently vanished when Cotten reportedly died last December.

“Gerry was a great dude and everyone you’d speak to that knew him personally would tell you that. He was a really, really genuine guy that was super smart.”

O’Brien says he was shocked to hear Cotten died. He doesn’t accept conspiracy theories, however, that suggest Cotten faked his death.

He doubts frustrated customers will ever recover their investments, despite a small army of lawyers and accountants who are trying to solve the puzzle.

Get breaking National news

“I don’t think people are going to see that money again. And the reason I don’t is because the way bitcoin is designed is that once the private key is gone, there’s no recovery,” O’Brien said.

Unless, he says, Cotten made arrangements, anticipating he could lose his fight against Crohn’s disease.

WATCH: Creditor protection extended for cryptocurrency exchange Quadriga (March 5)

“I think here we do have one leg up in a dead man’s switch,” O’Brien said. “A dead man’s switch would be something that Gerry would have had to set up before he passed away.”

A dead man’s switch is a system designed to be activated in the event that its human operator is killed or becomes incapacitated. In this case, it’s a computer program. If the user doesn’t talk to the program for a specified amount of time, ranging from days to years, the switch activates and sends encryption codes to someone the user designates, enabling that person to log into locked accounts.

So far, though, the court-appointed accounting firm that’s trying to recover the funds has struck out.

O’Brien says it could all have been avoided if bitcoin owners controlled their own investments, rather than entrusting them to an exchange.

- Alcohol sales in Canada just saw ‘largest’ annual drop since tracking began

- ‘Buy Canadian’ policy likely to cost taxpayers $12 billion yearly: study

- ‘A foreign policy based on short memory’: Carney continues push to diversify from the U.S.

- Alberta’s premier consulting on scrapping clock changes, prefers more light at night

Comments

Want to discuss? Please read our Commenting Policy first.