A year after the so-called mortgage stress test came into effect, the mortgage underwriting guidelines are being targeted by Conservative politicians ahead of a provincial and general election.

Alberta United Conservative Party Leader Jason Kenney, a speaker at the Calgary Real Estate Board on Jan. 30, said the mortgage stress test was punitive to prospective Alberta homeowners and out of touch with housing markets in the province.

READ MORE: Could you pass the mortgage stress test? Here’s how to find out

“One of the reasons why homes are less affordable in Alberta today is because of unfair rules imposed by Ottawa to deal with the overheated real estate markets in Toronto and Vancouver,” Kenney said.

“The so-called ‘stress test’ imposed by the CMHC (Canadian Mortgage and Housing Corporation) has put tens of thousands of Albertans out of reach of home ownership, diminishing the value of the homes they can buy, to deal with the real estate market in Toronto and Vancouver.”

Kenney went on to say that the mortgage stress test came into effect in January 2018, in the middle of Alberta’s post-oil price shock-fueled recession.

“We did not have the risk of overheating nationally. They did have the risk of overheating in Toronto and Vancouver. They took out a bazooka rather than a fly swatter to take care of the problem.”

Calgary-Shepard Conservative MP Tom Kmiec also took aim at the stress test in a House of Commons debate on affordable housing on Jan. 31, calling the CMHC regulations “a one-size-fits-all tool that punishes Canadians from coast to coast to coast, regardless of the prices in their local markets.”

What’s the allegation?

Kenney and Kmiec purport that the mortgage stress test is unfair to Albertans and punishes them for overheating housing markets in Toronto and Vancouver. They also say the stress test has put “tens of thousands of Albertans out of reach of home ownership.”

They call for the mortgage stress test to be scrapped in Alberta.

What are the facts?

The stress test is applicable to all prospective home buyers with a less-than-20 per cent down payment — the buyers who require mortgage insurance offered by CMHC and two private insurers.

Those home buyers are evaluated on whether they could pay their mortgage if interest rates went up by two per cent above their current rate. The interest rate rise also serves as a proxy to other financial stresses a household might face, like a job loss or a reduction in income.

The stress test was passed along to Canada’s federally-regulated financial institutions in guideline B-20, “Residential Mortgage Underwriting Practices and Procedures,” from the Office of the Superintendent of Financial Institutions (OSFI). It is the latest in a series of mechanisms designed to stabilize house prices across Canada.

“The federal government and CMHC were looking at things like price-to-income ratios and price-to-rent ratios and noted that, globally, Canada is at the top end of those ratios,” said David Dale-Johnson, the Stan Melton Chair in Real Estate at the University of Alberta School of Business.

“In other words, housing prices here are pretty high relative to most other places around the world. Their concern is that Canadians are overextended with respect to their purchases of housing.”

What do the experts say?

While the CMHC’s mission stated on its website is “to make housing affordable for everyone in Canada,” housing prices were running away from being affordable in cities other than Toronto and Vancouver, with areas like Ontario’s Golden Horseshoe, Victoria and the greater Lower Mainland who were getting most of that overheating in 2017.

The size of the Toronto and Vancouver markets in proportion to the national housing market gave good reason for regulatory intervention, especially in the event houses in the 416 and 604 area codes experience a downturn.

“When you have Toronto and Vancouver representing more than half of home resales across Canada, they do register at the national level,” Dale-Johnson said. “You have to pay attention to what’s going on and, if it’s overheating, the risk of the market turning down with the potential of a brutal decline that could disrupt the market with a significant price decline — just for the sake of the stability of the market — it did make sense.”

Get weekly money news

“If we go back a couple of years prior to the oil price shock, there were some worries in Edmonton and Calgary,” Dale-Johnson added.

Before the stress test, insured mortgage eligibility requirements changed to include an increase in the minimum credit score, reducing the amortization period to 25 years from 30, limiting the home price tag mortgage insurance would cover, among others.

Vancouver introduced a one per cent empty homes tax in November 2016 and the Ontario government announced its Fair Housing Plan in April 2017, which included a foreign buyers tax and expanded rent controls.

In addition to stabilizing housing prices, the B-20 guideline is designed to reduce the number of Canadians with high mortgage debts.

“They are particularly focused on reducing the share of borrowers who are highly-indebted, so those borrowers who are seeking high loan-to-value mortgages,” CMHC senior analyst James Cuddy said.

“And there’s evidence to show that the share of mortgages going toward highly-indebted individuals is declining in Calgary and Edmonton.”

This probably a good thing, according to RBC senior economist Robert Hogue.

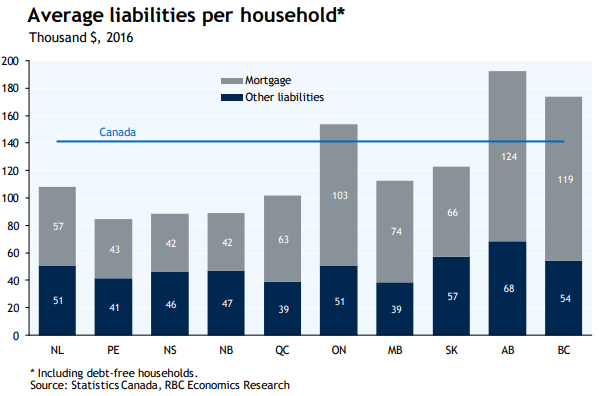

“Alberta households are the most indebted in Canada,” Hogue told Global News.

“Household debt has been identified by the Bank of Canada and many of us in the private sector as a key vulnerability to the health of the economy.

“High household debt may exacerbate the outcome” of the next downturn in the economy, Hogue said, adding the prudent course of action is to keep focusing on debt.

How indebted are Albertans?

Nationwide, Canadians have a debt-to-income ratio of 179 per cent to start 2019. Put another way, on average, for every dollar a Canadian earns, she or he owes $1.79. That’s the highest it’s been since records began in 1990.

According to an RBC economics report published in April 2018, Albertans’ total debts rose from $164,000 per household in 2010 to $192,000 in 2016, the highest of the 10 provinces. As of 2016, RBC says Alberta’s households spend 15.2 per cent of their disposable income servicing debt.

On Wednesday, Statistics Canada said Canadian households are spending even more to service their debt.

“Debt-to-income levels remain relatively high in both markets (Calgary and Edmonton). Part of the reason OSFI revised B-20 was to address this issue,” Cuddy added.

Moody’s, the international credit service, released a report Thursday saying “Canadian consumers are increasingly vulnerable to an adverse economic scenario despite stabilized household debt and low unemployment.”

What else do I need to know?

If a buyer has to qualify for a mortgage at a higher rate, does that affect how much house they can buy? Put simply, yes.

“The stress test had the biggest impact on the budget of buyers,” Hogue said.

“They have to have 20 per cent more income than they used to have or they would be buying a house that’s 20 per cent cheaper than they would have liked to have bought,” Dale-Johnson said.

In addition to lowering the budget Canadians are working with when buying a home, Mortgage Professionals Canada — a mortgage industry association — estimates a July 2018 report, that “about 100,000 Canadians have actually been prevented from buying a home.”

Credit report and credit score company Equifax recently said that consumer delinquency rates are on the rise in Canada.

Equifax reports that non-mortgage debt amounts are trending up in Alberta, with delinquencies increasing in Calgary but decreasing in Edmonton.

“Delinquency rates have much more to do with the state of the economy rather than interest rates or property values or size of mortgage,” Hogue said. “Delinquency rates, especially mortgage delinquency rates, correlates very highly with the unemployment rate.

“So what you’re witnessing in Alberta is the weakening in the provincial economy that is taking a toll on a number of borrowers that are facing some difficult situations,” the RBC senior economist added. “Rising interest rates possibly exacerbate the matter.”

According to the Office of the Superintendent of Bankruptcy Canada, more Albertans and Canadians are declaring bankruptcy — Alberta alone saw a 9.9 per cent increase in the 2018 calendar year.

Does the stress test unfairly punish Albertans?

For Hogue, one of the benefits of the stress test is a reduced debt load for Albertans who are already in a tough economy.

While reducing or eliminating the stress test could help increase house-buying budgets in the short term, market economic basics would kick in and increase demand and prices.

“While policymakers making changes might be well-intended, at the end of the day you’re not solving the basic issue of housing affordability,” Hogue said.

Hogue argued in a Feb. 28 report that the solution to getting more people into buying houses is to increase the supply of houses affordable to those entering the market.

According to ATB Financial, a record number of completed homes remain vacant and unpurchased in Edmonton, with Calgary reaching record numbers, as well. The provincial financial institution did not include a breakdown of the prices of those homes.

For the University of Alberta housing economist, the downturn in oil prices in 2015 took a lot of momentum out of the province’s housing market.

“If you look at Alberta separate from the rest of the country, I’d be inclined to think that you would not have needed a stress test because the oil price shock has taken care of any problem that might have arisen,” Dale-Johnson said.

The stress test isn’t the only reason it’s been difficult for Albertans to buy homes, according to Cuddy.

“The caveat is that it’s very difficult to disentangle the individual effects when looking at an environment in Calgary and Edmonton where we have some real challenges in the economy and higher interest rates as well,” Cuddy said. “Understanding the magnitude of the stress tests in terms of impact is difficult to assess.”

“Anywhere in Canada it’s hard to put together a down payment and finally get into home ownership,” Hogue said. “The bar is the highest it’s ever been in the country.

“At the same time, you don’t want to put young families, young households, at risk down the road of an even worse outcome.

“Knowing that Alberta households are the most indebted in Canada, that’s something to keep in mind when criticizing the type of policy that was really designed to address issues elsewhere but they are applicable to situations in Alberta.”

“If you want to help millennials or first time home buyers, focus on the economy,” Hogue said.

What can a premier do?

Given that the OSFI and CMHC are an independent federal agency and Crown corporation, respectively, premiers of any province are unable to do away with the mortgage stress test. The best they can hope for is to lobby and convince the finance minister and the executives of the OSFI and CMHC to change the mortgage stress test.

Whether or not they should is a question of caution.

Federal Finance Minister Bill Morneau — whose purview includes the OSFI and CMHC — is set to table the pre-election budget on March 19, where he could relax mortgage eligibility requirements, lengthen the amortization of mortgages (the amount of time to pay a mortgage off, reducing monthly mortgage payments) or increase the amount a home buyer can withdraw from an RRSP for a house purchase.

Comments