U.S. President Donald Trump dropped a headscratcher for economists on Wednesday night when he told Fox News that because the stock market has soared during his tenure, the U.S. national debt is now lower.

This is what Trump said:

“In the last 10 years they borrowed more than it did in the whole history of our country. So they borrowed more than $10 trillion, right? And yet we picked up more than $5.2 trillion just in the stock market, possibly picked up the whole thing, in terms of the first nine months in terms of values. So you could say in one sense we’re really increasing values and maybe in a sense we’re reducing debt.”

The trouble is that the value of the stock market has no bearing on the size of the U.S. deficit or debt.

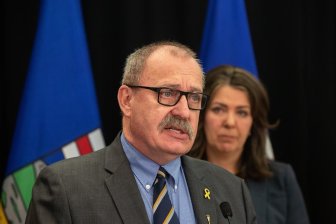

“He’s conflating two completely different things,” said Royce Mendes, senior economist at CIBC Capital Markets.

READ MORE: Justin Trudeau puts Donald Trump on notice over Bombardier tariffs

Mendes also took issue with Trump’s criticism of the Obama administration’s fiscal record. The $10 trillion in debt that the U.S. accumulated during the Obama years is largely the result of government spending that was necessary in order to dig the U.S. economy out of the hole after the 2008 financial crisis, he argued.

In 2009 Obama famously signed an $800 billion stimulus bill to help re-start America’s economic engine.

That was key in igniting the U.S. economic recovery, said Mendes. “If anything, they could have spent more,” he told Global News.

READ MORE: Expect to pay more for lots of stuff if Donald Trump dissolves NAFTA

But Trump does have reason to brag about the performance of the stock market, according to Mendes.

U.S. stocks have been on a tear pretty much since Trump won the election on Nov. 8, 2016.

And though that’s in part due to the current strength of the U.S. and global economies, it is also a sign of the market’s confidence in President Trump, said Mendes.

Investors welcomed Trump’s pledge to spend $1 trillion on infrastructure and slash taxes.

WATCH: Trump nearly forgets to sign order on Obamacare repeal after speech

And while the infrastructure plan is now in the doldrums, the White House has made some progress toward tax reform, noted Mendes.

The tax reform plan the administration released in September, while scant on details, did stick by Trump’s major campaign promises, he added. And that has only reinforced investors’ optimism.

But what did the U.S. president have in mind when he linked the stock market to America’s government debt?

It was an “obviously an imprecise statement,” Avery Shenfeld, chief economist at CIBC Capital Markets told Global News via email. But Trump did qualify it by saying “in one sense.”

READ MORE: Donald Trump to speak at anti-LGBTQ group’s Value Voters Summit in Washington

What he might have meant is that an increase in the market value of domestic corporations boosted America’s overall net worth, i.e. the sum of the wealth owned by the household, business and government sector.

“Debt issued to foreigners, including government debt, would show up as a decrease in net worth. So for the country as a whole, an increase in the stock market to some extent could be netted out against any foreign borrowing associated with financing government deficits,” wrote Shenfeld.

But that would be like someone claiming that they “reduced” their debt because the value of their home went up.

As Canadians surely know, it doesn’t quite work like that.

Comments