A developer exposed by a CKNW investigation for operating a luxury rental building like a hotel may have been breaking the law, but it’s the latest example of an illegal business that’s been a big source of revenue for tax collectors.

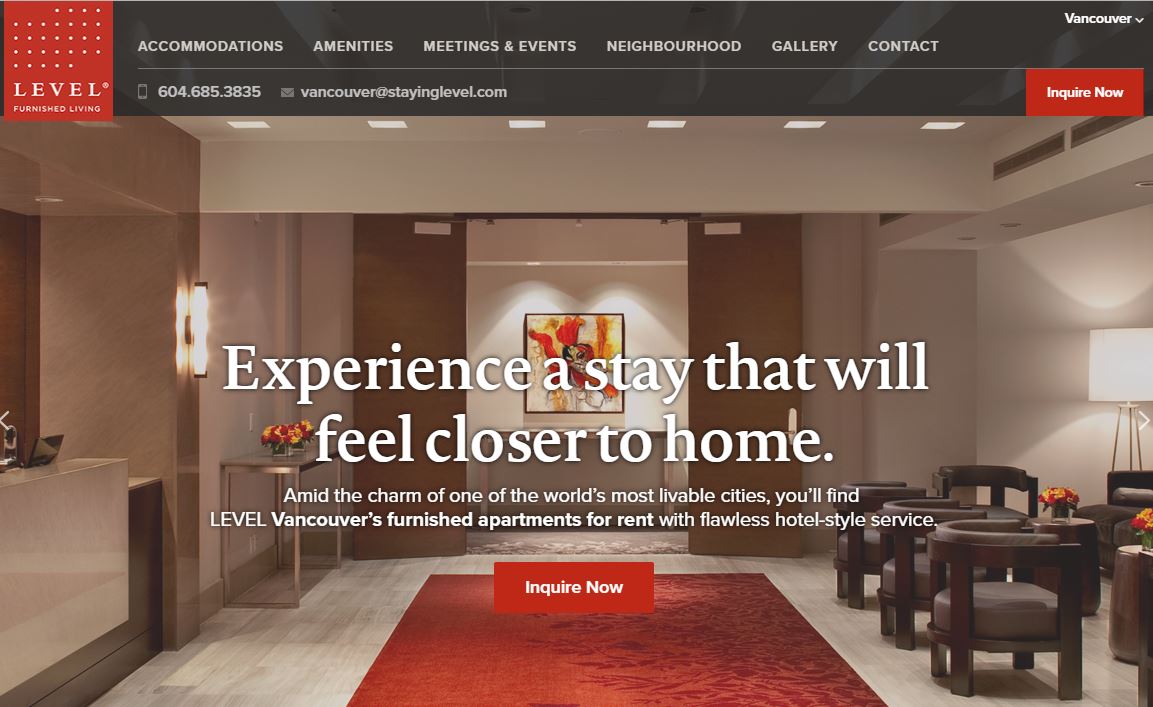

Developer Onni may have been skirting city rules by not having a hotel license or the proper zoning for its Level Furnished Living, but it was collecting taxes on short-term rentals.

Along with GST and PST, the Municipal Regional District Tax to support tourism marketing means 16 per cent was going to other levels of government.

So how did the developer not get busted sooner?

The situation is similar to the one faced by marijuana dispensaries.

In a statement, the province, which collects the PST and MRDT, says failing to comply with rules from the City doesn’t relieve a business of the obligation to levy, collect, and remit tax payable.

- High-profile B.C. sex offender Randall Hopley pleads guilty to 3 charges

- White Rock fatal stabbing suspect still at large while investigators remain tight-lipped

- BC Hydro offers free AC units to lower-income, vulnerable customers

- ‘It’s nice to be the villain’: Vancouver Canucks gear up for Game 3 in Nashville

Comments