Happy March 17. Today is St. Patrick’s day, World Sleep Day, and — perhaps less happily — also the day when Canada Mortgage and Housing Corp. insurance premiums are set to go up.

The agency announced in January it would raise premiums on new mortgages as part of new federal regulations that require it to hold additional capital.

READ MORE: Did you sell your home in 2016? Let the CRA know or else…

For the average Canadian home buyer with CMHC insurance, the change implies a small additional cost of about $5 per month, the agency said.

But many Canadians seeking CMHC insurance on their new mortgage could face higher costs depending on the size of their down payment and home price.

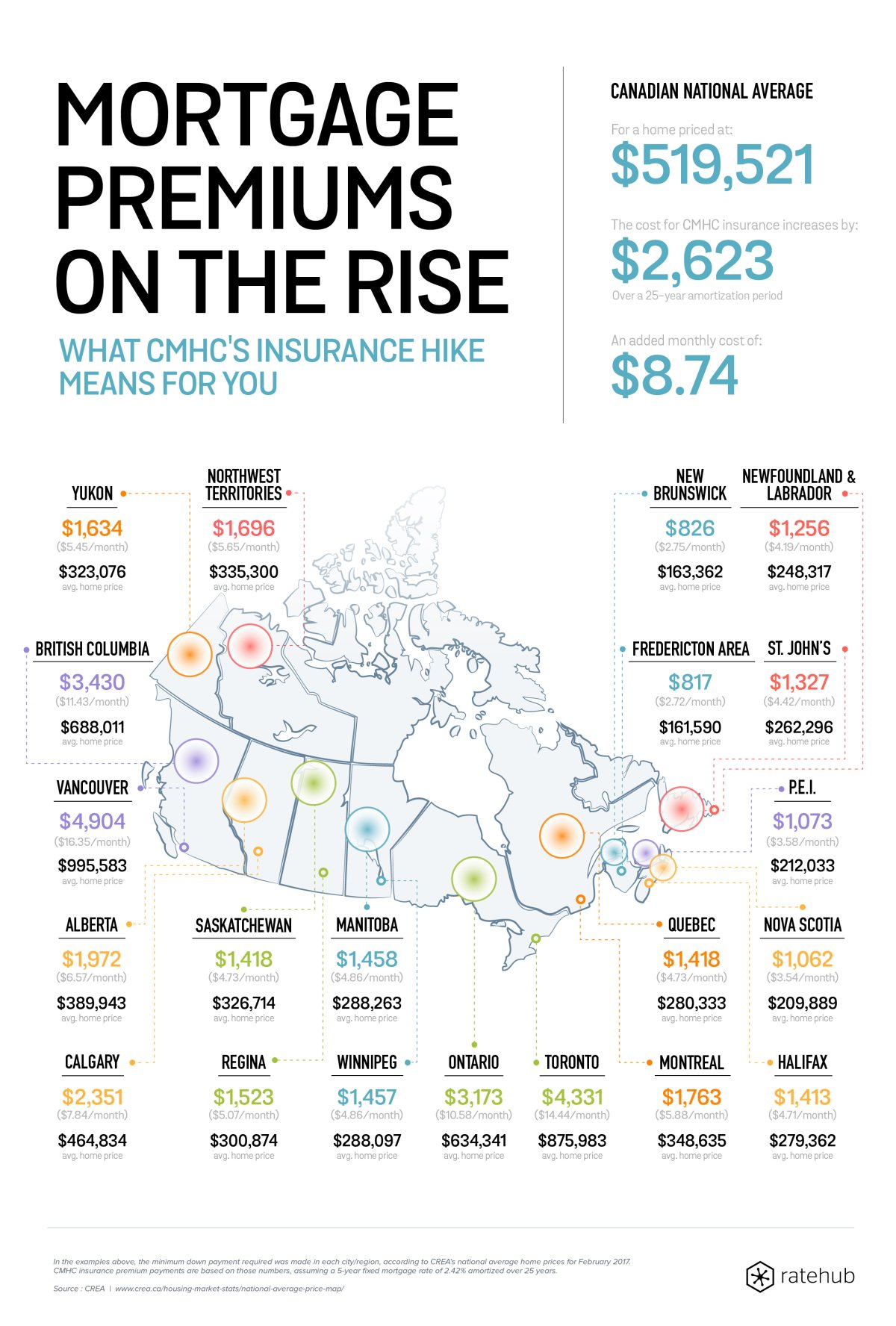

For example, a Toronto buyer who puts down the minimum allowed payment of 6.6 per cent on a home worth $730,472, the city’s average housing price, would face an added cost of approximately $12 per month, or $2,730 over the life the of the mortgage, according to RateHub, a rates comparison site. (The company’s calculations are based on a 2.44 per cent mortgage, amortized over 25 years).

With a down payment of 18 per cent, the same buyer would face an added cost of $27 per month, or $5,990 over 25 years.

READ MORE: Toronto is a city where even the ‘rich’ can’t afford an average-priced house: BMO

That’s because the size of the premium increase varies based on the size of the loan-to-value ratio of the mortgage being insured. The loan-to-value ratio is the value of the mortgage divided by the home price and expressed as a percentage.

For example, for mortgages with a loan-to-value ratio of up to 95 per cent, CMHC raised premiums from 3.6 per cent to 4 per cent, a 0.4 percentage point increase. For mortgages with a loan-to-value of up to 80 per cent, premiums went up from 1.25 per cent to 2.4 per cent, an increase of 1.15 percentage points.

- Canadian man dies during Texas Ironman event. His widow wants answers as to why

- ‘Shock and disbelief’ after Manitoba school trustee’s Indigenous comments

- Several baby products have been recalled by Health Canada. Here’s the list

- ‘Sciatica was gone’: hospital performs robot-assisted spinal surgery in Canadian first

READ MORE: Are federal mortgage rules actually working? Not really.

Lenders usually require mortgage insurance for home purchases with down payment of less than 20 per cent, that is, a loan-to-value ratio greater than 80 per cent.

Home buyers can pay the premium as a lump sum, but CMHC said the amount is usually added to the mortgage principal and repaid over the life of the loan.

READ MORE: 12 of Canada’s 15 most expensive homes for sale are in Metro Vancouver

The chart below, provided by RateHub, illustrates how costs vary across Canada based on local home prices. The calculations assume the minimum down payment required in each city or region and a 5-year fixed mortgage rate of 2.42 per cent with 25-year amortization.

The premium hikes come amid concern about Canadians’ debt levels.

In November, the CMHC warned that interest rate hikes could cause an economic crisis, with overinflated house prices falling by as much as 30 per cent and unemployment rising.

READ MORE: ‘Sudden’ spike in interest rates could trigger housing crash, unemployment spike: CMHC

And in December, the Bank of Canada warned that unsustainable debt levels posed a risk to the national economy.

The bank said at a national level the proportion of highly indebted borrowers with mortgage-to-income ratios above 450 per cent reached 18 per cent in the third quarter of 2016, up from 13 per cent two years earlier.

READ MORE: Rising household debt menaces the national economy, Bank of Canada warns

While Vancouver real estate prices eased after the introduction of a foreign buyers tax, they continue to soar elsewhere, with prices setting new records in the Greater Toronto Area and Victoria.

With files from the Canadian Press.

Comments