Millennials are finally thinking about settling down and buying a home. Many, though, are running up against the new mortgage rules that kicked in on Jan. 1.

The rules, essentially, require even borrowers who can afford a 20 per cent down payment on a house to show that they would be able to keep up with their bills if their mortgage rate rose by two percentage points.

For older or so-called “peak millennials,” Canadians between the ages of 25 and 31, the new standard means having to settle for a home that is around $40,000 cheaper than what they would have been able to afford in 2017, according to a new report by real estate giant Royal LePage.

READ MORE: Here’s the income you need to pass the mortgage stress test across Canada

With an average salary just above $38,000, the most expensive home a typical, single millennial can hope to buy is worth just over $200,000 with the new rules, calculates Royal LePage. For a couple with a combined income of $76,000, you’re looking at a maximum homebuying budget of around $400,000.

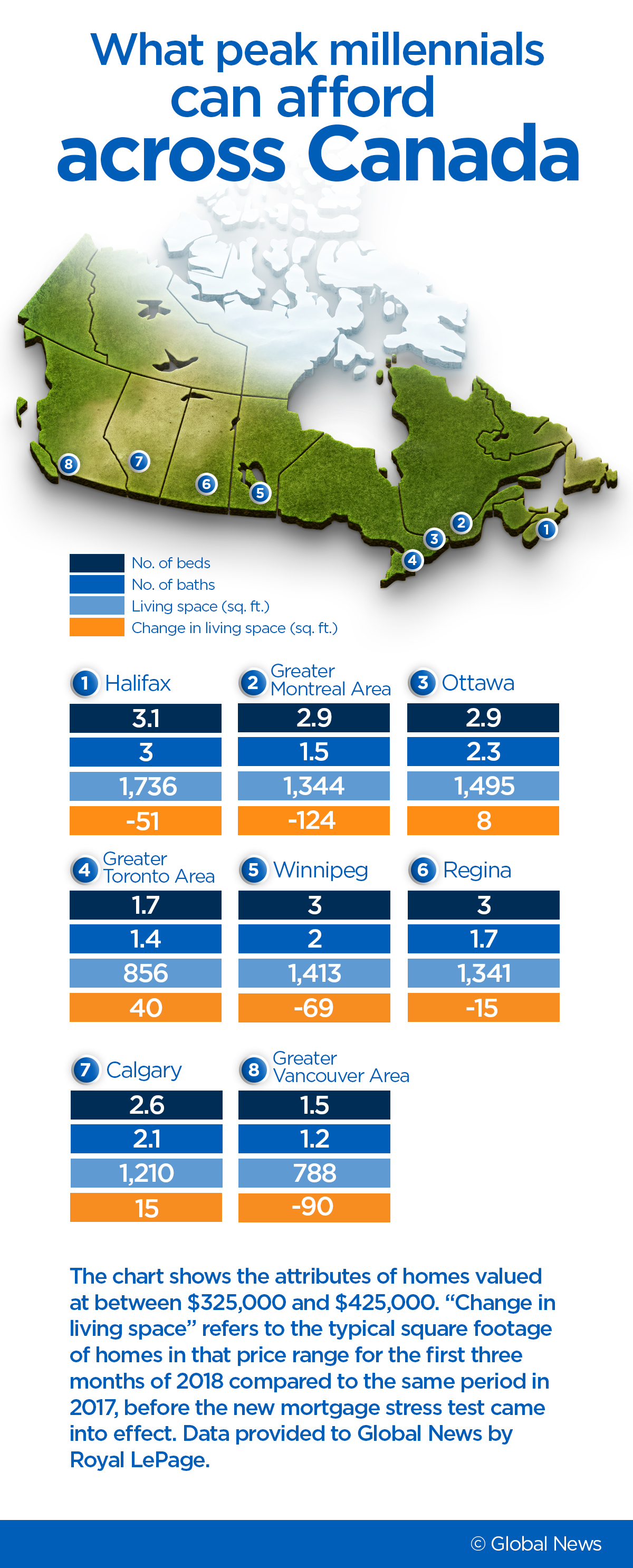

The average Canadian home priced between $325,000 and $425,000 had 2.7 bedrooms, 1.8 bathrooms and 1,269 sq. ft. of living space – arguably enough for a young family.

Get weekly money news

But what $400,000 actually gets a young couple is strikingly different depending on location. Around Vancouver, they’d likely have to make do with a one-bedroom condo and living quarters of less than 800 sq. ft. In Halifax, they’d be able to buy a three-bedroom, three-bathroom home that’s more than twice as big. And in Moncton, N.B., the 20 per cent down payment they’d have to fork over in Toronto or Vancouver would be enough for a house.

READ MORE: Should you lock in your mortgage rate or renew early before interest rates rise again?

- WestJet execs tried cramped seats on flight weeks before viral video sparked backlash

- Pizza wars? As U.S. chains fight for consumers, how things slice up here

- Health Canada says fake Viagra, Cialis likely sold in multiple Ontario cities

- Canada increased imports from the U.S. in October, StatCan says

Here’s how the purchasing power of the typical millennial couple varies across the country:

Halifax

Among the larger cities examined in the report, Halifax offers by far the best deals for millennials.

![“Recently, many peak millennials have begun to flock to Halifax to purchase some of the most affordable homes in the nation,” said Marc Doucet, broker of record at Royal LePage Atlantic. “As the region’s economy continues to strengthen, we expect this trend to continue.”READ MORE: Are variable mortgage rates still the best choice for saving on interest?Greater Montreal AreaMillennials have been flocking to Montreal, but the city isn’t what it used to be for young first-time homebuyers. High demand has pushed the price of many single-family homes out of the $325,000-$425,000 range, forcing house-hunters with this budget into condominiums, according to Royal LePage. This explains the steep drop in square footage between 2017 and 2018 of the typical home in the peak millennial price segment.WATCH: When to get a variable mortgage rate and when to choose a fixed rate[tp_video id=4157986]OttawaOttawa is the place where the average millennial couple can have it all: A relatively large home, a good job (and not just in government – the tech sector is booming, too), and a short commute to work.WATCH: These Canadian communities are at risk of drowning in debt if interest rates continue to rise[tp_video id=4133096]TorontoToronto is the only city that saw a material increase in the square footage of the homes associated with the $325,000-$425,000 price range, according to the report. Look at the numbers and you might think millennials might now be able to afford 40 sq. ft. more than last year.Unfortunately, though, the numbers reflect the fact that most smaller, downtown condos are now out of reach for young buyers with middling income. In turn, “this caused slightly larger properties in the north end of the Greater Toronto Area to have a greater weighting than in 2017,” Royal LePage told Global News.READ MORE: Canadians underwater – Where, exactly, rising interest rates may leave Canadians in danger of losing their homesWinnipegA millennial couple making $76,000 can afford “more than the average home” in Winnipeg, according to Royal LePage. But you don’t have to rely on the power of two incomes to get a foothold in the city’s real estate market. It might be why a growing number of young, professional women are buying homes on their own.READ MORE: 3 tips that could save you thousands on your mortgage, as interest rates riseReginaEven though Regina is one of Canada’s most affordable cities, local millennials are struggling to pass the new mortgage stress test on their own.“Mom and Dad must often pitch in and guarantee their loan to ensure that repayment obligations will be met,” said Brin Werrett, realtor at Royal LePage Regina Realty.READ MORE: New mortgage rules 2018: A practical guideCalgaryThe square footage of the typical home the average millennial couple can buy in Calgary went up by 15 sq. ft. since last year. And unlike in Toronto, that gain does reflect more purchasing power for young homebuyers.“A surplus of available condominiums gave purchasers more power at the negotiation table, resulting in prices decreasing across the segment and providing prospective homeowners with more options,” Royal LePage told Global News.READ MORE: Canada’s average home price drops over 10% year-over-year in MarchGreater Vancouver AreaIn the Greater Vancouver area, millennials are generally confined to suburbs like Coquitlam, Langley and Surrey, or, even further afield, Abbotsford, Mission and Chilliwack. Even there, though, what you can get with less than $450,000 isn’t much.And while new federal and provincial housing regulations seem to have cooled off the market for detached homes, they may have intensified the competition for entry-level properties.“New mortgage regulations have weakened [peak millennials’] purchasing power, making it tougher to compete with other buyers who now find themselves in the entry-level market as well,” said Adil Dinani, real estate adviser at Royal LePage West Real Estate Services.](https://globalnews.ca/wp-content/uploads/2018/04/screen-shot-2018-04-25-at-8-37-29-pm.png)

Comments