As Texas continues to endure devastating flooding from tropical storm Harvey, experts say the storm is a reminder for Canadian homeowners to ensure they are protected against all types of flooding.

Local officials have said there are at least 22 flood-related deaths, with that number expected to rise. Economic damages are likely to be in the tens of billions of dollars, with one estimate as high as $100 billion. Harvey made landfall in Texas late Friday as a Category 4 hurricane and has continued to pound the Gulf Coast as tropical storm.

WATCH: In Texas, there’s hope for relief with forecast of sun and less than an inch of rain

Craig Stewart, vice-president at the Insurance Bureau of Canada, said it will still be months before the total economic losses from Harvey can be calculated.

READ MORE: What Hurricane Harvey-level floods would look like in a Canadian city

Blair Feltmate, head of the Intact Centre on Climate Adaptation at the University of Waterloo, said many homeowners in Harvey’s path of destruction do not have flood insurance and when families return home they will be forced to pay out-of-pocket or take on more debt for the necessary repairs.

“The costs associated with the mental stress are going to be phenomenal,” said Feltmate. “Only about one out of six people in the Houston-area have any sort of insurance coverage at all, otherwise they are on their own. And even the coverage they do have will be very minimal.”

Private homeowners insurance in the U.S. typically covers just wind damage. Flood insurance policies have to be purchased by federally funded National Flood Insurance Program. Homeowners in areas known as Special Flood Hazard Zones are required to hold policies.

Get breaking National news

READ MORE: Houston’s flooding was ‘amplified’ by poor planning. Here’s what other cities can learn.

Created in 1968, the NFIP is administered by the Federal Emergency Management Agency and is designed to help people in flood-prone areas get insurance for their properties. And following a series of disasters like Hurricane Katrina and Superstorm Sandy, the flood insurance program is about $24 billion in debt.

Many have also complained about the high premiums which can be more than $2,000 for homes inside a floodplain and have chosen to remain uninsured against floods.

The U.S. research firm CoreLogic estimates about 1.2-million properties in greater Houston area are at high/moderate risk of flooding but are not in a designated flood zone requiring insurance — roughly half of all properties in that area.

Are Canadians protected from flooding?

If similar flooding seen in Texas were to occur in Canada, Feltmate said most homeowners would be left out to dry.

Feltmate said there are two types of flood insurance available in Canada: insurance for flooding caused by backed up sewer pipes and overland flood insurance, which covers damage from water flowing above ground and seeping in through doors and windows.

READ MORE: Flooding, flooding everywhere – do Canadians have insurance for it?

Felmate said overland flood insurance is a relatively new product in Canada and insurers only started offering it after the 2013 flooding in Alberta. He said the average cost of a flooded basement in major urban centres is roughly $42,000.

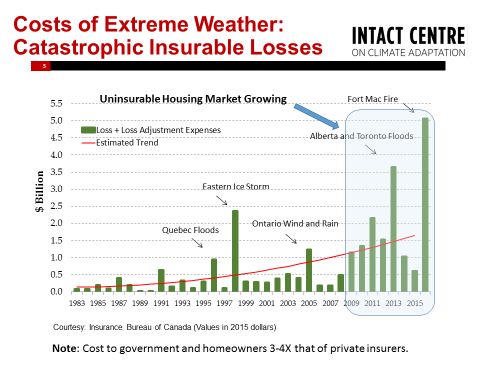

Severe weather events and natural disasters are becoming increasingly common, prompted by climate change, and the damage caused by hurricanes, fires and floods is also rising.

Stewart said there is a trend in the escalation of severe weather events, both in terms of length, intensity, and frequency of storms.

“Houston has just received three one-in-500-year events within the last five years,” he said. “In Canada, the floods that we saw this spring across the country are certainly an indicator of what is to come over the next few decades.”

WATCH: Harvey makes second landfall in Louisiana, residents urged to go into ‘survival mode’

Data from the Insurance Bureau of Canada shows that the annual economic cost of disasters around the world has increased from an average of $25 billion a year in the 1980s to an average of $130 billion a year in the 2000s.

In Canada, federal disaster relief spending between 2010 and 2016 rose even more to an average of over $600 million a year. In 2016, the wildfires in Fort McMurray and flooding in Atlantic Canada caused $4.9 billion in insured damages – surpassing the previous annual record of $3.2 billion set in 2013, according to the IBC.

“As a country, we’re not ready,” Stewart said. “Even large U.S. cities are not prepared for these types of events and it’s no different in Canada.”

How to protect your home from flooding

Flooding is very stressful and disruptive even if you have insurance. There are several easy and low-cost steps you can take to reduce that risk in your home:

- Make sure all downspouts discharge at least three metres away from your home’s foundations

- Ensure sewer grates are open and clear away debris like dirt and leaves

- Place plastic covers over window wells

- When it’s raining, go out and inspect your house to see if water is pooling anywhere around it. If it is, regrade the perimeter of your home so that water flows away from it

- Install one or more sump-pumps, which remove water that accumulates in the so-called sump basement, generally found in basements. You should also have 10 hours’ worth of battery backups to make sure they will continue to work even in case of a blackout, which often happens in conjunction with flooding

- You might also need a backwater valve, which helps to prevent flooding from sewer backup. These valves cost between $2,500 and $3,000 but many municipalities offer large subsidies for homeowners who decide to buy one

More information can be found on the Public Safety Ministry’s Flood Ready webpage.

*With files from Erica Alini and Rebecca Joseph

- China drops visa requirement for Canadian tourists, business visitors

- Epstein files fallout: People who’ve resigned or been fired after DOJ release

- Inuit look to Greenland’s social model as Canada pursues military buildup in Arctic

- Europe looks to boost its security, urges U.S. to ‘repair and revive trust’

Comments

Want to discuss? Please read our Commenting Policy first.