For most cannabis users the excitement around legalization is palpable, but for some Oct. 17 is taking an already pricey product and making it more expensive.

An excise tax has been levied on legal cannabis producers starting, but instead of taxing just recreational products, it’s an added cost for all products, including those consumed by medicinal users.

“I think it’s ridiculous that any medication that we get we’re not paying all these taxes on, and then you bring in cannabis, it’s been here legal medicinally since 2001 and now we’re going to add these taxes,” Kelly Shada, owner of Kelz Medical in Regina said.

An online petition calling for medical marijuana to be exempt from a new cannabis tax has garnered over 11,000 signatures and a parliamentary sponsor, Vancouver-Kingsway NDP MP Don Davies.

“The decision to apply a new excise tax…in addition to the existing sales tax, will disadvantage Canadians seeking relief from serious medical conditions,” Davies said in an emailed statement.

“Patients will struggle to afford a sufficient supply of cannabis, or may choose a riskier option, like prescription opioids, because they’re covered,” he continued.

The petition’s creator, Heather Tayler, said she created the petition because she believes it is “unjust for the government to profit off of medical patients.”

Tayler’s niece uses medical marijuana, and Tayler argues: “the costs were already prohibitive for many patients, there is already sales tax, and it isn’t covered by health insurance or medical plans – this is adding insult to injury.”

Unlike prescription medicine, medical marijuana is subject to provincial and federal sales taxes, but on Oct. 17, producers will have to factor in the additional excise tax; a cost that could be passed on to users.

“Some of these people are on disability because of their ailments, which is very low income, some of them are on fixed income because they have been retired already for 20 years,” Shada said.

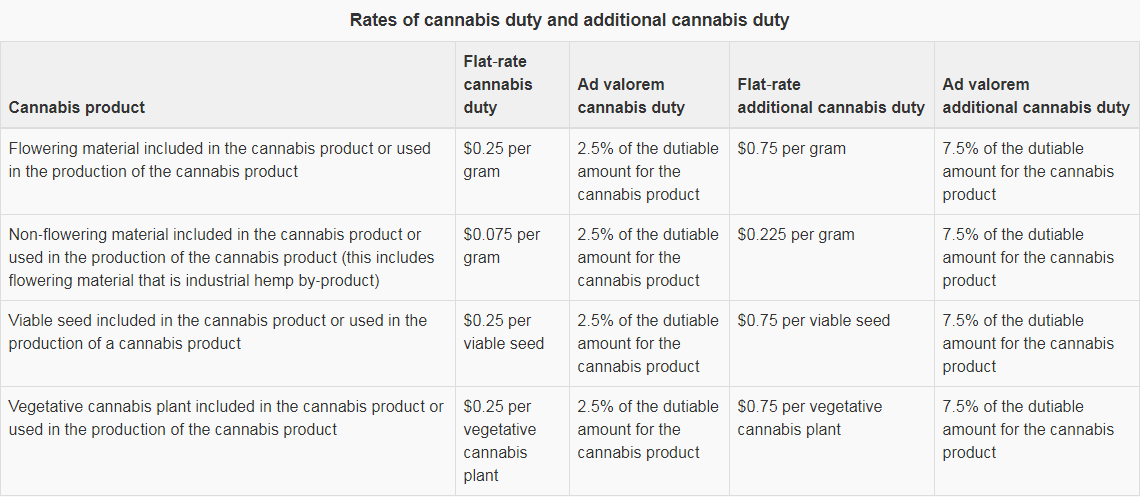

The federal government outlines the added duties producers will be charged on their website, but also notes some adjustments; increased prices in Nunavut, Ontario, Alberta, and Saskatchewan.

“In Saskatchewan’s case, an additional 6.45% of the producer’s selling price is added to the excise tax to account for the four percentage point difference between the Province’s 6% PST and the highest Harmonized Sales Tax rate of 10%,“ the provincial Ministry of Finance said in an emailed statement.

Under the cannabis tax framework, the province would receive 75% of the cannabis excise tax as well as the 6.45% provincial supplement.

Canopy Growth Corp. and Tweed and CannTrust have all said they will cover patient’s excise tax. Aurora Cannabis has promoted the petition.

WATCH: Washington-state’s pot economy thriving after six years

Comments