The Liberal government faces a slowing economy and an uphill battle in the polls as it prepares to table its 2024 federal budget on Tuesday.

Global News spoke to Canada’s former parliamentary budget officer ahead of April 16, who said he’s expecting a tight spending plan with little room for surprises or hotly demanded relief on cost-of-living issues for Canadians.

Heading into the third budget under the government’s current mandate, Justin Trudeau’s Liberals have been on a cross-country tour plugging a series of measures that will be included in the coming year’s spending plans.

Since late March, the Liberals have announced just over $37 billion in new spending and loans planned for the federal budget, according to a Global News analysis. Some of the Liberal announcements have spending spread out over multiple years, while other items come with little to no price tag attached.

A significant amount of spending is tied to the Canadian housing market, in the form of either incentives to build more supply or policy changes to support renters and help prospective buyers get their first rung on the property ladder. Those include promises to help renters build their credit scores, changes to savings plans and amortization rules aimed at promoting affordability and billions in incentives to get more shovels in the ground on new builds.

Outside the housing market, Ottawa is planning to introduce a national lunch program and promised billions for expanded child-care access, boosts to the country’s defence spending and artificial intelligence industry, and a new youth mental health fund.

All the while, Finance Minister Chrystia Freeland has pledged that the Liberals will not increase the federal deficit past its current $40.1-billion levels.

Liberals have little fiscal room to ‘manoeuvre’: former PBO

Kevin Page, Canada’s first PBO and the president of the Institute of Fiscal Studies and Democracy at the University of Ottawa, tells Global News the Liberals are facing significant headwinds in trying to keep the deficit stable while also meeting the needs of Canadians.

Canada’s economy may have avoided tipping into a recession in 2023, but growth remains weak under the weight of higher interest rates from the Bank of Canada. That means the federal government is seeing lower revenues flowing into its coffers at the same time its debt is becoming more expensive.

Get weekly money news

“Their challenge is, they just don’t have a lot of fiscal room to manoeuvre,” Page explains.

An RBC economics report released last week also warns of consequences for Canadians if governments are tempted to stray from their fiscal anchors, whether that be maintaining the overall size of the deficit or keeping a steady debt-to-GDP ratio.

Governments, federal or provincial, keeping to their fiscal anchors instils “confidence in voters and financial markets,” author Rachel Battaglia, an economist with RBC, wrote.

Canada’s sovereign triple-A credit rating heading into the 2024 federal budget is “strong,” Battaglia said, but the country risks a downgrade if Ottawa were to stray from its fiscal anchors.

A hit to this key credit rating would trickle down to large banks, and by extension, the rates paid by their customers on products like mortgages, according to Battaglia.

“Even though deeper deficits and higher associated sovereign borrowing costs may feel like a distant problem for many Canadians, the impact has the potential to trickle down to most households and businesses,” Battaglia wrote.

“Therefore, all Canadians have a stake in seeing the federal government meet its fiscal targets.”

Another tactic to increase revenues when economic growth is stalling is by hiking or introducing new taxes. While Freeland has pledged that no new taxes will be levied against the middle class in the 2024 budget, she has been mum on whether taxes on wealthier individuals or corporations could be in the cards.

Little room for surprises in the budget

One tailwind benefiting the federal government this budget season is that the first quarter of real GDP growth in Canada is so far coming in stronger than forecast in Ottawa’s fall economic statement last November.

That’s giving the Liberals a bit more spending room than they would’ve otherwise had amid pressures to maintain the deficit, Page says. But he expects this bandwidth will have been mostly eaten up with the already announced measures, and he does not expect any new big-ticket items will be unveiled on April 16.

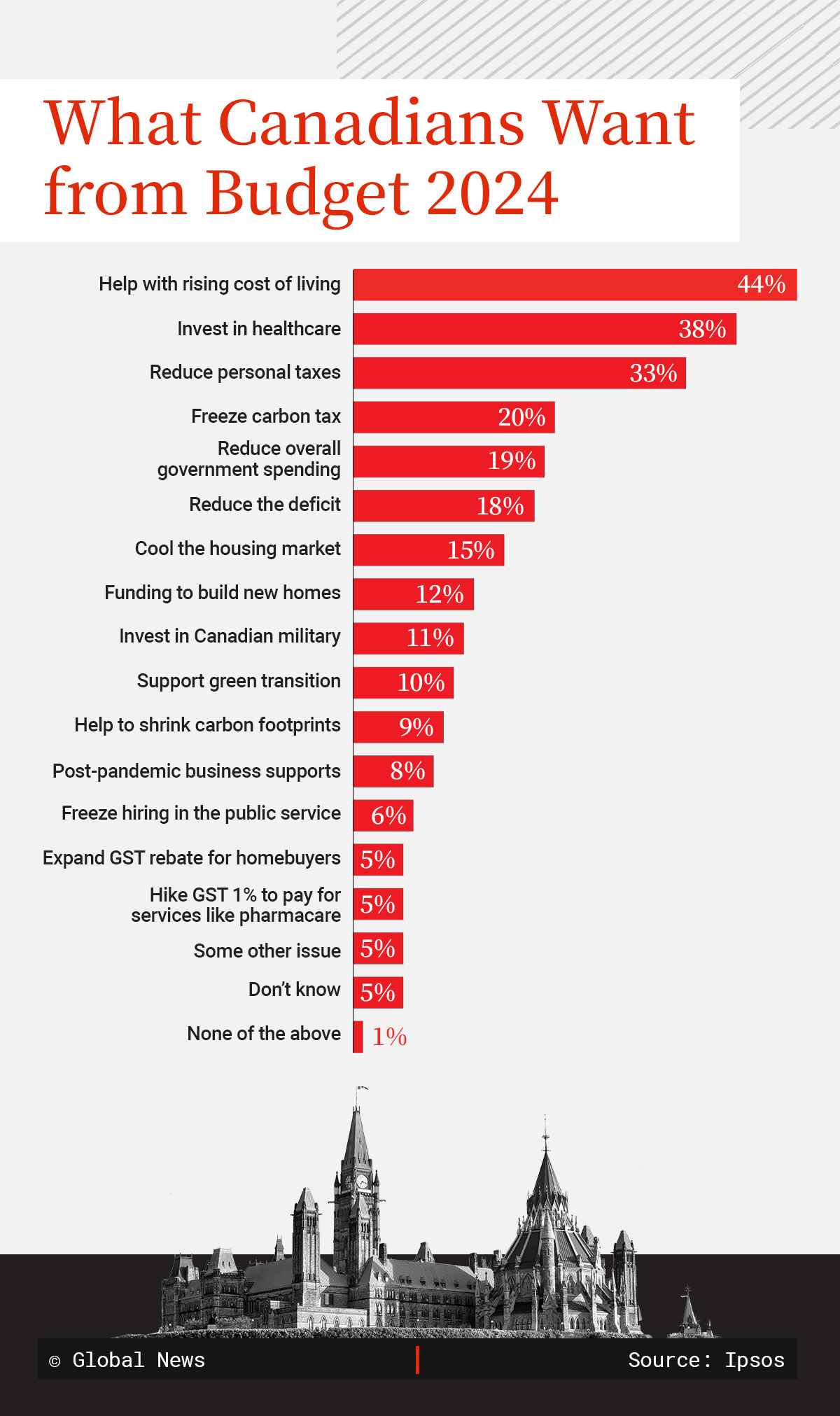

Ipsos polling conducted exclusively for Global News last month shows the top demand from voters heading into the federal budget is for financial relief from the rising cost of living.

Some 44 per cent of those surveyed in March said they wanted help with rising daily expenses, followed by 38 per cent who prioritized health-care investments and 33 per cent asking for a reduction in personal taxes.

“Pocketbook issues dominate the list of the things that Canadians want to see addressed in the budget,” Sean Simpson, senior vice-president at Ipsos Global Affairs, told Global News earlier this month.

But Page sees little room for those kinds of relief efforts in the 2024 budget if the Liberals want to maintain the deficit.

The best the Liberals can do is make it look to Canadians like they’re “trying their best” when it comes to acting in a fiscally responsible way while providing support to the most vulnerable, he says.

“I don’t think we’re going to see much new that can make a big difference for families in 2024 with respect to affordability,” Page says.

“It’s possible we see some small measures, but they will be small and targeted.”

The already announced efforts to get more homes built are “incremental steps” to solving the housing crisis, but Page says the country is “millions of units short” of what’s needed to restore affordability. Even efforts to put more housing supply in the pipeline will take years before homes are move-in ready, he says.

“It’s not something that we’re going to solve in the 2024 budget,” Page adds.

Liberals could have better prospects in 2025

Ipsos’s latest political polling from March 28 has the Conservatives up 18 points over the incumbent Liberals, who are themselves only three points ahead of the NDP. Simpson said the Liberals will need to “stop the bleeding” to avoid falling into third place behind the NDP.

A federal election is currently slated for no later than October 2025, but could be called earlier if the Liberals fail a confidence vote or bring down the government themselves.

Page expects a “pretty thin budget” this year, with some major items reserved for a hopeful pre-election budget next year.

But if the Liberals do get to put up another budget before the next federal election is called, Page thinks the incumbent party might find better fortunes in 2025.

By that point, many economists, as well as the Bank of Canada, forecast that the economy will be starting to recover amid anticipated cuts to the central bank’s benchmark interest rate.

This time next year, the Liberals might find rising revenues will boost their electoral prospects and give them more ammunition to deliver a 2025 budget that would have a better chance at restoring voter confidence in the government, Page says.

“The government knows it’s going to be a hard year economically for Canadians and probably a hard year politically,” he says. “But I think they’re hoping that this will rebalance when we get to 2025.”

– with files from Global News’ Sophall Duch

Comments

Want to discuss? Please read our Commenting Policy first.