You know a city’s real estate market is beyond the reach of its residents when even some of the highest earners can’t afford to buy an average-priced house there.

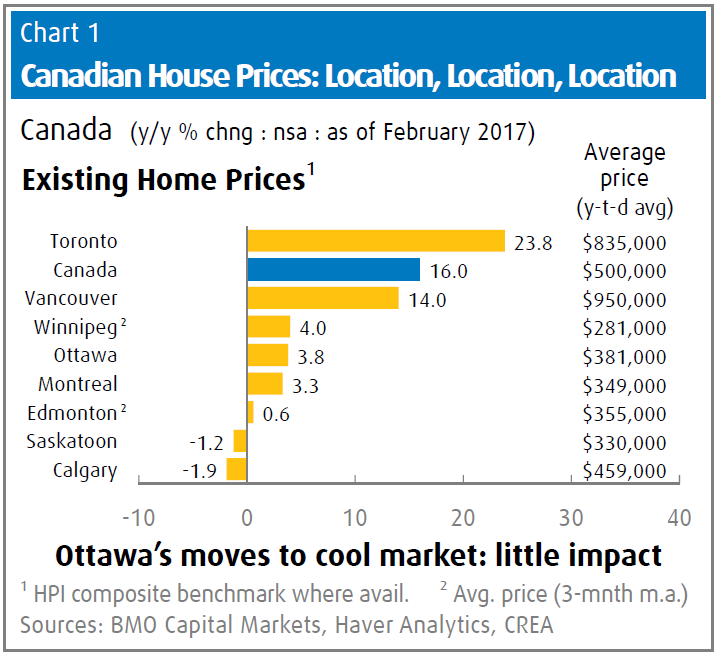

That’s the situation facing Toronto, where benchmark home prices climbed by just under 24 per cent year-over-year last month.

And that trend has helped to put a house of almost any kind outside the grasp of people who earn just about enough money to rank in the top one per cent of earners, said a draft of a BMO report that was set to be released on Friday.

In the report, BMO chief economist Douglas Porter used the example of a high-earning couple to show just how much the city’s housing market needs “serious” government intervention.

The couple in question, which Porter called Dudley and Darlene Doright, spent years piling away enough income to save for a down payment of $100,000.

The pair had just had a baby, but since the higher-earning spouse had an annual income of $225,000, the other was expected to stay home.

This income is enough to mean that the couple would be paying a marginal tax rate of 53.53 per cent — and that’s enough to consider them “rich,” Porter said.

“Given that the Dorights are almost 1%-ers and that they have saved heavily, surely they can afford a decent place to live in Toronto?” Porter asked.

“Not so much, as it turns out.”

The maximum home price this couple could afford would be $987,289, Porter said.

That’s not enough to afford an average detached home in Toronto’s 416 area code, where the price runs to $1.57 million.

It’s also not enough to buy an average-priced detached home in the Greater Toronto Area’s (GTA) 905 area code, where the price is $1.11 million.

Even a semi-detached Toronto home, at an average price of $1.08 million, would be out of reach, Porter noted.

READ MORE: Toronto detached home prices cool off more than they have in 2 years

The couple could afford a semi-detached home in the 905 region, where the average price is $700,000.

But even there, prices for this type of home went up by 33 per cent in the past year. There aren’t very many of these kinds of houses in the area, either.

“Even people who nearly qualify for the top one per cent of all incomes and will be paying over 53 per cent in personal marginal tax rates … are at best able to afford a semi-detached home on the fringes of Toronto, or maybe a low-end detached home verging on teardown status,” Porter said.

“Now just imagine the predicament a more typical couple of more modest means faces in the current market environment.”

This example provides proof that serious intervention is needed in the Toronto housing market, he said.

And so far, actions by the federal government haven’t been enough to cool prices down there.

Last year, the Liberals introduced new mortgage rules that required a “stress test” for homebuyers to ensure they could afford to service their mortgages if interest rates went up.

“Clearly something a bit more targeted and atypical is needed at this point,” Porter said.

READ MORE: The Liberals tried to clamp down on Canadians’ debt. So far, it isn’t working.

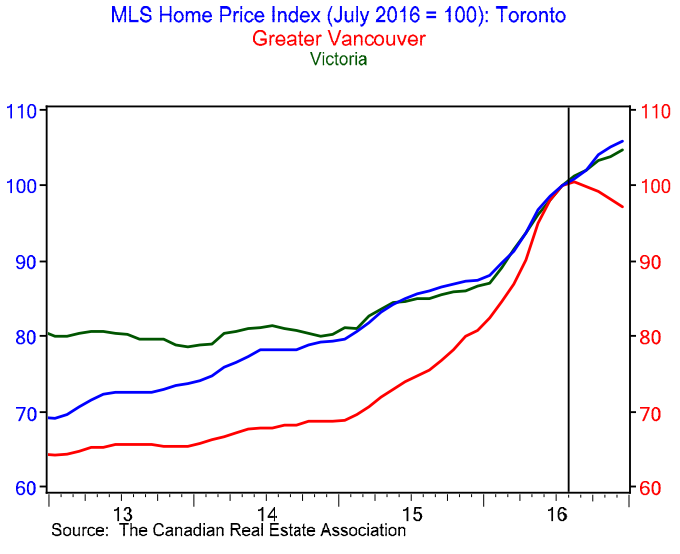

He raised the example of B.C.’s 15 per cent property transfer tax on foreign homebuyers in Metro Vancouver, which was introduced in August 2016.

The tax was enough to cool prices there without crashing the market, he said.

It’s not the first time that Porter has vouched for the tax over the federal government’s mortgage rules.

He offered similar commentary in January, with a graph showing what happened to home prices in Vancouver compared to other cities.

Porter is also far from the first to note that the Liberals’ mortgage rules aren’t having their intended effects in Toronto, as far as slowing home price growth.

The lack of price cooling in Toronto’s real estate market suggests that wealthy investors, foreign and domestic, are driving up home values there, Simon Fraser University professor Josh Gordon told Global News this week.

READ MORE: Are federal mortgage rules actually working? Not really.

While many blast the idea of a foreign buyers’ tax, “each argument against it simply doesn’t hold up to even casual inspection,” Porter said in his report.

“It will be incredibly tough to attract talented folks like the Dorights if they will struggle to buy a home and yet still pay taxes of over 50 per cent,” he said.

- With files from Erica Alini

- ‘Shock and disbelief’ after Manitoba school trustee’s Indigenous comments

- Canadian man dies during Texas Ironman event. His widow wants answers as to why

- Several baby products have been recalled by Health Canada. Here’s the list

- ‘Sciatica was gone’: hospital performs robot-assisted spinal surgery in Canadian first

Comments