Canadian auto parts giant Magna said last week it has scrapped plans for another plant here.

The decision is another blow to a sector that has seen more than its fair share in recent years, while experts say the outook for the still major source of jobs and employment in this country is anything but clear.

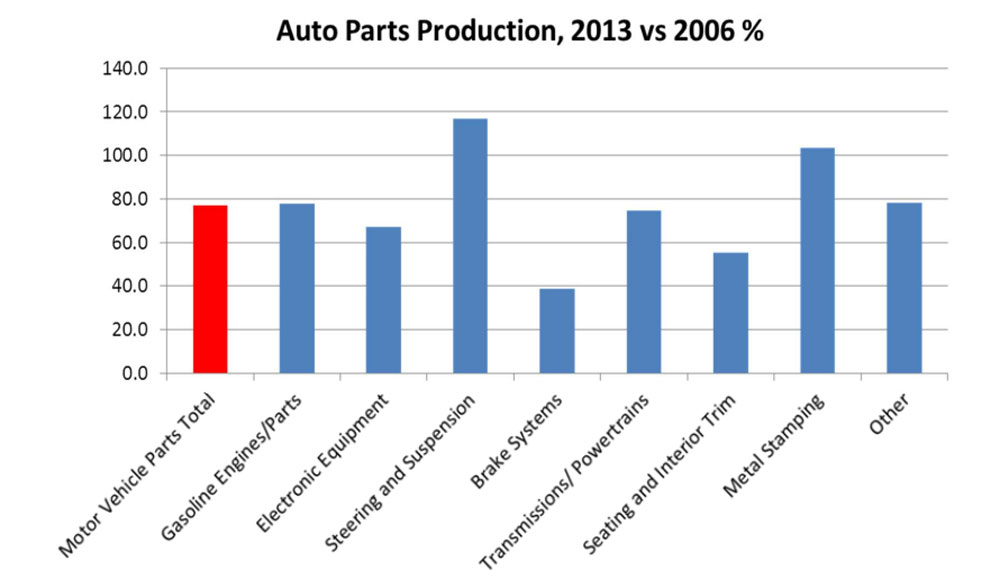

At a time of record production in North America, Canada is being passed by — production at Canadian plants is now down more than 20 per cent compared to pre-recession levels, according to BMO research published Tuesday.

Six of eight component categories are producing less, thus employing fewer people, compared to 2006, BMO said.

READ MORE: The rise of the eight year car loan

Across North America, more than 16.5 million cars, trucks, crossovers and SUVs were made last year, a feat last achieved in 2002. Some, like Magna, are calling for production to hit 16.8 million vehicles in 2014.

Still higher production costs

Get weekly money news

The cost of production is still higher in Canada than in most states south of the border, experts say.

And new factors now threaten to push them higher still. In Ontario, where most of the country’s auto jobs reside, higher electricity costs and a looming provincial pension plan weighed on Magna’s decision.

The company says the Ontario Retirement Pension Plan, which Premier Kathleen Wynne is campaigning on, will add $1,900 a year in added costs for each of the 19,000 employees Magna has in the province.

READ MORE: Fed finance minister takes aim at Ontario’s pension scheme

The loonie’s decline (around 10 per cent since last summer) has helped manufacturers by easing costs. But experts say the dollar needs to fall another five to 10 cents if more investment decisions among multinationals are going to swing in Canada’s favour.

Magna is planning to open new plants in the coming years — twenty-three in all, with eight slated for the United States and Mexico.

And still not one for Canada.

“The outlook for Canada’s auto industry only gets murkier,” BMO economist Alex Koustas said.

Here’s a chart from Koustas showing how far production across various component lines has fallen since 2006.

“The climb out of the hole looks pretty steep right now,” Koustas said.

Comments