Toronto could soon turn into a buyer’s market, according to a new report by RBC.

“Don’t be surprised if the Toronto-area market moves into a buyer’s market territory in the coming months,” wrote Robert Hogue, senior economist at the bank.

WATCH: Within weeks of the Ontario Liberal government’s introduction of a foreign buyer tax and other measures to cool Toronto’s real estate market, buyers and sellers are taking notice.

Compared to a year ago, home sales were down a whopping 20 per cent in May, nearly twice as many Torontonians put their property on the market and the list of homes waiting for a buyer rose by over 40 per cent, according to data released by the Toronto Real Estate Board on Monday.

Average prices fell 6.2 per cent compared to April, although they remained nearly 15 per cent above May 2016 levels.

READ MORE: Toronto-area home sales drop in May after province introduces foreign buyers’ tax

There is “no doubt” that Ontario’s new measures to cool off the market — including a Vancouver-style tax on non-resident homebuyers — had much to do with this, according to Hogue.

“We’ve entered a period of adjustment in price expectations in the market and this causes buyers and sellers to lock horns,” he wrote.

Worried about declining prices, sellers are rushing to offload properties but remain determined to cash in, the numbers suggest. Meanwhile, buyers are likely holding off for prices to come down further.

READ MORE: Why Canada wins, but many Torontonians lose, from Ontario’s new housing measures

It might not be long until buyers get the upper hand, according to the report.

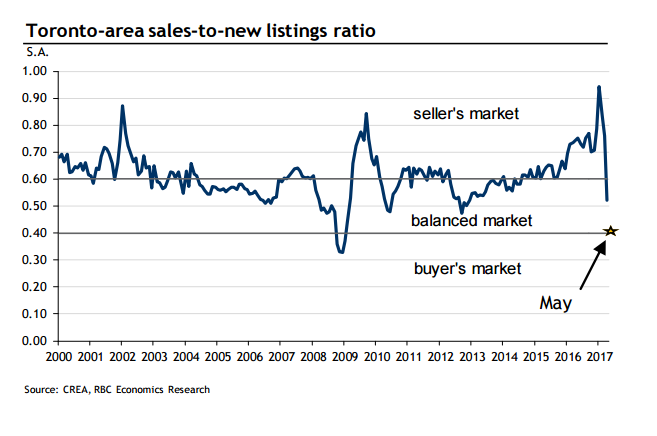

There’s a statistical benchmark that real estate boards use to determine whether a real estate market is in seller’s or buyer’s territory — and Toronto is fast approaching the latter.

In May there were about four homes sold for every 10 homes put on the market, estimated Hogue, at the threshold of what’s generally considered a buyer’s market. In March, by comparison, there were over eight homes sold for every 10 new listings, meaning homes were being snatched up pretty much as soon as the “for sale” sign went up.

By contrast, a lower number of sales compared to listings suggests it’s getting harder to sell a home (and by extension sellers may be more open to negotiate down prices).

The change isn’t a sign that housing prices are about to collapse, Hogue noted. But it may signal “changing sales tactics in the face of more patient buyers.”

What does this mean for homeowners across Canada?

Toronto-area homebuyers may be rubbing their hands, but what’s happening in southern Ontario is a cautionary tale for homeowners across the country.

New government measures aimed at pouring cold water onto overheated markets represent a risk for homeowners and investors who have much of their money tied up in real estate, Chris Catliff, head of North Vancouver, B.C.-based BlueShore Financial, told Global News.

It isn’t just British Columbia and Ontario that have stepped into the real estate fray. Ottawa has intervened numerous times over the past few years with measures that affect Canadians coast to coast (most recently with new mortgage rules announced in October 2016).

WATCH: What Canada’s new mortgage rules mean for new homebuyers

The government’s record on being able to slow down home prices is arguably chequered. Home prices in Vancouver, for example, are on the rise again, suggesting that the impact of the British Columbia’s foreign buyer’s tax may be already be waning.

But Canadians loading up on real estate are effectively betting against regulators, which “is never a good thing,” said Catliff.

Even those living far away from the sizzling markets of Toronto and Vancouver should be leery of putting too much of their savings into real estate or loading up with debt backed their homes, he added.

READ MORE: Home renovations: The 4 big risks of borrowing against your house to pay for it

Maximizing your RRSP and TFSA contributions instead of buying more house is a good idea, said Catliff.

Also consider talking to a financial adviser about putting more of your savings into the financial market and even investing in foreign shares, which reduces your exposure to Canadian stocks that would be affected by a Canadian housing downturn, he added.

READ MORE: 15% of Canada’s economy vulnerable to a housing slump, RBC says

Comments