The CEO of the Canadian Association of Petroleum Producers (CAPP) says Canada’s crude oil is the cheapest in the world because we can’t get our raw product to market and compete on a global scale.

Tim McMillan shared his insights with Global News Wednesday in Edmonton (scroll down for full interview), where he will address the Chamber of Commerce in a lunch-hour speech on the ever-evolving Canadian energy sector.

He will talk about the latest trends at the sold-out event and highlight the ways in which Canadian oil and gas producers are positioning themselves to meet the needs of the global marketplace.

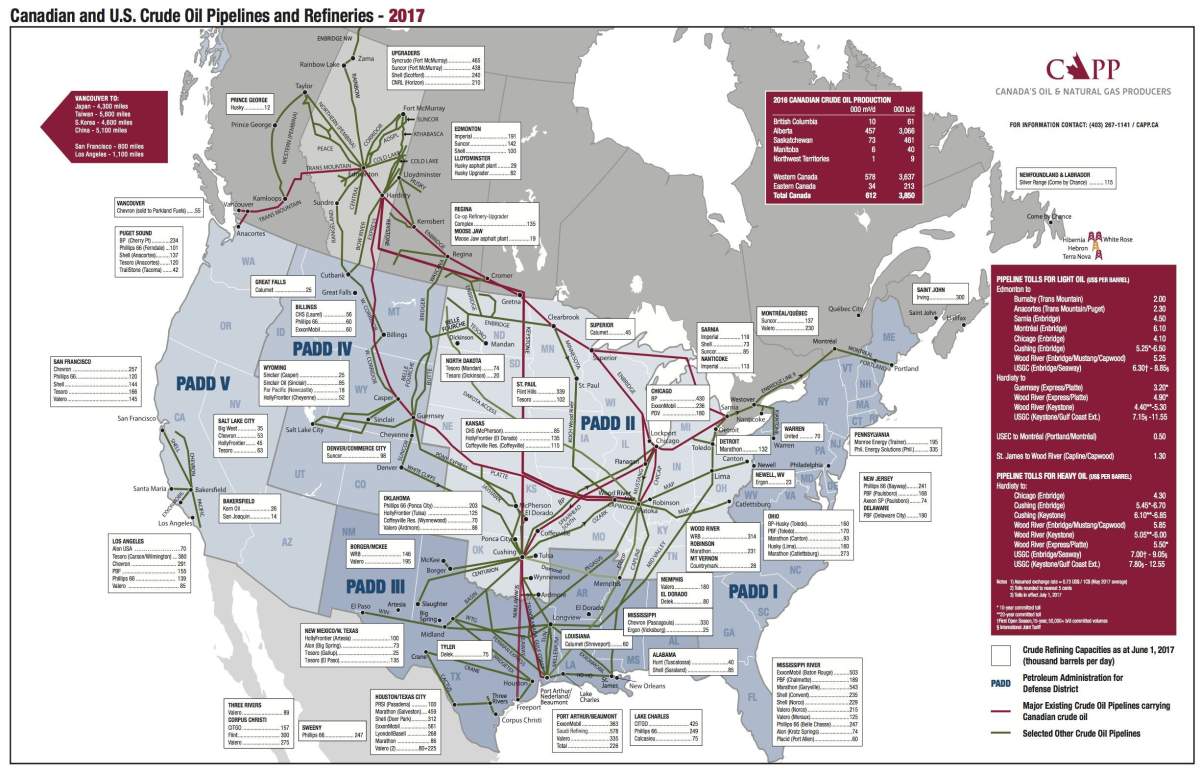

The Alberta and Canadian energy sector has struggled for years with getting oil and gas products to the international market due to a lack of pipelines.

One of the options approved by the federal government is upgrading the existing Trans Mountain pipeline between Edmonton and the B.C. lower mainland, but last week the B.C. government moved to possibly halt it entirely with proposed regulations to ban increased flows of oil pending new research.

This week, Premier Rachel Notley cut off imports of wine from B.C. in retaliation.

READ MORE: B.C. wine boycott could hurt Albertans, say food and beverage industry entrepreneurs

In advance of his speaking engagement, CAPP’s Tim McMillan joined Erin Chalmers on Global News Morning to talk about the challenges the energy sector faces. Below is a transcript of their conversation.

ERIN: First of all Tim, let’s talk about this trade dispute because it all comes down to getting Alberta’s oil to tide — a big issue building these pipelines. Where do you think things are at? Are you impressed to see the move that the Notley government has made?

Get daily National news

TIM: You know, I think it’s important we have a response from the producing side, the province of Alberta. I think it’s also important that the federal government continues to say, “this is our responsibility, we looked at it in detail, the oceans protection plan is in place and this project going to go forward.” And I think having them take the high ground and continue to put confidence into the system is important, and Alberta to give a response to a very political and irresponsible action from B.C.

Chalmers: And the prime minister has said ‘We stand by, we’ve already approved this pipeline.’ Does he need to do more?

McMillan: I think he needs to do that again and again and again, and in the past week I’ve heard three separate statements, all of which were very concrete about the federal government’s role here. I think that Canadians, and certainly British Columbians, will need to hear that on a weekly basis, maybe even a daily basis until this project’s concluded.

Chalmers: So overall how do you think things look for the oil industry?

McMillan: It is a very difficult time and prices have rebounded, we’re back up to some stability in the mid-$60s, but in Canada we are seeing a lack of investment. Global investment bounce back this year, another five to nine per cent — Canada’s actually losing capital investment and global demand continues to increase at almost record pace — Canada’s just missing out. This is just one more challenge on market access, but we’re also seeing on the cost side, on the regulatory efficiency — we’re falling behind.

READ MORE: Alberta ranks 33rd on global list of attractive places for oil, gas investment: Fraser Institute

Chalmers: And we’re seeing, we just reported earlier this month about companies that are sending their rigs down to the (United) States, they’re going to Texas, they feel like it’s better there, lower taxes, they’re building pipelines there, they’re getting the oil out. What do you do about that?

McMillan: It’s so frustrating that Canada has world-class resources, we have a workforce that’s sophisticated, mature … we can compete with anyone in the world, but the U.S. and other countries have been very deliberate about saying, “We want investment, we’re going to streamline our regulatory process, we’re going to build the infrastructure needed or allow industry to,” and Canada’s fallen behind. And the effects are, we’ve seen a divestment by some companies in Canada, and retaking that capital to Iran and to Brazil. We’re seeing rigs leaving Canada for the U.S., at a time when we’re struggling to get employment numbers back to where we want them in our industry.

READ MORE: Canadian drillers moving oil rigs south to chase better prospects in Texas

Chalmers: So what needs to happen?

McMillan: You know, I think it needs to be a very deliberate approach. Those that are getting the investments today have taken that, they’ve publicly and politically said, ‘We are going to compete for investment,” and they have streamlined their regulatory systems. In Canada, we continue to layer on challenges. In many cases, we’re going it alone on regulatory initiatives and I think that’s OK, but we have to do in the very thoughtful manner and today the markets are choosing other places.

Chalmers: And I think too, having those conversations within communities about how the oil industry does work. I read one article where you were saying ‘there’s misconceptions out there and we need people to speak up around the tables, around Tim Hortons, about the way things are working.’

McMillan: Absolutely and that’s why it’s so great to be invited to the chamber in Edmonton, that business leaders with the credibility to talk about our industry and talk about the effects it has on their business, their community is crucial. Those who have opposed our industry have gotten ahold of the loudspeaker and have been very effective at causing us problems. Those who know our industry well, those who are working in it, those that have businesses — if we aren’t prepared to get the microphone back, we’re going to be challenged for a long time.

Chalmers: What do you feel is the timeline? Do you think that they will be a turnaround in the next five, 10 years?

McMillan: You know, I think so. Global demand continues to rise for both oil and natural gas. Canada has some of the largest resources: we’re third in the world in resources on oil, we’re sixth-largest producer of gas, and we have the lowest prices in the world. We’re getting half the world price on oil today; natural gas we are getting the lowest price in North America. North America has the lowest gas prices in the world and it’s all because we can’t get our products offshore. So I think the fundamentals are in place for us to succeed, we just need to step up and take responsibility for our regulatory system, our costs as governments, as industry, and we need to work together to create the jobs we all want.

READ MORE: Pipeline problems, not carbon taxes, the bigger factor in energy competitiveness

Comments