Canada’s banking regulator says it has left the stress test rate for uninsured mortgages unchanged.

The Office of the Superintendent of Financial Institutions says the minimum qualifying rate for uninsured residential mortgages will remain the greater of 5.25 per cent, or the mortgage contract rate plus two per cent.

Uninsured mortgages are generally residential mortgages with a down payment of 20 per cent or more.

Superintendent Peter Routledge says holding the minimum rate helps ensure lenders and borrowers manage risk associated with residential mortgages.

He says the stress test has produced a more resilient residential mortgage financing system.

OSFI sets the stress test for uninsured mortgages, while the finance department sets the rate for insured mortgages.

Shortly after OSFI’s announcement Tuesday, Finance Minister Chrystia Freeland issued a statement confirming the minimum qualifying rate for insured mortgages would also remain unchanged.

“Our goal is to protect Canadians—by ensuring they have the support they need to afford their mortgages,” Freeland said.” We will continue to monitor the Canadian housing market and remain ready to make changes to the minimum qualifying rate if warranted.”

With files from Global News’ Nicole Gibillini

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- Do you need to own a home to be wealthy in Canada? How renters can get ahead

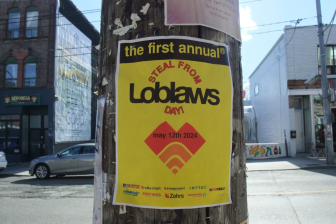

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

Comments