Canadian home prices rose in February as prices continued to climb in the hot Toronto market, data showed on Tuesday in a report that was unlikely to alleviate concerns from some quarters that the city is facing a real estate bubble.

The Teranet-National Bank Composite House Price Index, which measures changes for repeat sales of single-family homes, showed prices rose 1.0 percent from January.

READ MORE: Are federal mortgage rules actually working? Not really.

It was the largest February increase on record for the index going back 18 years as prices in Toronto jumped 1.9 percent. In nearby Hamilton, where home values have been boosted as buyers are forced out of Toronto, prices were up 1.4 percent.

It was the 13th month in a row that prices have risen in Toronto. While Canada’s housing market has been largely robust in the years since the global financial crisis, some economists have begun to call the Toronto market a bubble.

READ MORE: Foreign buyer tax alone won’t cool down scorching Toronto housing market: report

Get weekly money news

In a research note accompanying the release, National Bank economist Marc Pinsonneault called the Toronto market “especially worrisome.”

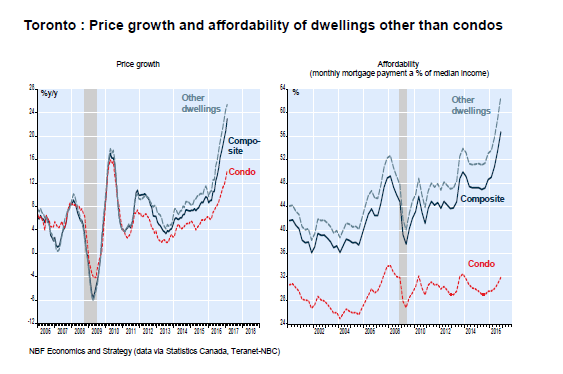

“In a city where apartments account for only 26 per cent of home sales, affordability of other types of dwellings has become an acute problem,” he noted.

The chart below, by National Bank, shows that mortgage payments for homes other than condos now take up nearly 64 per cent of the city’s median income:

The lofty prices in Toronto despite tighter mortgage lending rules will likely pressure policymakers to take further steps to rein in the market, a Reuters poll showed last month.

READ MORE: Biggest factor in Ontario’s red-hot housing market is demand: finance minister

Vancouver also helped drive the national index higher, with prices rising 1.4 percent, though they were still down 1.1 percent from the peak seen in September last year. Activity in Vancouver cooled last year as the provincial government implemented a tax on foreign buyers in the city.

READ MORE: B.C. foreign buyers tax really did yank down Vancouver home prices: BMO

Prices across Canada were up 13.4 percent compared to a year ago, the biggest 12-month increase since November 2006. Toronto led the pack with a record 23.0 percent surge.

It was the latest data to suggest the Canadian housing market was defying expectations of a slowdown, coming on the heels of surprisingly strong housing starts figures released last week

Comments