From New Brunswick to Quebec, through Ontario, Manitoba and to British Columbia, Canadians have been coping with flooding or bracing for torrential downpours.

And yet, flood insurance is still a relatively new concept in the Great White North.

Overland flood insurance, which covers damage from water flowing above ground and seeping in through windows, doors and cracks, only became widely available in the last couple of years, according to Blair Feltmate, head of the Intact Centre on Climate Adaptation at the University of Waterloo.

Until then, Canada was the only country in the G8 group of advanced economies not to offer overland insurance. That was because flooding used to be such a rare occurrence in this country, said Feltmate.

READ MORE: 30 homes evacuated after flooding in Pierrefonds-Roxboro, Île Bizard

But that all changed in June 2013, when heavy rainfall in Calgary turned into the worst flooding in Alberta’s history.

Floods became more frequent in Canada and the problem is only going to grow worse due to climate change, Feltmate told Global News.

WATCH: Here’s why cities flood more easily than rural areas

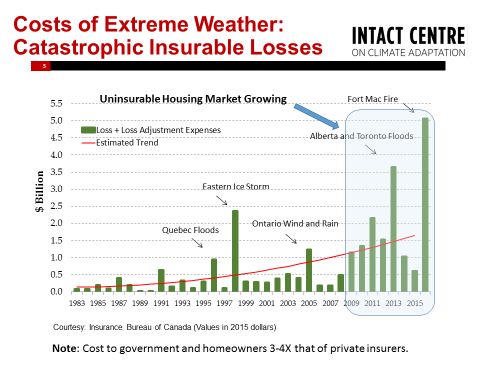

The average damage from severe weather stands at $400 million in Canada per year. That’s up from $100 million before 2008-2009, according to Karageorgos.

Urban flooding alone resulted in over $20 billion in damage over the ten-year period between 2003 and 2012, according to the federal government.

Here’s what homeowners need to know:

Get weekly money news

Who should be worrying about flooding? Pretty much everyone across Canada, according to Feltmate.

You don’t need to live close to a creek, river or lake to be at risk, he said.

Flooding often happens because cities’ sewage systems become backed up and start overflowing into basement drains, Feltmate noted.

Flooded basements replaced house fires as the most expensive source of home insurance claims in the 1990s, according to a study on climate change adaptation that Feltmate chaired in 2012.

Homes located in downstream and low-lying areas are particularly exposed, Feltmate said.

Make sure you’re covered

There are two major types of insurance against flooding: regular flood insurance and overland flood insurance.

Provinces don’t regulate these types of insurance so pricing depends on the provider, your address and your property, said Feltmate.

“The first tip or trick is to shop around,” said Karageorgos.

It’s also important to read the fine print and be aware of whether there is a cap on the amount of damage covered, said Feltmate.

A flooded basement costs an average of $42,000 in major cities – and not all insurers will cover 100 per cent of the damage, he noted.

Flood insurance

This kind of coverage has long been available in Canada but it isn’t necessarily included in regular home insurance. Many Canadians don’t know that they’re not covered when floods happen, Feltmate said.

Much attention has focused on the need for overland flood insurance in the aftermath of the Calgary floods. But plain-vanilla flood insurance is what you need to protect you from the risk of sewer back-up.

Overland flood insurance

Not every insurance provider offers coverage for overland flooding, said Karageorgos, so that’s another reason to take a look at multiple home insurers.

READ MORE: June flooding in Alberta called costliest natural disaster in Canadian history

If you aren’t covered or can’t get insurance

Across the country, many Canadians are finding out that their homes either can’t be insured against flooding or that premiums are so high they can’t afford to buy coverage, Feltmate said.

This is mostly the case for older homes built in areas where the risk of flooding has become extremely high, he explained.

Homeowners who don’t have insurance coverage can still make a claim with the federal Emergency Management Office of the Public Safety Minister.

Citizens can apply for Disaster Financial Assistance Arrangements, which are funded by the federal government but distributed by the provincial government.

How to protect your home from flooding

Flooding is very stressful and disruptive even if you have insurance. There are several easy and low-cost steps you can take to reduce that risk in your home:

- Make sure all downspouts discharge at least three metres away from your home’s foundations

- Ensure sewer grates are open and clear away debris like dirty and leaves

- Place plastic covers over window wells

- When it’s raining, go out and inspect your house to see if water is pooling anywhere around it. If it is, regrade the perimeter of your home so that water flows away from it

- Install one or more sump-pumps, which remove water that accumulates in the so-called sump basement, generally found in basements. You should also have 10 hours’ worth of battery backups to make sure they will continue to work even in case of a blackout, which often happens in conjunction with flooding

- You might also need a backwater valve, which helps to prevent flooding from sewer backup. These valves cost between $2,500 and $3,000 but many municipalities offer large subsidies for homeowners who decide to buy one

More information can be found on the Public Safety Ministry’s Flood Ready webpage.

How to mitigate the damage

What do you do if you’ve already been flooded? The first step is to document what’s been damaged.

“A lot of times individuals, if they’re faced with flooding in their basements, they start throwing things out. And if they do have insurance policies that cover them for damage they want to document what is part of the claim… furniture, appliances, carpet or hardwood flooring,” Karageorgos said.

It’s also useful to inventory your basement beforehand, he explained, so you can check if your policy will have enough coverage for all the things that could be damaged – as well as accounting for disposal and replacing.

“Move sentimental items to higher ground, because some things can’t be replaced.” Karageorgos said.

-NOON_848x480_929141315598.jpg?w=1200&quality=70&strip=all)

Comments

Want to discuss? Please read our Commenting Policy first.