Residential home sales in B.C. are forecast to slide 14.1 per cent in 2017 and the average home price should fall nearly five per cent, according to a report from the B.C. Real Estate Association (BCREA).

The association says “rising property tax burdens aimed at foreign buyers and at sales of homes valued over $2 million have impacted home transactions, especially in Metro Vancouver.”

It also cites tighter federal mortgage regulation as a roadblock for first time homebuyers with low equity from entering the market.

On the supply side, a boom in new home construction is likely to keep the housing stock high, according to the report.

Those factors will likely drop the average home price down to $657,000, mostly due to a softening of the luxury market in Metro Vancouver.

However, not all places in the province will see a reprieve from several years of spiking home prices.

Interestingly, the only places that are expected to see a considerable price drop in 2017 are under the effect of the 15-per cent foreign buyer’s tax – except for the South Okanagan.

- Gas prices surge in some parts of Canada. What’s causing pain at the pumps?

- Roll Up To Win? Tim Hortons says $55K boat win email was ‘human error’

- Ontario premier calls cost of gas ‘absolutely disgusting,’ raises price-gouging concerns

- Netflix beats subscriber targets, but revenue falls short of forecast

Greater Vancouver should see prices fall by 7.4 per cent this year and the Fraser Valley will see a slight drop of 2.9 per cent. The South Okanagan could decline by 3.5 per cent.

Meanwhile, all other regions in the province will have price increases between 0.5 and 4.5 per cent.

BCREA chief economist Cameron Muir, who has been outspoken in denying that foreign buyers have been a driving force in Vancouver home prices in recent years, maintains he hasn’t changed his opinion on the matter.

“When we look at the extent of it, we had concluded at the time – given the available data – that it was a market segment for sure, but it was not the most significant driver of housing demand or prices in the region,” Muir told Global News.

In the spring of 2015, Muir penned an op-ed in the Vancouver Sun in which he stated “despite the news depicting a few empty houses or a frustrated first-time buyer or two, there is scant evidence that foreign investors are much more than a market niche or have any effect on the ability of Metro Vancouver residents to purchase their first home.”

He says he still believes that is true, despite evidence connecting Vancouver’s hot housing market with foreign investment.

“Home sales fell more before the foreign buyer tax was introduced than after. That’s a fact,” he told Global News.

Muir is accurate. The number of home sales peaked in March 2016 with 5,173 sales. By July, the number was down to 3,226 – a decrease of 37 per cent in the five months prior to the tax.

It fell another 31 per cent in the five months after the tax.

While the number of sales had been falling before the tax, the slowdown was not reflected in home prices until after the tax.

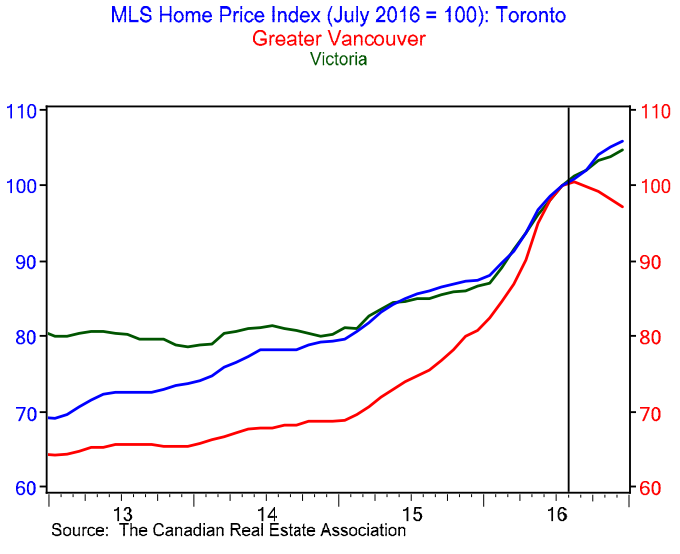

The benchmark price of a detached home grew steadily by almost 24 per cent between January and July 2016. But after the tax, the price fell 6.5 per cent between July and January 2017, while markets not subject to the tax, like Victoria and Toronto, continued to rise.

The condo market has remained more stable after the tax.

The clear impact of the foreign buyer’s tax on the Vancouver real estate market was recently pointed out by economists at the Bank of Montreal.

BMO’s report also stated the federal government’s tightened mortgage rules implemented in October was not the cause of falling prices, contrary to statements made by the BCREA this week.

To go along with the falling prices, the number of foreign buyers entering the Metro Vancouver market has also shrunk considerably.

On July 29, the last business day before the B.C. foreign buyer’s tax was implemented, more than $850 million in residential property transactions involving foreign nationals in Metro Vancouver were registered. That was equal to more than 55 per cent of all transactions registered in Metro Vancouver on that day.

In contrast, the period of Aug. 2 to 31 saw 60 transactions in Metro Vancouver that involved foreign nationals. The total value of the properties transferred was $46.9 million, which, the government said, was less than one per cent of total Metro Vancouver transactions during that period.

The number of foreign buyers has been creeping back up since a low in August, but remains significantly below June levels when the B.C. government began tracking the data.

The demand may have shifted south of the border and to other cities across the country, according to Chinese realty website Juwai.com.

Seattle property searches on the site grew by 143 per cent year-over-year in August 2016, making it the third busiest month in the last three years for number of inquiries in the city.

Toronto saw a 142 per cent increase in property inquiries in August compared to 2015, according to Juwai.

That city has now taken over as Canada’s real estate hot spot.

Comments