North American stock markets continued their slide on Tuesday, clobbered by a selloff in technology shares, underwhelming earnings from U.S. retail giants like Target and Kohl’s and falling energy stocks.

In the U.S., the Nasdaq closed at its lowest level in more than seven months while the S&P 500 and Dow ended at their lowest since late October, a day after Apple, internet and other technology shares dropped, further shaking confidence in a group of stocks that has propelled the long bull market.

Apple shares dropped again on Tuesday, falling 4.8 percent to its lowest level since early May, as concerns lingered over slowing demand for iPhones.

Target Corp shares slumped 10.5 percent after third-quarter profit missed analysts’ estimates. The company’s investments in its online business, higher wages and price cuts hurt margins.

Department store operator Kohl’s Corp shed 9.2 percent after its full-year profit forecast fell below expectations.

READ MORE: How much Canadians across the country plan to spend this holiday season

Meanwhile, U.S. oil prices plunged another 6.6 per cent amid concerns about rising global supplies.

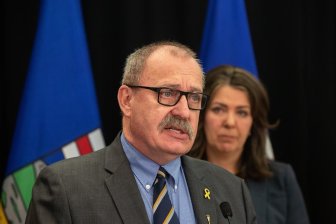

WATCH: Notley asks 3 experts and industry to address oil price discount

The market rout has investors once again wondering whether the end of the longest bull run in history is near.

The stock market has been on a roll since March 2009. And while there have been a few drops — most recently in February and October — those pullbacks have so far failed to halt the overall upward trend. The question is whether that may be about to change.

Brian Belski, chief investment strategist at BMO Capital Markets, sees a slowdown rather than an imminent crash.

“You see the momentum starting to unwind,” he said.

But bear markets, where stocks get stuck into a prolonged downward spiral, tend to coincide with economic downturns, he said.

The good news is that “nowhere in the data over the next year are we going to see a recession,” he added.

READ MORE: Bank of Canada raises interest rate to 1.75% — signals more hikes imminent

It isn’t hard to see what might be souring investors’ mood. For one, “corporate earnings will have a hard time keeping up with the momentum displayed in 2018,” reads BMO’s 2019 Market Outlook report, which Belski co-authored.

In the U.S., the impact of the Trump tax cuts is starting to wane, and job growth is cooling, said John De Goey, portfolio manager at Industrial Alliance Securities. Plus, interest rate hikes, which usually slow down economic growth, are expected to continue on both sides of the border.

WATCH: President Donald Trump signs $1.5 trillion tax bill into law

In sum, as far as the U.S. goes, “things have been great and now they’re just ‘meh,'” De Goey said.

But what might look like “meh” today is still pretty good when you take a historical perspective, Belski argues.

The paper forecasts the S&P 500 to be around 17 per cent higher than it is today by the end of 2019.

WATCH: How to find the right financial advisor

What about Canada though?

If things in the U.S. financial markets went from great to good, Canada seems to have gone from “meh” to pretty bad.

Canadian stocks have underperformed the U.S. stock markets for the past 10 years, with average annual returns in the mid-single digits compared to double-digit growth in the U.S.

Part of the problem is that Canada’s stock market is dominated by energy, materials and financial stocks. And while the big banks have fared well, the resource industry hasn’t quite gotten its mojo back since commodity prices tanked in 2014.

And while soaring prices for cannabis stocks propped up the overall market for most of the year, investors are now cautiously looking at whether post-legalization corporate earnings will justify marijuana producers’ sky-high market values.

Belski, though, remains optimistic about Canada, too. Many Canadians’ stocks are trading at bargain prices right now, he said.

Still, investors who aren’t thrilled by the performance of their Canadian shares might consider turning lemons into lemonade through capital losses, De Goey said.

Selling stocks at a loss before Christmas allows you to declare a capital loss, which you might be able to use to reduce your taxable income.

— With files from Reuters

Comments