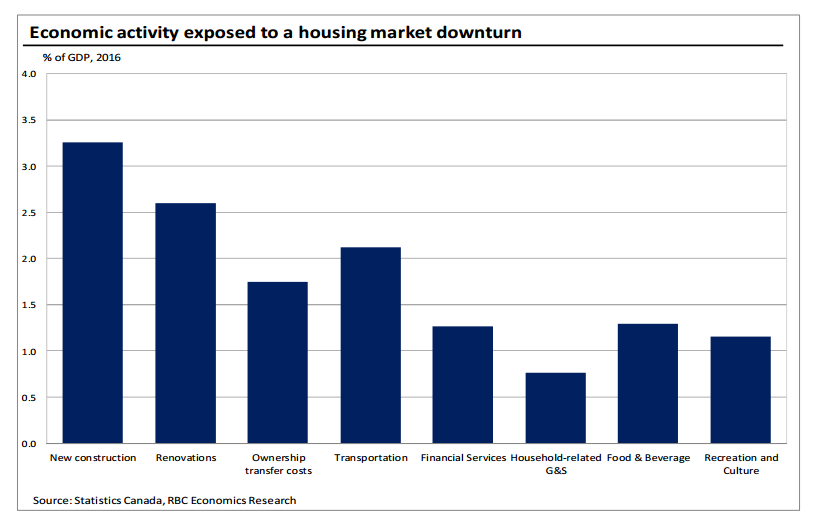

Nearly 15 per cent of Canada’s economy is vulnerable to a housing slump, according to a new report by the Royal Bank of Canada (RBC).

If several housing markets across the country were to see a 30 per cent decrease in home sales — a scenario similar to what recently happened in Vancouver after the introduction of a foreign homebuyers’ tax — Canada’s GDP could shrink by one per cent to two per cent, RBC noted.

READ MORE: Why Canada wins, but many Torontonians lose, from Ontario’s new housing measures

Whether a housing downturn means a recession would depend on what triggers the plunge in home sales, RBC economist Laura Cooper, who authored the report, told Global News.

However, “if we were to have a sharp rise in unemployment and an increase in interest rates that then spurred a more severe downturn, then that certainly would play out in a different fashion.”

READ MORE: Canadian housing price trend ‘very similar’ to U.S. just before the crash: National Bank

Homebuilders, real estate agents and real estate lawyers would likely suffer most

Homebuilders, real estate agents and real estate lawyers are among the groups that would take the hardest hit from a fall in home sales, the report suggests.

When homes sales plummeted by 30 per cent in 1990, new-home construction also fell by around 30 per cent over the following months, shaving nearly $10 billion off GDP, Cooper wrote.

READ MORE: Why trouble at alternative lender Home Capital could reduce your mortgage options

Business generated by the buying and selling of homes dropped even more, by over 40 per cent, in the housing correction of 1990, she noted.

WATCH: Ontario’s plan to fix out of control housing market

Business from home renovations would also decrease

Home renovation activity would also likely slow down as home sales decline.

Historically, the value of home renovations tends to decrease by about one-third of the home sales drop, Cooper wrote.

That would suggest a 10 per cent decrease in home renovations for a 30 per cent slump in the number of home sales.

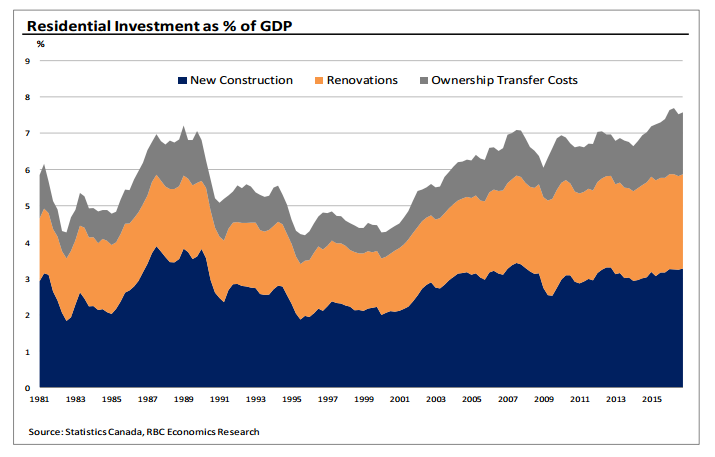

However, Canadians’ collective obsession with home makeovers has reached such a high over the past decade or so, it is likely more susceptible than usual to a housing downturn, according to the report.

WATCH: Interior designer Candace Wolfe on dos and don’ts of home renovations

Just how much the renovations business would suffer also depends on the extent to which Canadians have been relying on debt to finance their home upgrades, Cooper told Global News.

On that, she noted, there just isn’t data to formulate an assessment, she added.

READ MORE: Why homebuyers should stay away from this popular financing strategy

- Honda expected to announce Ontario EV battery plant, part of a $15B investment

- Trudeau says ‘good luck’ to Saskatchewan premier in carbon price spat

- Canadians more likely to eat food past best-before date. What are the risks?

- Hundreds mourn 16-year-old Halifax homicide victim: ‘The youth are feeling it’

Household spending more broadly would probably take a hit as well

Whether or not they plan to sell, homeowners feel wealthier when the price of their home goes up, economic research shows. And when families feel wealthier, they tend to spend more.

There’s no doubt that “wealth effect” has been boosting household spending in Canada, too, according to Cooper.

READ MORE: Could you handle a 33 per cent interest-rate hike on your debt? If not, start paying it off now

“Rising housing wealth amongst households likely contributed to the record levels of car sales in Canada and an insatiable appetite for renovations in the recent housing upswing,” the report reads.

But a housing slowdown would have the opposite impact, likely put the breaks on “vehicle purchases, eating out at restaurants, spending on recreation, cultural events and financial services,” Cooper wrote.

There is also the question of whether Canadian families would cut down on spending more drastically than they have in previous housing downturns because they’re so heavily indebted.

READ MORE: 3 things you probably didn’t know about your credit score

“Estimating the wealth effect if prices were to go down is a little bit trickier this time,” because of the currently elevated levels of household debt, Cooper told Global News.

Still, “we don’t expect a downturn similar to that recorded in the early 1990s or even in the United States leading up to the financial crisis,” the paper noted.

Rather, Cooper expects “a mild hangover” after “Canada’s years-long housing-market party.”

Her research did not look at how a drop in home sales would affect housing prices.

Comments