Can’t afford to buy a house? The government may take on part of the cost.

That is the gist of the boldest proposal that Budget 2019 puts forth to help more middle-income Canadians fulfill their homeownership dream.

Under the new CMHC First-Time Home Buyer Incentive, the Canada Mortgage and Housing Corporation would use up to $1.25 billion over three years to help lower mortgage costs for eligible Canadians.

The money would go to first-time home buyers applying for insured mortgages. Borrowers would still have to pony up a down payment of at least five per cent of the home purchase price. On top of that, though, they would receive an incentive of up to 10 per cent of the house price, which would lower the amount of their mortgage.

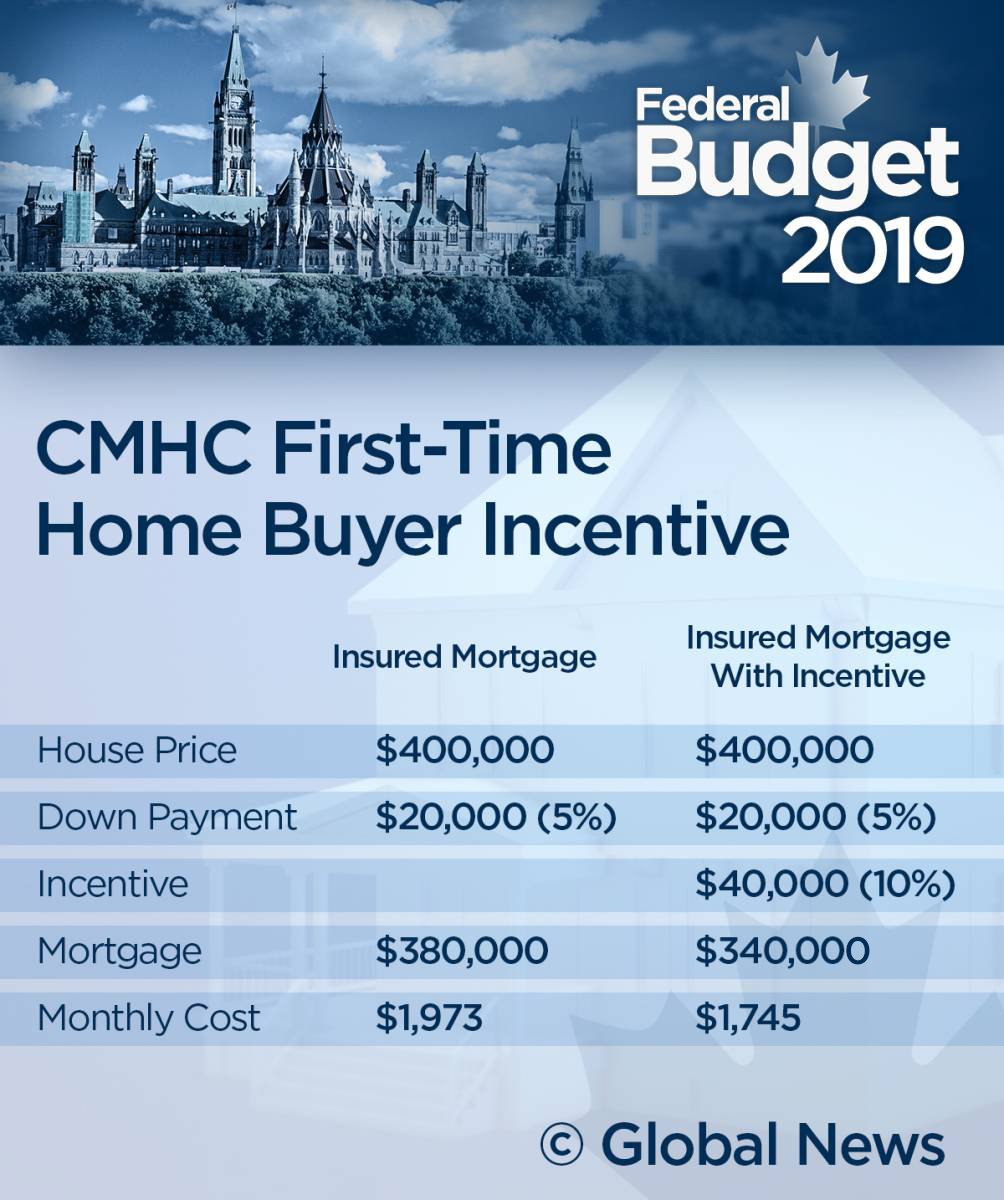

For example, say you’re hoping to buy a $400,000 home with the minimum required five per cent down payment, which works out to $20,000. With the new incentive, you could receive up to $40,000 through the CMHC. Now, instead of taking out a $380,000 mortgage, you’d need to borrow only $340,000. This would lower your monthly mortgage bill from over $1,970 to less than $1,750.

The incentive would be 10 per cent for buyers purchasing a newly built home and 5 per cent for existing homes. Only households with an annual income under $120,000 would be able to participate in the program.

Watch: Finance Minister Bill Morneau presented the 2019 federal budget in the House of Commons Tuesday.

Home owners would eventually have to repay the incentive, possibly at re-sale, though it’s unclear yet how that would work.

Also, mortgage applicants still have to qualify under the federal stress test, which ensures that borrowers will be able to keep up with their debt repayments even at higher interest rates.

Get weekly money news

However, the incentive would essentially lower the bar for test takers, as applicants would have to qualify for a lower mortgage.

On the other hand, the amount of the insured mortgage plus the CMHC incentive would be capped at four times the home buyers’ annual incomes, or up to $480,000.

WATCH: Morneau argues housing incentives won’t inflate market

This means the most expensive homes Canadians would be able to buy this way would be worth around $500,000 ($480,000 max in insured mortgage and incentive, plus the down payment amount).

The government is hoping to have the program up and running by September.

Home Buyer’s Plan gets a boost

As was widely anticipated, the government would also enhance the Home Buyer’s Plan (HBP), which currently allows first-time buyers to take out up to $25,000 from their registered retirement savings plan (RRSP) to finance the purchase of a home, without having to pay tax on the withdrawal. The budget proposes raising that cap to $35,000.

The new limit would apply to HBP withdrawals made after March 19, 2019.

New measures would encourage more borrowing, possibly drive up home prices

Economists said the new CMHC incentive and the enhanced HBP would encourage Canadians to take on more debt, stimulate housing demand, and possibly push up housing prices.

“It’s a different kind of borrowing,” David Macdonald, senior economist at the Canadian Centre for Policy Alternatives, said of the CMHC incentive.

And with a home-price limit of around $500,000, the program is unlikely to help middle-class millennials buy homes in Vancouver and Toronto, where average property values are far higher, said TD economist Brain De Pratto.

Those taking advantage of the higher HBP limit, on the other hand, would have to keep in mind that the government is not extending the program’s repayment timeline, said Doug Carroll, a tax and financial planning expert at Meridian.

Home buyers must put the money back into their RRSP over 15 years to avoid their HBP withdrawal being added to their taxable income. Now Canadians will have to repay a maximum of $35,000 – instead of $25,000 – over the same period, Carroll noted.

In general, the economists and financial experts Global News spoke to saw the budget as being focused on demand-side housing measures, rather than policies that would encourage the construction of new homes.

And while the budget does earmark $10 billion over nine years for new rental homes, it does not propose major tax breaks for homebuilders.

Tax incentives proved to be an effective way to stimulate residential construction in the past, said Don Carson, tax partner at MNP.

“They really drove supply,” he said.

Comments