The Canadian dollar is in the midst of its steepest decline in history. On Jan. 15, 2014, it was trading at a little over 91 cents U.S.

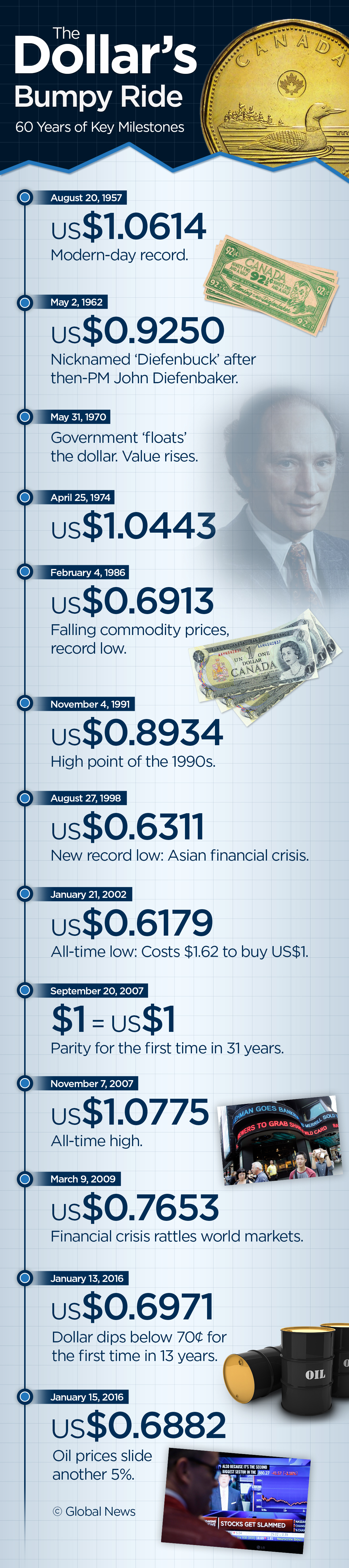

On Friday, it dipped below 69 cents US for the first time in 13 years.

That’s a drop of almost 25 per cent. In just two years.

READ MORE: 5 money-saving tips to get you through tough economic times

That means your one-day ticket to Disney World near Orlando, Fla., – pegged at US$105 – will run you at least C$150. Two years ago, it would’ve set you back a little under C$115.

Get weekly money news

Throw in a few nights in a hotel, some meals and the cost of travel, and this year’s vacation just got a whole lot more expensive.

READ MORE: A 60-cent loonie and $10 oil? Sure, why not?

And it might only get worse for Canadians looking to get away. Earlier this week, David Doyle, an analyst at investment dealer Macquarie Capital Markets Canada Ltd., predicted the loonie will slip below 60 cents US by the end of the year.

Some predict the price of commodities – especially oil – will tumble further while China’s economy sputters, meaning it could be some time before the dollar recovers.

Comments

Want to discuss? Please read our Commenting Policy first.