To look at Vancouver and Victoria is to see two places where median household incomes grew steadily over the course of a decade.

But they’re also two places where the money people make can’t keep pace with the growth of shelter costs.

Coverage of housing affordability on Globalnews.ca:

That’s according to data attached to a release by the Canada Mortgage and Housing Corporation (CMHC) last week.

The release looked at the income of homeowners and renters in census metropolitan areas (CMA) across Canada from 2006 to 2016.

It showed that homeowners’ household income was “roughly double that of renters” during that period.

That was certainly true in the Vancouver CMA, as the following chart shows:

Data from Statistics Canada’s Canadian Income Survey showed that, in 2006, Vancouver-area median renter household incomes, before taxes, were $41,400, while owner households were making $87,500.

By 2016, those numbers had climbed to $48,600 for renter households and $94,400 for owner households.

That represented growth of 17.4 per cent for renter households and 7.9 per cent for owner households.

This chart shows a similar trend in the Victoria CMA from 2006 to 2016:

Get daily National news

In 2006, median renter before-tax household incomes in Victoria were $48,500 and $81,200 for owner households.

By 2016, those numbers had grown to $51,700 for renters and $95,200 for owners.

That represented growth of 6.6 per cent for renter households and 17.2 per cent for owner households.

For Steeve Mongrain, an economics professor at Simon Fraser University (SFU), one statistic was particularly concerning: that homeowner incomes in Vancouver are growing at a slower rate than that of renters, even if they’re over twice as high.

In an email to Global News, he said this is likely happening because many homeowners are retiring — and thus their incomes won’t grow as fast.

But another, more likely reason is that young professionals in Vancouver simply don’t — or can’t — buy homes there.

READ MORE: Vancouver, Toronto residents digging into debt faster than any Canadians, data shows

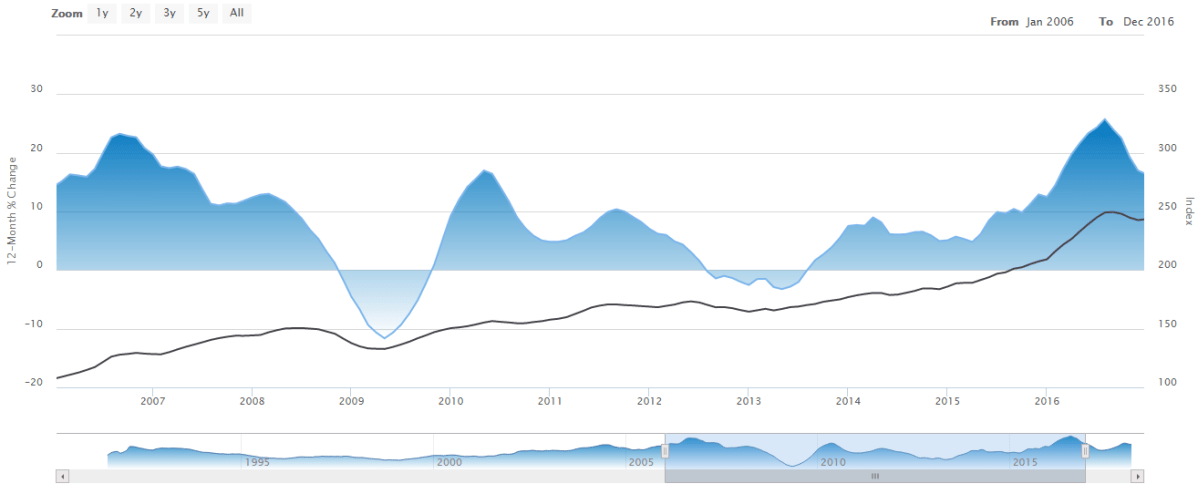

Incomes may be growing steadily in Vancouver and Victoria, but none of that was fast enough to catch up to the pace at which home prices grew in the same period.

Data from the Teranet-National Bank Home Price Index shows Vancouver property values growing by 126.4 per cent in the same period, while Victoria home values grew by 42.6 per cent.

Average rent growth is also proving difficult to keep up with.

Rental data provided by the CMHC showed the total cost to rent a rowhouse or apartment in the Vancouver area at $876 per month in October 2006.

That had grown to $1,236 per month by October 2016, representing a hike of 41.1 per cent against renter income growth of 17.4 per cent.

READ MORE: Buying vs. renting in Vancouver — moneywise, it doesn’t make much difference: analysis

Rental rate hikes in Victoria weren’t quite as pronounced — but they still grew faster than renters’ incomes.

In 2006, it cost about $742 to rent a rowhouse or apartment; by 2016, that cost had climbed to $1,003.

That makes a growth rate of 35.2 per cent against income growth of 6.6 per cent in the same time frame.

The income data are being released as B.C. implements a number of measures to tamp down on home price increases.

They include hiking the property Transfer Tax (PTT) on foreign buyers from 15 per cent to 20 per cent and implementing a speculation tax that targets vacant homes and people who own property but don’t pay income tax in B.C.

Meanwhile, the City of Vancouver has also implemented an empty homes tax (EHT) of one per cent of a property’s assessed value in an effort to make more rentals available.

A March rental report by Quantitative Rhetoric, which tracks rents for Vancouver, showed that Vancouver has seen three consecutive months of growth for rental listings.

Author Louie Dinh said he’s “cautiously optimistic” that measures like the EHT are driving more rental stock.

- Comox Valley issues State of Local Emergency due to flooding, 1 person may be missing

- B.C. government launches selection process for AI, data centre projects to compete for power

- Board of Metro Vancouver meets to address affordability, spending

- Virginia warehouse sale to ICE won’t proceed, B.C.-based Jim Pattison group says

Comments